Lam Research Corporation $LRCX

Lam Research Corporation LRCX 0.00%↑ is a major supplier of wafer fabrication equipment and services to the semiconductor industry. Headquartered in Fremont, California, Lam Research plays a crucial role in the manufacturing of semiconductor devices by providing equipment used in the process of etching, deposition, and cleaning semiconductor wafers.

Here is a brief review of their financial metrics:

Is LRCX a winner?

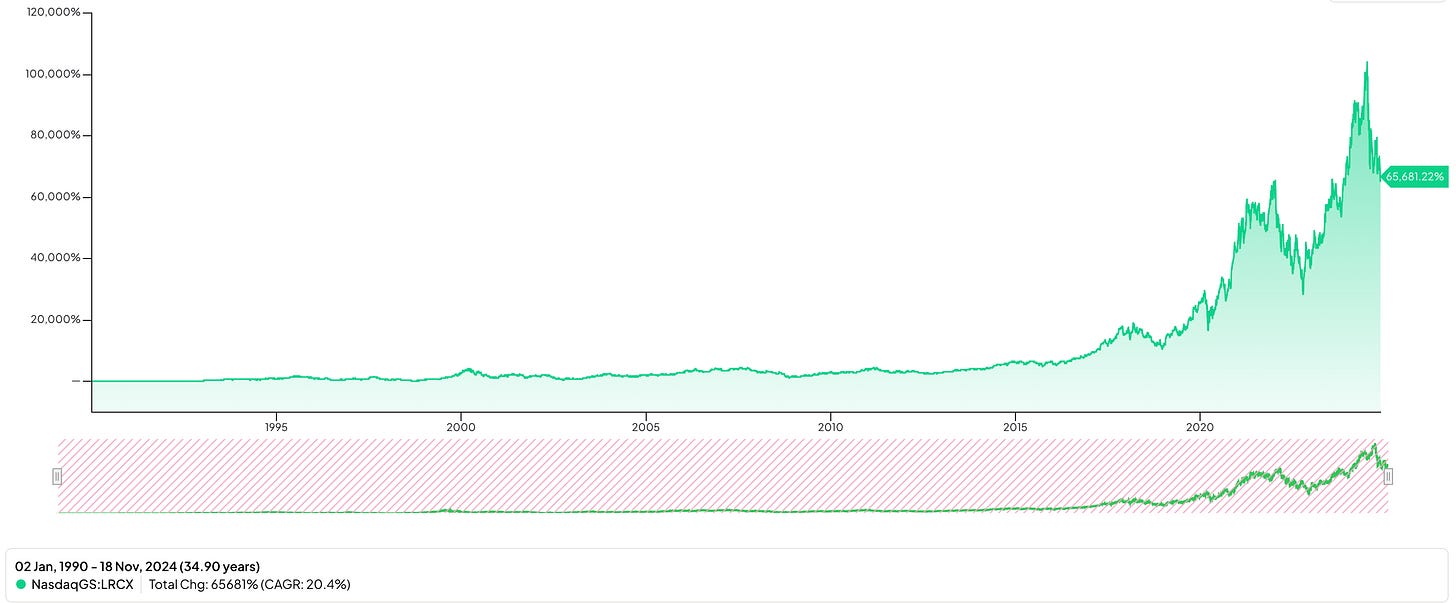

Since 1990, LRCX 0.00%↑ has provided investors with an astounding return of more than 65,000% equating to a compound annual growth rate of more than 20%, well above the average market return.

More recently, LRCX 0.00%↑ has actually improved their return, with a CAGR of almost 25% in just the past decade. Although that CAGR is obviously quite healthy, it has not been a smooth ride. From 2015 through 2017, investors saw increases of 1.5%, 35% and 76% respectively; however, these increases were followed by a nearly 25% drop in FY 2018. In 2019 LRCX 0.00%↑ rebounded nicely with a return of almost 120%. During 2020 and 2021 LRCX 0.00%↑ experienced more of the same growth with returns of 64% and 53% respectively. This of course included some bumpiness due to the pandemic. Calendar year 2022 was a very tough year with LRCX 0.00%↑ declining by about 40%. Just last year, the stock again recovered nicely climbing 88%; conversely, this year hasn’t been great with LRCX 0.00%↑ registering a small decline, with about 6 weeks left to go. Ultimately, in my opinion, a company that is able to beat the average market return, consistently by double-digits, is a very high quality company, worthy of further research by investors.

Dividend Data

Since we are exploring the market for a quality Dividend stock it only makes sense we examine a company’s dividend history.

LRCX 0.00%↑ has grown its dividend at an inflation-beating rate, approximately 28% per year over the past decade. The company’s 3 and 5-year dividend growth rates are a robust 16.8% and 13.5% respectively. It’s worth noting, the 10-year DGR is also skewed by the 366% increase in FY 2015. Earlier this year LRCX 0.00%↑ announced a 15% increase in their dividend from $0.20 to $0.23 (split adjusted), this is pretty much in-line with the aforementioned 3 and 5-year DGRs. The payout ratio has fluctuated minimally over the past decade and is still ripe to provide investors with dividend increases well into the future.

Quality Metrics

In my opinion, there are 3 important quantitative characteristics all high quality businesses have; a rising revenue stream, a steady and predictable gross profit margin and a healthy return on invested capital. Let’s examine these metrics for LRCX 0.00%↑ and see if it’s a high-quality company.

The revenue per share metric grew nicely from 2015 through 2018 but then flattened out during the height of the pandemic. However, coming out of the pandemic LRCX 0.00%↑ saw a healthy rise in its revenue per share numbers, including a 45% increase in overall revenue in 2021. There was another solid jump in revenue in FY22 of almost 18%, while FY 23 essentially was flat. Overall, LRCX 0.00%↑ has grown its revenue per share by nearly 15% annually over the past decade, with some bumps along the way, hopefully Lam Research can provide investors with a little more consistency moving forward.

The gross profit margin for LRCX 0.00%↑ has been very stable, only oscillating minimally during the past decade. In 2015, the GPM was a chart low of 43.6%, while the most recent fiscal year provided the best GPM at 47.6%. A steady GPM is a great sign and something LRCX 0.00%↑ should continue to strive for.

The final metric is the return on invested capital which has channeled some during the past 10 years. From a low in FY 2015 of 16.3% to a high in FY 2021 of more than 50%, the ROIC has improved overall but has declined more recently. Ideally, LRCX 0.00%↑ can stabilize, and maintain this metric moving forward and keep it close to its historical levels.

Overall, the financial metrics discussed are generally headed in the right direction. The revenue per share did have a rough patch during the pandemic but has since recovered nicely. The GPM is very steady which is always encouraging, and while the ROIC has been robust, it’d be nice to see it fluctuate less to provide more consistency.

Valuation

The final piece of this puzzle is to determine if the LRCX 0.00%↑ is trading for an attractive valuation. To determine this, let’s analyze the valuation from a free cash flow perspective.

As you can see, LRCX 0.00%↑ spent the majority of 2018 and 2019 in the “strong buy” zone, as the price declined nearly 25% in 2018, while the FCF only rose about 14%. In 2019, there was an astounding jump in FCF/share of approximately 40%, while the stock climbed close to 120%. This led to the stock being overvalued beginning in 2020; but the decline in FCF of almost 30% didn’t slow down the price, as it again rose 64% in 2020 and another 53% in 2021, resulting in a gross overvaluation even with the increase in FCF in 2021 of 70%. In 2022, the FCF dropped by almost 20% and thus the stock finally came back to reality and dropped about 40%. The stock rebounded very well in 2023 with an almost 90% increase, and the FCF also grew at almost 90%. So far in 2024, after a strong rally and subsequent decline, the stock has dropped about 4% and is again in the “strong buy” zone for the first time since the beginning of 2023.

LRCX 0.00%↑ has a current long-term expected rate of return of more than 20%, and the components of that estimate are as follows:

A dividend yield of 1.30%.

A return to fair value factor of 2.83%.

An expected earnings growth rate of 17.19%.

In closing, LRCX 0.00%↑ has improving financial metrics, a healthy and growing dividend and a history of providing investors with market-beating returns. The valuation makes sense for the first time in a while, and dividend growth investors may want to consider adding LRCX 0.00%↑ to their watchlist.