Stryker Corporation (SYK)

Stryker Corporation SYK 0.00%↑ is an American medical technologies firm that develops and manufactures medical devices and equipment. It was started in 1941 by Dr. Homer Stryker, an orthopedic surgeon, and the company originally focused on creating innovative surgical instruments and devices. Over the years it has transformed into one of the largest medical device companies in the world, with a wide portfolio which spans multiple healthcare sectors.

Shown below are some of the current financial metrics of the company:

Is Stryker a winner?

Over the past ten years SYK 0.00%↑ has a total return of nearly 350%, resulting in compound annual growth rate slightly above 16%. The stock only had one down year during that time, which came in 2022 when it lost a modest 7.5%, every other year was up, including 3 years where the stock rose more than 30%, and 5 years where the stock returned at least 20%. Although the stock has not drastically outperformed the overall market, it’s definitely done a better than average job, and a company that consistently beats the overall market is definitely a winner.

Quality Metrics

In my opinion, I believe there are three important quantitative characteristics all high-quality companies should possess. They are a rising revenue stream, a steady gross profit margin and a robust return on invested capital. Let’s examine these metrics for SYK 0.00%↑ and see where they stand.

Stryker has grown its revenue per share metric at a clip of about 8.7% over the past decade. The standard seems to be around 10% per year with 2015 and 2020 as outliers where the RPS grew 3.3% and dropped 4%, respectively. The company has also had some better than average years, such as 2016 and 2021, both of which occurred after subpar years which were previously mentioned.

The company’s gross profit margin is very healthy and consistent. Since 2014 this metric has always been at least 63%, but is usually even higher than that, including a peak of 66.7% in 2016.

The return on invested capital metric fluctuated quite a bit in the early part of the past decade. The ROIC reached a chart high in FY 2018, at more than 23%, before settling closer to 10% over the last 6 fiscal years. I prefer to see a ROIC around 20%, so this is a little disappointing, especially since it’s clearly capable of achieving that level.

Overall these metrics are pretty good, the only knock on SYK 0.00%↑ is the decline in the ROIC. To be fair, the company has stabilized this metric in recent years, but hopefully in the very near future it can increase it.

Dividend Data

Since we are looking for a quality Dividend company it only makes sense we examine the company’s dividend history.

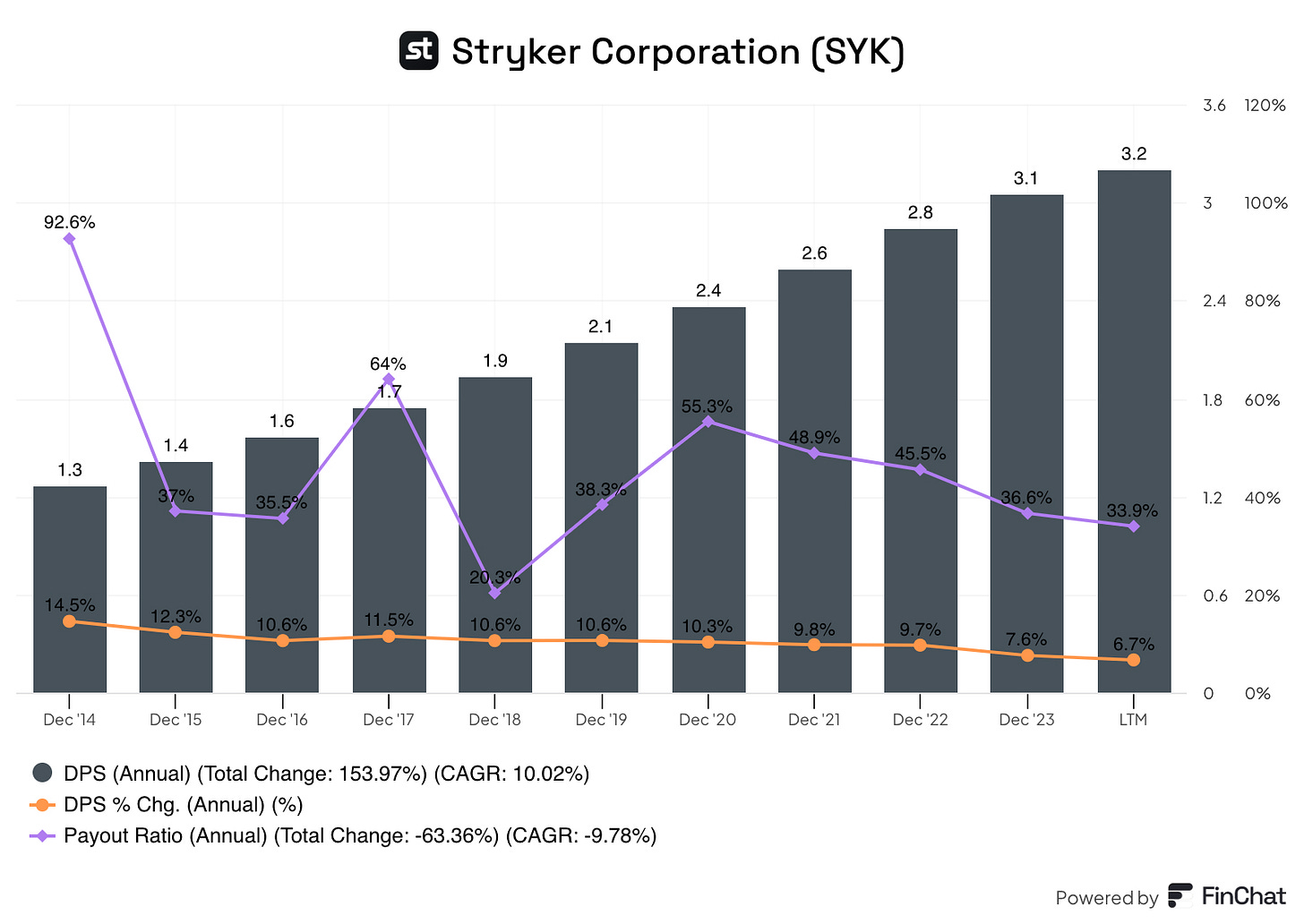

Stryker is a dividend champion, raising its dividend for more than 30 straight years. The dividend has increased at a rate of about 10% per year since FY 2014, but has clearly slowed as you can see from the orange line on the chart below. In fact, while the 10-year DGR is about 10%, the 3 and 5-year dividend growth rates sit at 7.8% and 8.7% respectively. However, in my opinion, it’s better for a company to consistently raise its dividend, even if it’s just a modest amount, as opposed to having a fluctuating dividend amount that increases and decreases erratically.

The payout ratio for SYK 0.00%↑ has channelled some, but in more recent years has been steadily declining. This metric reached a chart high in FY 2014 before dropping dramatically the next year. It rose again in 2017 before again declining the following year. It increased again over the next two years, and has been shrinking ever since. With the payout ratio dropping to just 34% in FY 2024, there is still ample room for the company to continue growing its dividend.

Recent Earnings

In late October of last year SYK 0.00%↑ released Q3 earnings with a double beat. Non-GAAP earnings per share came in $0.10 above expectations at $2.87, on revenue of $5.5B, a 12% increase from the prior year and $130M more than analysts expected.

The company reports earnings through two main segments, MedSurg and Neurotechnology and Orthopedics and Spine. Revenue for MedSurg & Neuro increased 12.8% to $3.2B for the quarter, mostly due to increased unit volume. The Ortho and Spine segment sales rose 10.7% to $2.3B, again because of increased unit volume.

Net income for the quarter was $834M, a nice 20.5% increase from the same period a year ago. While GAAP EPS also climbed about 20% to $2.16 per share. Furthermore, the company’s operating margin was 19.7% and the GPM was 64%.

Management expects 2024 full-year adjusted earnings per share to come in around $12.00 to $12.10 per share.

The full earnings release can be read here.

Valuation

The final piece of this puzzle is to determine if SYK 0.00%↑ is trading for an attractive valuation.

The custom FCF valuation tool suggests SYK 0.00%↑ is trading for an approximate 24% premium to its fair value as of 1/12/25. As you can see, the free cash flow valuation zones have fluctuated, some years more than others. During 2019 the stock spent most of the year close to the trim level, before the FCF spiked more than 80% in 2020, leading to the stock becoming undervalued. In early 2020 the stock declined approximately 40%, and would’ve been a great time to buy SYK 0.00%↑ as it was severely undervalued. After a mediocre 2021, the FCF declined 25% in FY22 resulting in a noticeable change in the valuation zone, and as previously mentioned FY22 was the one down year for Stryker over the past 10. The FCF rebounded handsomely in 2023, surging more than 50% and ending the year reasonably valued. 2024 was essentially flat for the FCF; however, the stock ended the year up about 20%.

The company has a long-term expected rate of return slightly above 7%, and the components of that estimate are as follows:

A current dividend yield of 0.92%.

A return to fair value factor of -4.40%.

An expected earnings growth rate of 10.60%.

In summary, Stryker is a consistent winner with the stock rising in 9 out of the last 10 years. The revenue per share is growing nicely, and the GPM is stable; conversely, the ROIC has some room for improvement, which I expect to happen over time. The dividend growth has slowed some but is still exceeding inflation for the time-being. The most recent earnings report was solid and the stock has preformed well since then. The valuation is the only real issue with Stryker at the moment, so it’ll have to remain on the watchlist for now until a better entry point presents itself.

The 2024 quality score for SYK 0.00%↑ came in at 67.7%, while the long-term quality score is 78.5%.

If you found this content insightful consider upgrading to a paid subscription. You’ll gain access to a live complimentary Free Cash Flow Valuation Tool for over 200 stocks, as well as access to our 3 model portfolios. The paid subscription is only $5 per month and you can cancel any time.