Lincoln Electric Holdings is a global leader in the design, development and manufacturing of welding and cutting products. LECO is best known for its wide range of welding equipment, including welding machines, welding consumables, robots and automation solutions. Additionally, the company also provides welding technical support and training services.

Here is a brief overview of their financial metrics:

Is LECO a winner?

Since going public nearly 30 years ago, Lincoln has a total return of almost 4,400%, resulting in a compound annual growth rate of 13.8%. Any company whose long-term return beats the market average should be a considered a winner.

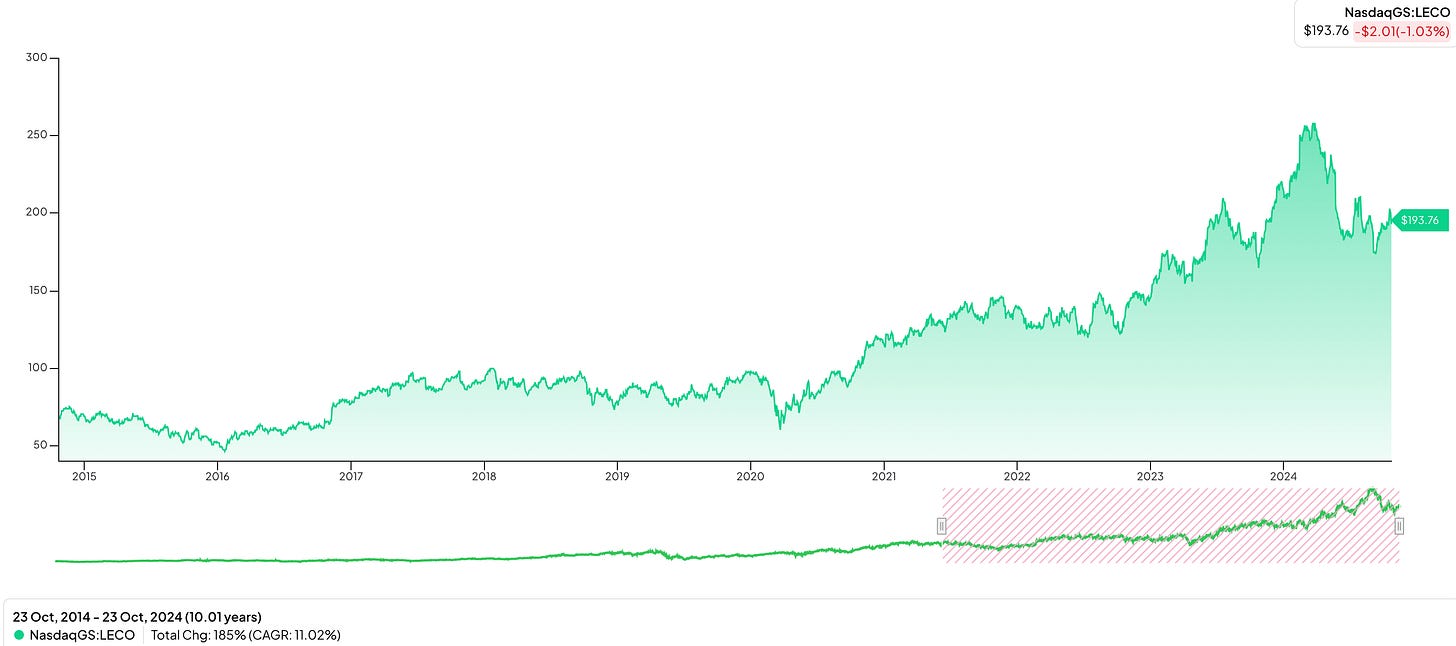

The last ten years for LECO when split (almost) in half, tells two different stories. From about mid-2014 through the first quarter of 2020, the price was essentially flat, only climbing 2% over more than five years. The rest of 2020 was much better for the company as the stock rose from below $60.00 (March 2020) to nearly $120/share by the end of year, basically doubling its share price in 9 months. 2021 provided investors with more of the same, as the stock climbed another 23%, ending the year just north of $140/share. The next year was not as impressive as 2021, but still the stock rose another 10%. In 2023 LECO returned to its market-beating ways and rose another 50% ending the year slightly above $215/share. Thus far in 2024 the stock has struggled, dropping 9% as of this writing. Overall, LECO has had a CAGR of more than 11% over the past 10 years and total return of 185%.

Dividend Data

Since we are looking for a quality Dividend stock it makes sense we investigate the company’s dividend history.

LECO has grown its dividend at a fairly predictable pace with occasional slight fluctuations. The company’s 5-year dividend growth rate sits at 8.6% while its 10-year dividend growth rate is 11.55%. Earlier this week (10/17/24), the company announced a below average, 5.6% increase to raise its quarterly dividend to $0.75 per share.

The payout ratio has swung up and down over the past decade. This metric reached a high of 69% in 2015 and a low of 27.7% in the most recent fiscal year. Hopefully the company can continue to keep the payout ratio low and pave the way for future dividend increases.

Quality Metrics

In my opinion the three most important financial metrics that all high quality companies should have in common is an increasing revenue stream, a stable gross profit margin and a healthy return on invested capital.

The company’s revenue per share has been on steady upward trend with the exception of 2020 where there was a minor dip. This metric has grown at a CAGR of 7.7% over the past decade and ideally will continue to climb well into the future.

As you can see, the gross profit margin has been very steady shifting only minimally over the entire chart. A predictable and constant gross profit margin is admirable here, especially during the pandemic when many companies struggled to just stay afloat LECO was able to weather the storm.

The ROIC was near 20% pre-pandemic and trickled lower going into and coming out of the pandemic. In 2021, this metric shot up nicely to almost 28%, but over the past two fiscal years has settled just above 20%.

Valuation

The last consideration is whether LECO is trading for an attractive price today. As the custom FCF valuation tool below suggests the stock is trading for a slight discount to fair value. We can see in 2018 the stock was overvalued before falling into the strong buy range for nearly all of 2019, thanks to the pandemic. From mid-2020 all the way through 2022 the stock was grossly overvalued as the stock price surged significantly but the FCF only rose a small amount creating the overvaluation. In 2023 the FCF/share increased a robust 87% causing the stock to finally return to the strong buy range. This opportunity lasted for a only short time because by early 2024 the stock had again become overvalued. As previously mentioned, the stock has struggled thus far this year creating a potential opportunity for investors.

LECO currently has a long-term expected rate of return of 17.53%, the components of this ROR are as follows:

1.55% dividend yield

0.98% return to fair value

15.00% expected earnings growth rate

In conclusion, LECO has seen a lot of growth of the past few years. The GPM has been constant and the revenue per share and ROIC are both trending in the right direction. Additionally, the company offers investors a safe and growing dividend, even if the yield is on the lower end. Finally, according to the custom valuation tool the stock appears to be trading at a slight discount to fair value, thus investors might want to keep on an eye on this company for any more price weakness in 2024.

If you found this post insightful and would like to receive more Dividend Stock reviews directly to your inbox, subscribe below!