1. Rotation from Tech to Small Caps

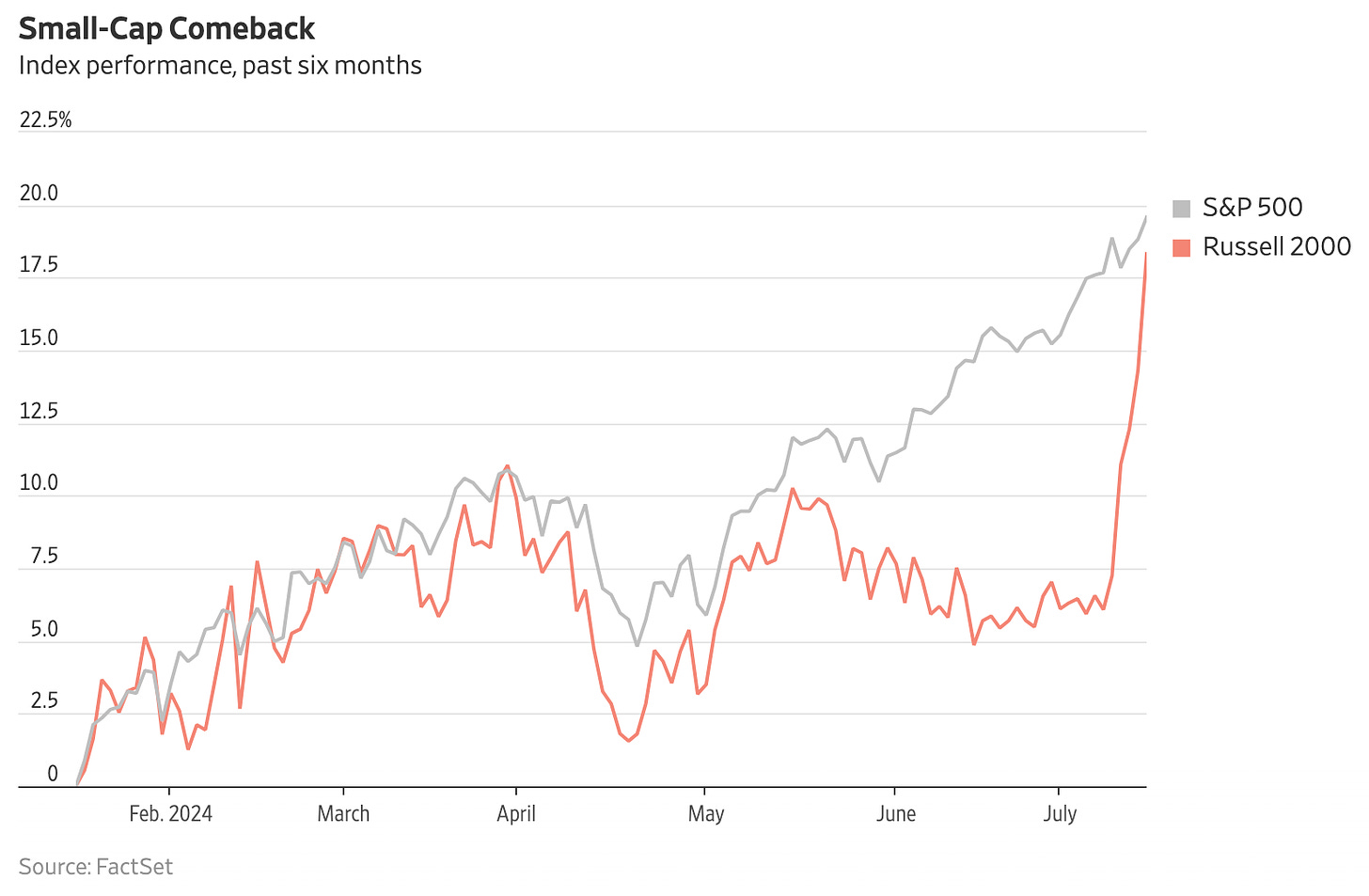

Following a better than expected CPI announcement last week the market experienced a shift with investors selling tech stocks and moving capital into small cap stocks. This rotation was swift as can be seen in the chart below comparing the returns between the S&P 500 and the Russell 2000 indices.

While the likelihood of a rate cut this year was always high, now there is even more optimism the Fed will cut rates earlier, possibly in August or September. This optimism may continue to drive this shift in market sentiment and its worthy to note that many dividend stocks and value stocks are benefitting from this as well. However, this momentum has to be substantiated by strong earnings and even a whiff of an economic slowdown can trigger a sell off.

2. Is the Tech Rally Over?

As technology stocks sold off many have called the Tech rally over with investors locking in gains and moving on to more attractively valued sections of the market. News of an AI bubble and its ensuing pop have ramped up with some claiming the bubble is ready to pop while others proclaiming AI has legs and room to keep running. A case can be made to differentiate the so called “AI bubble” from the Dot Com bubble. I think the major differentiator is that the gains in AI stocks are, to an extent, justified by growth in earnings, and not simply based on optimism of the future. In order for the wave of exceptional AI returns to continue, these companies will need to continue to see earnings growth. Even if earnings come in-line with analyst forecast we could be due for a correction. I’m not betting the house on the AI revolution but I am also not cashing out my exposure, and I certainly wouldn’t short AI just yet.

3. 3DGR Portfolio is Alive!

If you happened to read my last update on the 3DGR portfolio you already know that this experiment did not start out quite as I envisioned. Well, things turned 180 degrees very quickly following my update. As of 7/9, when I wrote the June update, the 3DGR portfolio was coming off two very disappointing months, with losses of 3.8% and 3.86% to SPY. July started out on the same sour note, by July 9th the portfolio was losing to SPY by another 2.23%. As of today, midday 7/17, the 3DGR portfolio is outperforming SPY by 2.46% this month and has cut its deficit to the benchmark by half in the last week. These are staggering figures, a nearly 4.7% outperformance in the span of just a week. While these types of market moves aren’t the norm I think it just goes to show you how quickly the stock market can shift based on a little bit of news.

I think we are in for a pretty interesting rest of the year with expected interest rates cuts and of course a U.S. election that will surely impact the market. My outlook remains unchanged, I will evaluate the strategy after it finishes its first full year and in the meantime I will look for opportunities to further optimize this investing approach.

What a difference a day can make :-)