HEICO Corporation (HEI)

HEI 0.00%↑ is a diversified company based in Hollywood, FL. The company has evolved over the years, originally known for its work in the aerospace sector, it now is a prominent player in a couple different industries, including aerospace (still), defense and electronics. The company designs, manufactures and markets a wide variety of products and services with a concentration in solutions for aircraft and spacecraft components, systems and repair services.

Below are some of its financial metrics:

Is HEI a winner?

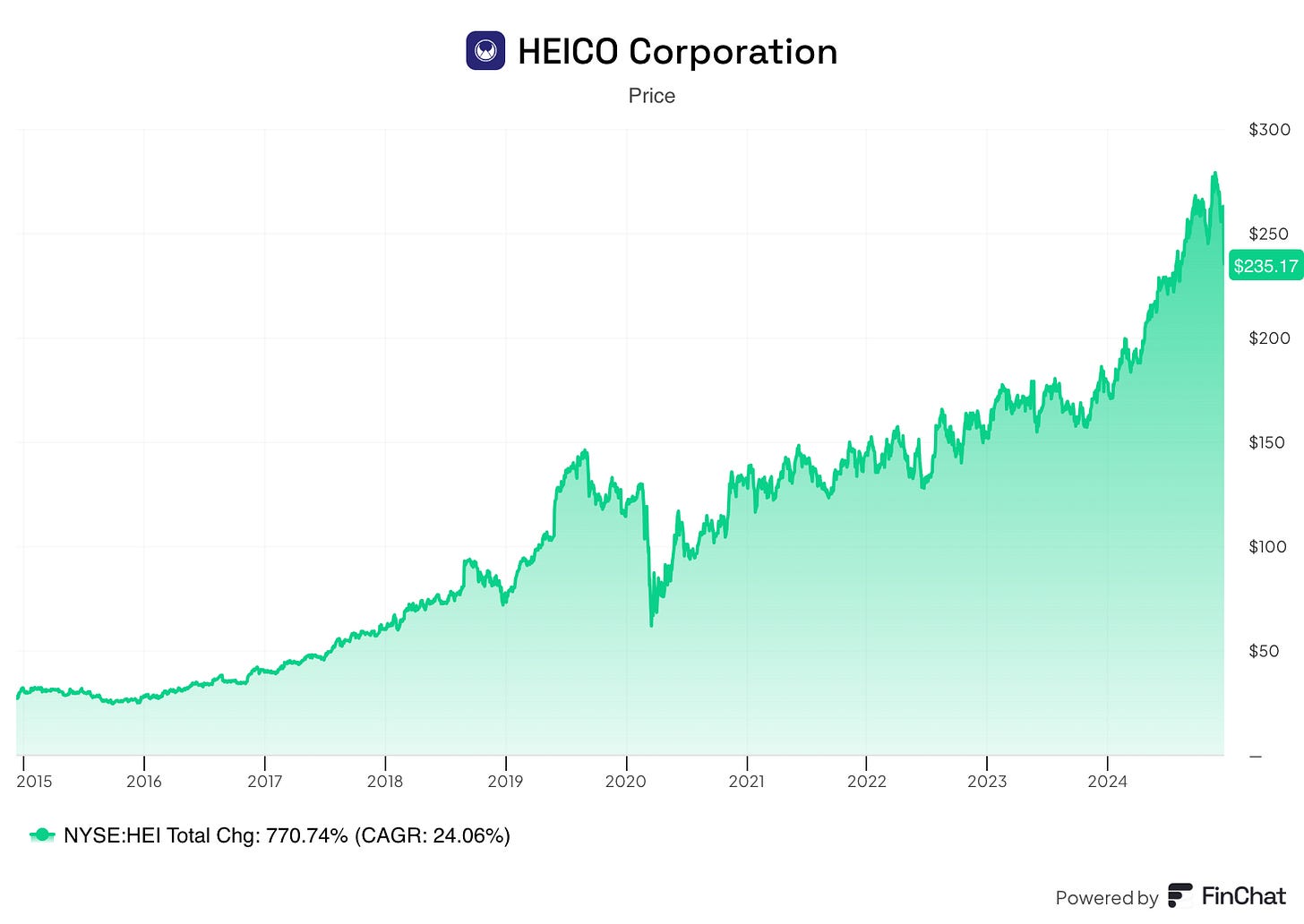

Over the past decade HEI 0.00%↑ has done very well with only one down year, 2015 where it declined approximately 10%. Since then stock has been on an amazing run with the smallest INCREASE from 2016 through current year being 6.67%. Additionally, during that span, there were multiple years where the stock appreciated more than 40%, 2016, 2017, 2019 and thus far in 2024. Overall since 2015 the stock has a remarkable CAGR of just above 24%, more than 10% higher than that of SPY 0.00%↑. A company’s ability to consistently and handily outpace the return of the S&P 500 is impressive, and HEI 0.00%↑ does not disappoint, there’s no doubt in my HEICO is definitely a winner.

Quality Metrics

In my opinion, there are three quantitative characteristics all high-quality companies should possess. They are a rising revenue stream, a stable or expanding gross profit margin and a robust return on invested capital. Let’s examine these metrics for HEI 0.00%↑ and see if they meet our standards.

The revenue per share metric rose nicely from 2015 through 2019 before taking a step down in 2020 and dropping by almost 14%. Following that rather large decline, HEI 0.00%↑ picked up where it left off in 2019 with an increase, albeit a small increase, in 2021 of about 4%. Since then the growth has been significantly more impressive with increases of 17.8%, 33.3% and 28.8% over the past three years.

HEICO’s gross profit margin has been on a steady rise since 2015. The company began the past decade with a GPM of 36.5% and it has since risen to 38.9% in 2023 and 2024. A company’s ability to maintain, or better yet, expand its gross profit margin is a testament to their cost efficiencies as well as proof of consistent pricing power.

The return on invested capital seen some minor fluctuations over the past 10 years. In 2015 this metric was just above 10%, but it rose a couple years in a row to a high of 15% in 2019. Since then the ROIC has struggled, essentially declining every year since its peak and in FY 24 sat at just 9.7%

With the exception of the ROIC, these metrics are quite good, with the revenue per share increasing at a CAGR of more than 13% over the past decade and the GPM remaining very steady during that time. Ideally, HEI 0.00%↑ will become more efficient at turning its investments into profits in the very near future, until then this will be something to monitor. Ultimately, I am fairly confident in saying that HEI 0.00%↑ is still a high quality business.

Dividend Data

Since we are looking for a quality Dividend company it only makes sense we take a look at a company’s dividend history.

HEI 0.00%↑ has raised its dividend for about 20 years and is unique in that it pays a semi-annual dividend, in January and July. Currently, the company doesn’t offer much in terms of yield, with the stock yielding around 0.10%. However, the dividend growth has actually been very relatively good, it’s just that the stock price has outpaced the growth. In fact, the company’s 3 and 5-year dividend growth rates sit at 7.3% and 8.5% respectively, while its 10-year dividend growth rate is a healthy 13.6%.

As you can see from the chart below the payout ratio has been very low, never surpassing 10% over the past decade. Obviously, the payout ratio is unlikely to remain at this level forever but with the run the stock has been on and the modest dividend increases it could remain there for an extended period of time.

Clearly, this isn’t the most exciting area for HEI 0.00%↑ as the stock price appreciation has driven most of the returns for this company. However, the low payout ratio coupled with the healthy dividend increases is encouraging, thus making this a company worth monitoring for the future.

Recent Earnings

On Tuesday, December 17th HEI 0.00%↑ announced Q4 2024 earnings with a miss on top line revenue which came in at $1.01B (missed by $20M) but was a nearly 8% increase from the same period a year ago. Conversely, GAAP EPS was $0.99 for the quarter which beat analyst estimates by $0.01.

Net income for the quarter rose 35% YoY to $139.7M from $103.4M. Additionally, the aforementioned revenue amount was up from $936.4M last year. Operating income also increase 15% to $218.6M from $189.4M a year ago. Lastly the consolidated operating margin expanded about 150 bps, from 20.2% to 21.6%.

Finally, below is a breakdown by segment of the company’s sales and operating income. Although all signs pointed to a positive earnings release the market did not respond well as the stock dropped about 8% in after-hours trading.

The full earnings release can be listened to here.

Valuation

The final piece of the puzzle is to determine if HEI 0.00%↑ is trading for an attractive valuation today. As the custom FCF valuation tool suggest, the stock is pretty overvalued today, with a conservative fair value estimate of $187.

From the chart above we can see that the stock rarely trads for a significant discount with the exception of early 2020. Aside from that short time period, the stock has routinely traded near or above the “trim” line indicated in red. Additionally, the FCF for HEI 0.00%↑ has trended higher with some minor dips here and there over the years.

HEI 0.00%↑ currently has a long-term expected rate of return of about 13.5% and the components of that estimates are as follows:

A current dividend yield of 0.10%

A return to fair value factor of -4.90%.

An expected earnings growth rate of 18.23%.

To sum up, this stock has consistently outperformed the broad market, and has not had a negative return since 2015. The financial metrics are overall good, with some room for improvement with the return on invested capital. The dividend yield is weak thanks to the significant run up from prior years, as well as this year where it’s climbed more than 50%. The valuation is rich but as previously mentioned the potential earnings growth is quite high too. HEI 0.00%↑ seems like a good investment with exception of the valuation, this stock will be monitored moving forward due to its quality score which I touch on briefly in the next section.

In the last update provided regarding the investable universe I discussed looking at quality scores for companies based on a variety of factors. The quality score for HEICO came in at 89% with the biggest drivers being revenue growth, gross profit margin expansion and a low payout ratio. The only real negative for HEICO was the lackluster ROIC, which I discussed above.

If you found this content useful consider upgrading to a paid subscription. You’ll gain access to live a complimentary Free Cash Flow Valuation Tool for over 200 stocks as well as access to our 3 model portfolios. The paid subscription is only $5 and you can cancel any time.