Texas Roadhouse Inc. (TXRH)

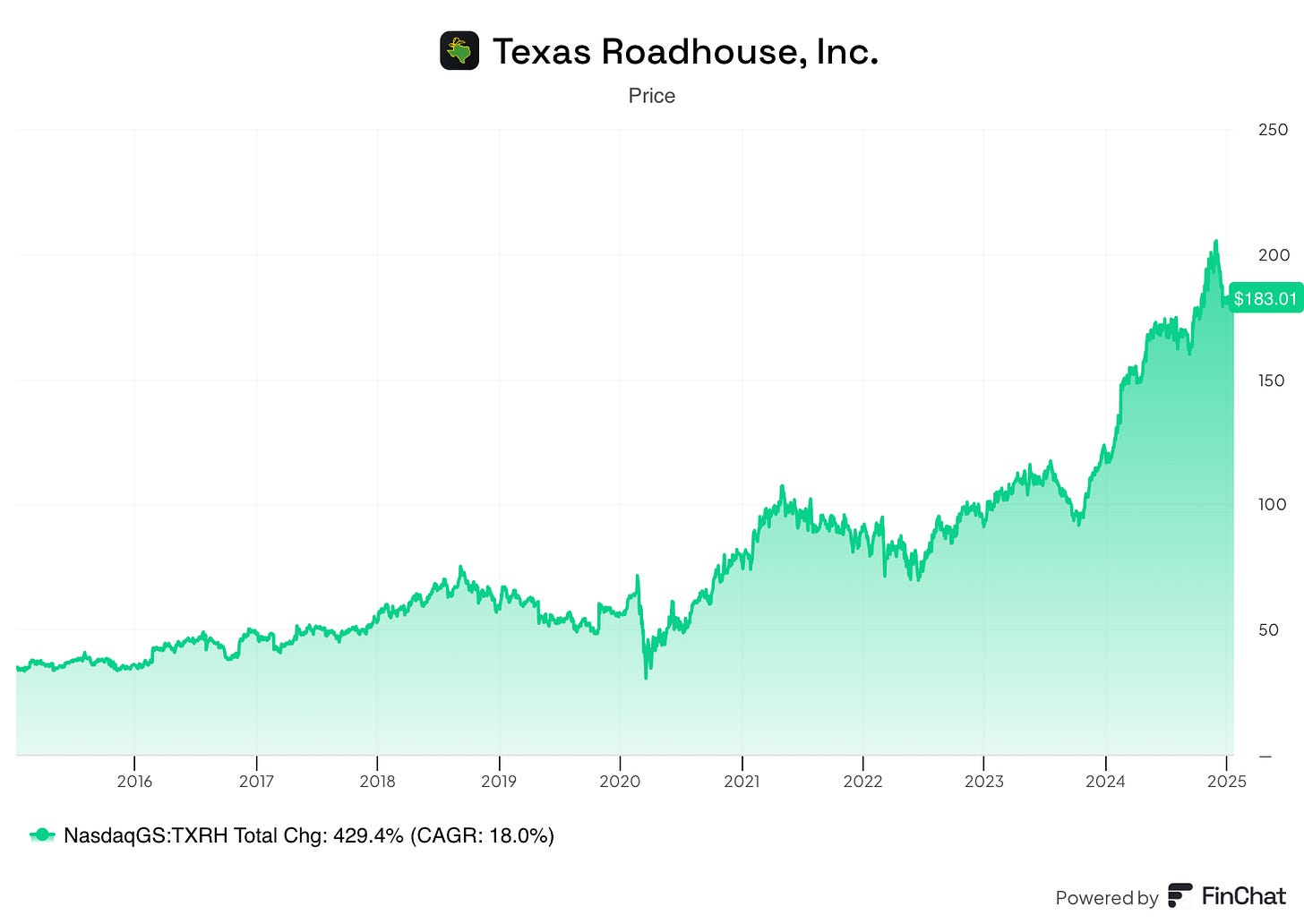

Texas Roadhouse TXRH 0.00%↑ is a popular American chain of casual dining restaurants, known for its hearty, made-from-scratch meals and sides, along with a fun and lively atmosphere. The vibe of this chain is something I can get on board with, laid-back, wooden tables and country music and decor. The company was founded in 1993 in Clarksville, Indiana and over the past 10 years has a total compound annual growth rate above 20%, well above the average market return.

Additionally, below are some of the company’s current financial metrics:

Is Texas Roadhouse a winner?

Above, I mentioned the 10-year total return of TXRH 0.00%↑ has been just north of 20%. Additionally, on the chart below you’ll see a 20-year chart which shows a 14.5% CAGR, indicating the company has seen greater returns more recently. Either way you slice it, TXRH 0.00%↑ has consistently outperformed the market and its ability to do so is a testament to the type of company we are reviewing here.

Quality Metrics

In my view, there are three essential financial metrics that all high-quality businesses should have: increasing sales, a reliable gross profit margin and a solid return on invested capital. Let’s review these metrics for TXRH 0.00%↑ and see how they measure up.

The revenue per share numbers have actually gotten better more recently, although early on during the past decade the growth was still very good. TXRH 0.00%↑ has a revenue per share CAGR of 13.26% over the past decade, with some outliers in there, thanks to covid. But what’s great to see is the growth has actually been more impressive recently with its last few fiscal years all 14% or higher.

The GPM began the past decade close to 20% for Texas Roadhouse but started to dip prior to the height of the pandemic in 2020, where it declined further. This metric rebounded nicely in 2021 close to pre-pandemic levels, before dropping slightly over the next two years. During the LTM, it has bounced back some, near 18%, hopefully it can continue to climb closer to 20% in the near future.

Texas Roadhouse’s return on invested capital hasn’t fluctuated too much, outside of 2020, ranging anywhere from 10 to 12 precent. The ROIC did increase a little bit over the past twelve months to its highest level on the chart, 14.5%. As stated in previously newsletters, I like to see this metric close to or above 20%, but for now it appears to be heading the right direction.

The RPS metric is clearly the best for Texas Roadhouse with this metric growing at more than 13% annually. The GPM and ROIC have been stable with a little fluctuation recently towards the positive. Overall, these metrics are fair, with some room for improvement on the latter two discussed.

Dividend Data

Given that we’re looking for a high-quality dividend stock, it’s only logical to review the company’s dividend track record.

Prior to 2020 the company had raised its dividend for 9 straight years and was set to become a dividend contender in 2020, but again the Covid-19 pandemic struck and the company froze its dividend for a year. TXRH 0.00%↑ resumed paying a dividend in 2021 and even increased it from its last dividend payment. Since then the company has given shareholders some impressive dividend increases of 15%, 19.5% and almost 11% just last year. I expect another healthy dividend increase in the near future as the company typically announces its annual dividend increase in mid-February.

Lastly, the payout ratio has been very consistent just above or below 50%, even with the rising dividend payments. This is an excellent sign the company is in good financial health, as its dividend growth has kept up with earnings per share.

Recent Earnings and Looking Ahead

In October of last year the company announced Q3 2024 earnings which missed on the bottom line, coming in at $1.26, 6 cents short of estimates on revenue of $1.27B, in-line with expectations and a 13.4% increase YoY.

Although the headline of missing on EPS, and revenue as expected isn’t that exciting, the earnings report was still very strong. The company announced an 8.5% increase in sales at company restaurants, coupled with a 7.2% increase at franchise restaurants.

For the 13-week period, the average weekly sales at company restaurants was nearly $150,000, including about $19,000 of that being to-go sales. This compares well with the same period a year ago where average weekly sales were slightly under $140,000 while its to-go sales were just above $17,000.

Restaurant margin dollars rose 24.1% to $202M, primarily drive be higher sales. Additionally, TXRH 0.00%↑ saw a higher average guest check, which combined with improved labor productivity, offset their cost of labor as well as commodity price fluctuations.

Lastly, the company paid $40.7M in dividends during the quarter and repurchased about $9.5M worth of stock.

Management also provided a 2025 outlook, and had the following expectations. Positive comparable sales growth and sales growth per week of about 5%. The company also expects commodity price increases of 2 to 3 percent, and wage and other labor inflation to climb 4 to 5 percent.

The full earnings release can be read here.

Potential Headwinds

As with any company you invest in, it’s imperative to look at some of the challenges the company may face in the future to see if it will materially effect how the company operates and/or its profitability.

The biggest concern for many companies, but I feel it’s especially important in the restaurant industry, is the purchasing power of the consumer. Discretionary spending is down, thanks in large part to the rise of inflation in recent years, couple this with rising wages and the aforementioned commodity price increases and things aren’t going to get cheaper anytime soon. This could keep people from going out as much as they would like to and some people may avoid it entirely. It’s hard for a family of 4 who used to be able to go out dinner for about $10 per person (give or take a few bucks depending on where you ate), and now from what I’ve seen in taking my family out, it’s closer to $15 and sometimes $20 per person.

Another factor management must consider is the labor market, many states have seen a push for a minimum of $15 per hour, and while in most states it is different for servers, since they also earn tips, it can weigh on the costs to operate a restaurant. Along those same lines, employee training and retention can be effected as well, with the labor market ever-changing.

Ultimately, Texas Roadhouse has been able to weather these issues as I think they successfully differentiate themselves from other restaurant chains. Their restaurants serve high-quality meals for very competitive prices, as all main courses come with 2 sides, and of course every table getting those warm rolls with cinnamon butter, which if you haven’t had you’re missing out. Regarding the labor market challenges, this is essentially out of their control, but the company has been able to effectively rollout price increases to combat the rising cost of labor. It’ll be important for the company to continue to provide excellent meals in order to keep the customers coming back and their staff busy.

Valuation

The last piece of this puzzle is to determine if TXRH 0.00%↑ is trading for an attractive valuation.

The custom FCF valuation tool suggests TXRH 0.00%↑ is trading for an 18% premium to its fair value as of 1/25/25. As you can see at the beginning of the chart TXRH 0.00%↑ traded for a pretty good discount to its fair value in the first couple years. Thanks to a significant decline in its FCF, the stock was pretty overvalued during 2020, mostly due to the uncertainty of the pandemic and where that would take the restaurant industry. The company’s FCF surged more than 250% in 2021, combine this with a pretty stagnant stock price (only a 4% increase), and the stock stayed undervalued for all of 2021 and the majority of 2022. Near the end of 2022 the stock price began to climb but the FCF saw a minor dip in 2023 leading to an overvaluation for most of the year. Throughout 2023 and 2024 the stock saw some hefty gains, with the stock climbing more than 37% in 2023 and nearly 50% in 2024. Those strong gains over the last two years have outpaced the growth of the FCF which grew by an impressive 50% in 2024.

The company has a long-term expected rate of return of almost 20%, and the elements of that estimate are as follows:

A current dividend yield of 1.37%.

A return to fair value factor of -3.37%.

A forward earnings growth rate of 21.44%.

In summary, TXRH 0.00%↑ has grown revenue at a very impressive pace, but to be fair the GPM and ROIC have some room to improve, but I think because of how well-run this company is, we’ll see those advance over time. Although the company did freeze its dividend in 2020, it picked right back up where it left off and I expect another solid increase next month. The recent earnings report was as expected, nothing flashy but solid nonetheless. There are some potential headwinds to consider but the real knock on this stock at the moment is the valuation. For the time being we’ll keep it on the watchlist and hope for some price weakness in the future to give investors a potential buying opportunity.

The long-term quality score for TXRH 0.00%↑ sits at 81.8%, while the 2024 quality score comes in at 87.8%.

If you found this content insightful consider upgrading to a paid subscription, you can see the live valuation ratings here, at any time. Additionally, you’ll gain access to a live complimentary Free Cash Flow Valuation Tool for over 200 stocks, as well as access to our 3 model portfolios. The paid subscription is only $5 per month and you can cancel any time.