Lennox International Inc. (LII)

Company Description

Lennox International Inc. LII 0.00%↑ is a leading provider of climate control solutions, specializing in the design, manufacture, and marketing of heating, ventilation, air conditioning, and refrigeration (HVACR) products. Headquartered in Richardson, Texas, Lennox operates through three segments: Home Comfort Solutions, Building Climate Solutions, and Corporate and Other, serving both residential and commercial markets in the United States, Canada, and internationally. The company markets its products under multiple brands, with Lennox as its flagship HVAC brand. Lennox International has a current market capitalization of approximately $21.5 billion and employs around 14,000 people. Over the past decade, LII 0.00%↑ stock has delivered strong performance, with a total return of approximately 425%, equating to a compound annual growth rate of 18%.

Quality Financial Metrics

As per usual in this section, we’re looking for a growing revenue stream, a steady gross profit margin and robust return on invested capital. These three metrics are important in determining if Lennox International is a high-quality company.

LII 0.00%↑’s revenue per share has shown significant growth over the past decade, increasing from $77.2 in FY15 to $150.9 over the last twelve months, a total change of nearly 100%, with a compound annual growth rate of 7.5%. RPS growth began the chart steadily increasing and rising to $97.6 in 2019, but experienced a slight dip to $94.9 in 2020. A notable surge occurred in 2021, with this metric reaching $112.7, followed by another big jump in 2022. Over the last few years, the RPS has continued to climb, all the way up to $150 in the most recent FY.

The gross profit margin has remained relatively stable but with a slight upward trend, growing from 27.3% in FY15 to 33.2% in FY24, a total change of about 20%. The margin peaked at 29.6% in FY16 but declined to 27.2% in FY22. Following that downward trend, the GPM rebounded to 31.1% in FY23 and increased again to 33.2% just last year.

The return on invested capital has shown a strong upward trajectory, rising from 20.5% to more than 40% last year. This metric saw steady growth early on, reaching 32.3% in 2018 but slipped to 28.3% in the Covid year—2020. It recovered nicely to 35.1% the following year, but declined once more before reaching its best mark in FY 2024.

LII has demonstrated solid growth in RPS over the past decade with a 7.5% CAGR. The gross profit margin and return on invested capital metrics have been reliable and improving in recent years which is encouraging. Overall, these metrics are quite good and are all heading in the right direction.

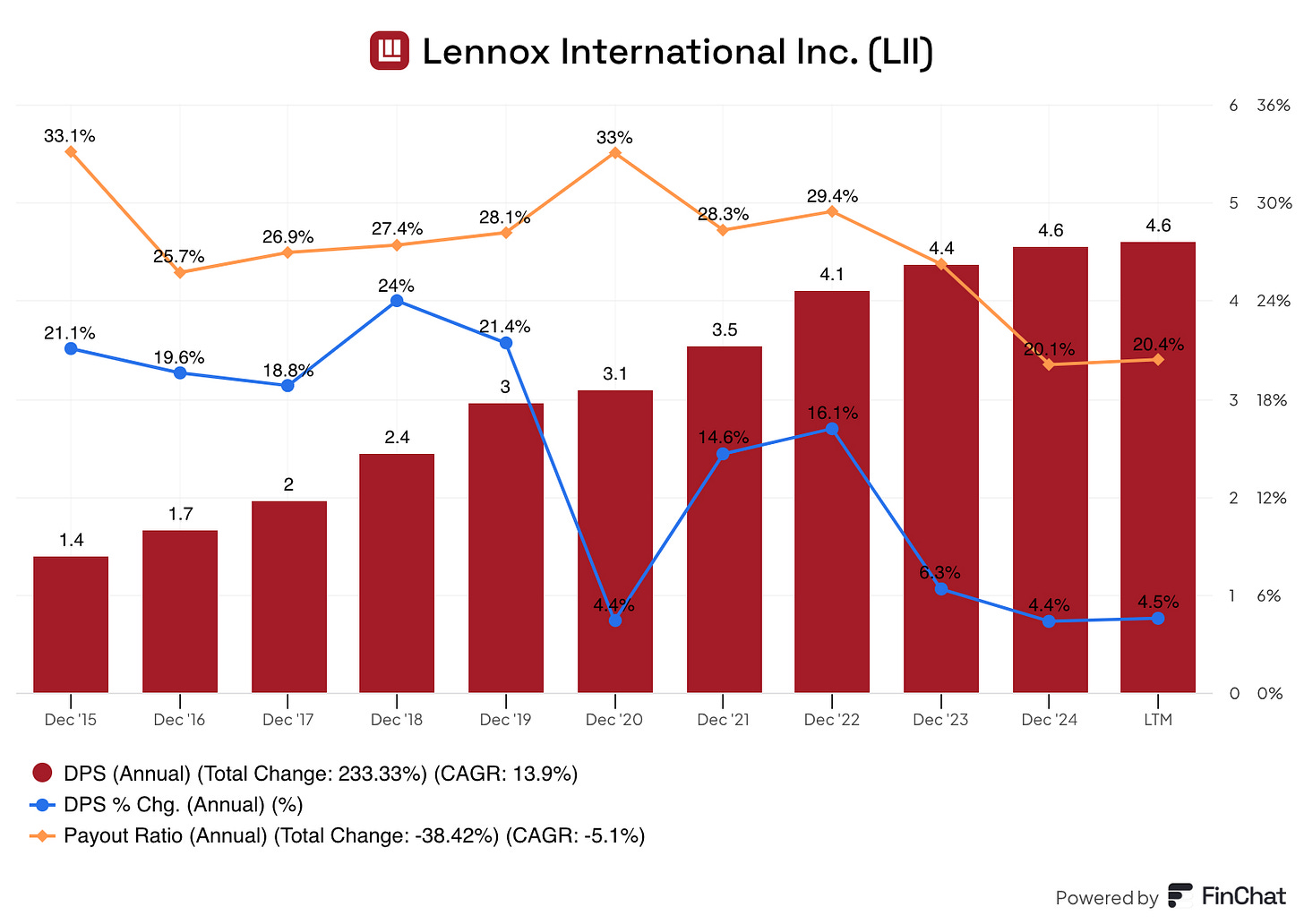

Dividend Data

Lennox International has maintained a consistent dividend history over the past decade, increasing its dividend by approximately 14% annually. The company currently pays a quarterly dividend of $1.15 per share, equating to an annual payout of $4.60, and a dividend yield of around 0.90%. The payout ratio has remained stable and even declined some, leaving ample room for LII 0.00%↑ to grow its dividend into the future. With a solid track record of dividend growth and a low payout ratio, LII 0.00%↑ presents an attractive option for dividend growth investors.

Potential Headwinds

Lennox faces several potential challenges which could impact its performance in the near term. Let’s take a look at a few potential issues

Market & Economic Weakness: LII 0.00%↑derives about 67% of its revenue from the residential HVAC market, which is currently facing challenges. Declining construction spending and a slowdown in HVAC product shipments, coupled with a saturated replacement market post-pandemic, are pressuring demand. Additionally, rising interest rates, which began impacting the economy around 2023, pose a risk to Lennox’s growth too. Heightened interest rates can reduce consumer spending on home improvements as well as new construction, both vital to Lennox’s business.

Pricing Sustainability: Lennox has benefited from higher pricing to offset inflation-gross margin expanded to more than 33% in 2024; however, analysts have mentioned this may not be sustainable long-term. The company’s 2025 guidance anticipates only a 2% revenue increase, with pricing gains expected to counter tariffs and volume declines, but any inability to maintain its pricing power could erode margins, especially if demand weakens further.

(Very) Recent Earnings

LII 0.00%↑ has good track record of beating earnings, exceeding EPS estimates in 14 of the last 16 quarters, while revenue has topped estimates in 12 of the last 16 quarters.

On Wednesday of this week, LII 0.00%↑ announced Q1 2025 earnings with a double beat. GAAP earnings per share came in at $0.16 above estimates at $3.37, on revenue of $1.07B, up 2% YoY, which also surpassed expectations by $50M.

Looking at the performance by segment, Home Comfort Solutions had revenue of $721M, up 7% YoY, driven by volume and price increases. The company expects flat revenue in 2025, with mid-single-digit volume declines due to 2024 pre-buy effects.

Building Climate Solutions revenue was $351M down 6% from Q1 2024 due to destocking and delays in orders related to the R-454B transition. Additionally, margins were impacted by short-term inefficiencies from the new Saltillo, Mexico factory startup and existing facility transitions. Management expects 6% revenue growth for all of 2025 in this segment, with order rates improving in the coming quarters.

Valuation

Let’s take a look at our valuation chart and see if LII 0.00%↑ is attractively valued at this moment.

Based on the custom free cash flow model, the stock appears to be slightly undervalued by about 6%, with the current price at $527 and the fair price near $560. As you can see around the end of 2024, and a few times since, the stock has traded for more than $650 a share. However the last few months have been tough for Lennox, but the recent price weakness might have given investors a good entry point.

Forward Return Assumptions

As you know I typically look for a projected RoR of at least 10% and although LII 0.00%↑ comes up a little short (less than 1%), I still think this is a great company worth considering. The components of the company’s expected rate of return are as follows:

Forward Dividend Yield: 0.87%

Return To Fair Value Factor: 1.17%

Projected EPS Growth Rate: 7.14%

Lennox International is a high-quality HVACR leader with strong financials. Its 14% annual dividend growth rate and low payout ratio should appeal to dividend investors, even with a low yield. The company has a pretty good track record of beating earnings, and rising to the occasion. Although the company faces some challenges, like heightened interest rates, I believe the stock is a solid consideration for growth and income investors.

If you found this content insightful consider upgrading to a paid subscription, you can see live valuation ratings here, at any time. Additionally, you’ll gain access to a live complimentary Free Cash Flow Valuation Tool for over 200 stocks, as well as access to our 3 model portfolios. The paid subscription is only $5 per month and you can cancel any time.

In case you miss them, here are some recently covered stocks:

Also check out some tools to help with your investing journey

Follow on other social media platforms

Link to Youtube

Link to X @LongacresFin