The Dream

The idea of building a dividend snowball that will one day generate enough passive income to give you financial freedom is very appealing. It might be the most attractive selling point for pursing a dividend focused investing strategy. But the journey from start to finish will not look the same for each investor. There are many dividend snowball paths you can take, so let’s dive deeper into this concept and help you create your own monster dividend snowball.

Reality

Before we dive in let’s talk about reality for a moment. Financial freedom requires time, effort and consistency and the journey will not be short nor will it be easy. How much time and how much effort will be required depends on your current situation and a how fortunate your time in the market will be. The latter is out of your control but it may have a significant impact on the time and effort that will be required.

The most important part of building a dividend snowball is to start your journey as early in life as possible. From there you can intertwine your dividend snowball into your finances and continually feed this passive income machine until it grows to be a beast of its own.

I’ll breakdown how a dividend snowball works, how it evolves with different dividend strategies, run through a few hypothetical examples and finally give you a tool to further model your own personal dividend snowball.

Dividend Snowball 101

The concept of a dividend snowball is quite simple and it revolves around the idea of growing your dividend income. Your dividend income can grow from 1 of 3 ways:

Contributing money to your dividend portfolio

Re-investing your dividend payments

Dividend increases in your portfolio

Each one of these 3 will increase your passive dividend income. At first, it may appear that contributing more money is growing your dividend income the most, and that is true. But over time, re-investing dividends and dividend increases gain momentum and eventually they will eclipse the dividend growth from your contributions. That is how a dividend snowball works. Your job is to stay patient while the dividend snowball is small and consistently contribute more money to your portfolio until it gains this momentum. And even after you reach the point where re-investing dividends and dividend increases are growing your dividend snowball faster than your contributions, you should keep contributing more money to your portfolio until you reach your financial freedom number. Because while your contributions may at one point not move the needle much they will still increase the compounding effect and play a meaningful role on the long run results.

Optimal Dividend Strategy

There are many differing opinions as to which dividend strategy is optimal for a dividend snowball. Some prefer to focus on high-yield, others prefer to focus on dividend growth and of course there are those that attempt to find the right mix of both. At first glance it may appear that a high-yield strategy may be the fastest way to financial freedom, after all why wouldn’t you want to receive more dividend income sooner? I believe the optimal dividend strategy depends on a few factors that will be unique to each investor. Here are a few questions to ask yourself before you decide which dividend strategy is best for you.

How much money are you starting with?

How much are you planning to invest?

What is your timeframe to reach your goal?

How would you like your dividend income to look beyond your goal?

These questions may be easier to explain with a few examples. I’ll be using my Dividend Snowball Calculator to help me run a few scenarios, you can grab a free copy of this google spreadsheet, a link is provided towards the end of the post.

High Yield

A very popular trend for High-yield dividend strategies sweeping the market today are covered call ETFs. Let’s consider the Global X NASDAQ 100 Covered Call ETF ticker symbol QYLD. This fund had a CAGR of 10.29% between June 2020 and Jan 2025, assuming you were re-investing dividends along the way. This is a time weighted rate of return that excludes the impact of any cash flows in your portfolio. Inclusive of a consistent cash flow stream your CAGR would be slightly better, 11.17%, which is the money weighted rate of return. QYLD had a trailing twelve month dividend yield of 12.38% at the end of January. I’m going to round these numbers to make the math a bit more simple, let’s run a hypothetical dividend snowball for QYLD.

Assumptions:

Starting Capital: $1,000

Monthly Contribution: $500

Capital Appreciation: -1.00%

Dividend Yield: 12.00%

Monthly Cost of Living: $4,000

Inflation: 2.00%

Annual Contribution Increases: 3.00%

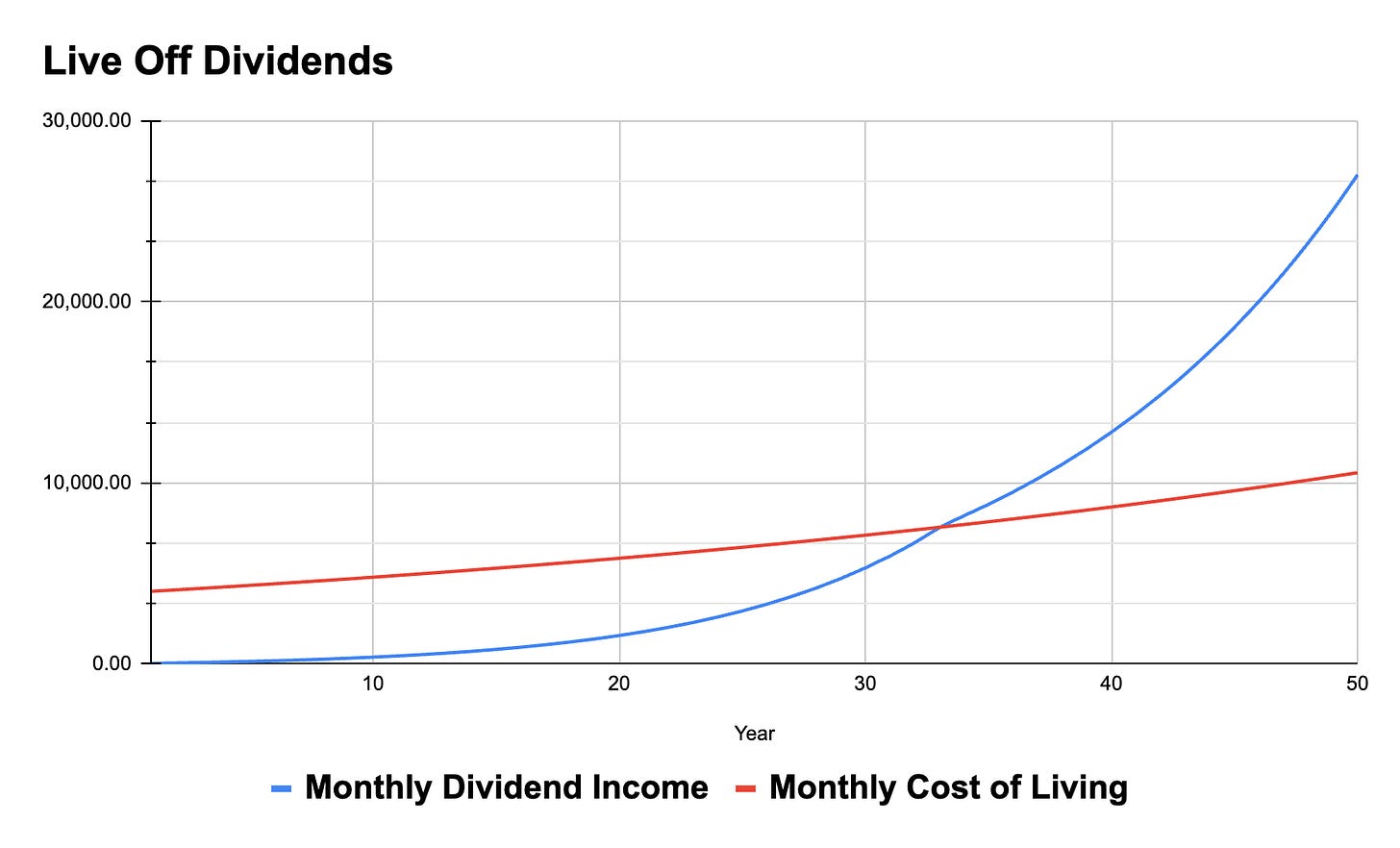

The goal is to see how long it would take the QYLD snowball to replace our inflation adjusted monthly cost of living with passive monthly dividend income. The dividend growth rate of our investment is presumed to align with our rate of capital appreciation. Here’s the chart:

It would take 21 years and 11 months for the dividend income from our portfolio to exceed our inflation adjusted cost of living. We’re talking about roughly $6,000 per month. What you might have noticed in the chart is that the dividend income starts out rather slow but gains momentum each and every year. You may have also noticed that the blue, dividend income line, disappears shortly after eclipsing the red, cost of living line. This is due to the fact that QYLD has no capital appreciation and no dividend growth. While the actual dividend payments do fluctuate and may grow from time to time, measured over a longer period of time there is no consistent dividend growth pattern. What may not be as evident in the chart above is that this passive dividend stream is unable to keep up with your rising cost of living beyond the financial freedom point, at the inflection of the dividend income and cost of living lines in the chart. Every few months, the model requires a monthly dividend payment to be used to purchase more shares of QYLD in order to keep up pace with inflation. This is probably not the ideal financial freedom situation you are envisioning.

One way to combat this inflation problem with QYLD would be to aim for a buffer between your dividend income and cost of living. Then use this buffer to continually purchase more shares of QYLD, in turn generating artificial dividend growth, and hope that this juicy dividend yield never dries up. Again, this may not be the most ideal strategy for a passive dividend income portfolio, as this buffer idea is not very passive.

If 21 years and 11 months sounds like way too long for you to reach financial freedom then you could increase the amount of your contributions. For example, if you double the original $500 monthly contribution to $1,000 you could reach financial freedom 6 years faster (15 years and 11 months). But again, you would run into the same issue of your dividend income not keeping up pace with your inflation adjusted cost of living.

Blend of High-Yield and Dividend Growth

Let’s say we are willing to forego some of the high-yield appeal in exchange for a moderate level of capital appreciation and dividend growth. Enter the JPMorgan Equity Premium Income ETF ticker symbol JEPI. JEPI had a CAGR of 12.30% between June 2020 and January 2025, assuming you re-invested dividends along the way. The money-weighted rate of return, with consistent cash flows, is not as generous at 10.76%. JEPI had a trailing twelve month dividend yield of 7.15% as of the end of January. The fund did have nice dividend growth in its first few years but not so much recently. For the sake of this example let’s assume JEPI can grow at the its historical pace and see some moderate dividend growth over the long term.

Assumptions:

Starting Capital: $1,000

Monthly Contribution: $500

Capital Appreciation: 4.00%

Dividend Yield: 7.00%

Monthly Cost of Living: $4,000

Inflation: 2.00%

Annual Contribution Increases: 3.00%

It would take exactly 27 years for our dividend snowball to reach financial freedom, under these assumptions. In contrast to the high-yield, QYLD, example above, the dividend income stream from JEPI grows much slower at first. It does gain momentum over time but requires 3 years and 1 month longer to reach our goal. However, beyond the financial freedom moment the dividend stream from JEPI consistently outpaces our inflation adjusted cost of living. This is exactly the kind of financial freedom dividend snowball you want to see.

What’s interesting is that if we increase our monthly contribution from $500 to $1,000, similar to what we did with QYLD earlier, the outcome is very favorable. Now it would take just 20 years and 7 months to reach financial freedom. That’s 6 years and 5 months faster, which is 5 months better than what increasing our contribution with QYLD offered. And keep in mind that JEPI’s dividend stream is more likely to grow faster than inflation whereas that is an unlikely scenario with QYLD.

High Dividend Growth

Now that we have looked at a high-yield example, a blend of yield and dividend growth, it’s only fair that we consider a pure dividend growth focus as well. Enter the popular Schwab U.S. Dividend Equity ETF ticker symbol SCHD. SCHD has a CAGR of 14.45% between June 2020 and January 2025, the best amongst the 3 options we have considered thus far. It’s money weighted rate of return is however the lowest, at just 10.26%. The reason why SCHD has the lowest money weighted rate of return, relative to QYLD and JEPI, is due to lackluster performance in 2023 and 2024. SCHD also has a much longer track record than both QYLD and JEPI and I believe in the long run it has the potential to offer very competitive if not superior total returns relative to both of these ETFs.

SCHD has a trailing twelve month dividend yield of 3.57% and a great track record of above average dividend growth. Let’s see how SCHD fairs in our dividend snowball calculator assuming it can also deliver the same 11% long term CAGR we used for QYLD and JEPI.

Assumptions:

Starting Capital: $1,000

Monthly Contribution: $500

Capital Appreciation: 7.50%

Dividend Yield: 3.50%

Monthly Cost of Living: $4,000

Inflation: 2.00%

Annual Contribution Increases: 3.00%

It would take 34 years and 3 months for our dividend snowball to reach financial freedom, the longest of the 3 examples we have considered. Our dividend income with SCHD grows very slowly during the first 10 to 15 years, relative to our inflation adjusted cost of living. Somewhere between year 15 and year 20 the dividend snowball starts to pick up pace but it still takes nearly 2 decades to catch up with our cost of living. While it would take much longer to reach financial freedom with SCHD, our dividend income beyond that inflection point grows at the most generous rate, ensuring the most financially stable and secure retirement.

If we increase our monthly contribution from $500 to $1,000, it would still take 27 years and 3 months to reach financial freedom. This is 3 months longer than investing only $500 into JEPI in the prior example. However, its worthy to note that the additional monthly contribution offered the largest time improvement in this example, reaching financial freedom a full 7 years earlier.

How Do You Build Your Own Monster Dividend Snowball?

A good place to start building your own monster dividend snowball is by answering the 4 questions I laid out at the beginning.

How much money are you starting with?

How much are you planning to invest?

What is your timeframe to reach your goal?

How would you like your dividend income to look beyond your goal?

You can download a copy of my dividend snowball calculator here, and use it help you figure out what combination of capital appreciation and dividend yield are optimal for you. Start by inputting your starting capital, how much you intend to invest monthly and your estimated cost of living it today’s dollars. You can also change the rate of inflation and the annual contribution increase to align with your plans. Then all that is left is to play around with various combinations of capital appreciation and dividend yield until the duration of time to reach financial freedom aligns with your goal.

Once you figure out the optimal capital appreciation and dividend yield mix, you can use this information to design a portfolio of stocks or funds that will best help you reach this balance.

It’s also worth playing around with the calculator to see how much improvement small changes in the assumptions can make. For example, contributing a few extra dollars per month or setting your annual contribution increase a half a percent higher.

This calculator is meant to be used a motivational tool but it’s results should not be taken as any guarantee of outcome. It is highly unlikely that your dividend journey will be a seamless ride of exponential growth. On the contrary, the stock market is volatile and our journey is filled with many periods of ups and downs. It’s worth noting that a dividend snowball keeps working under all market conditions, in fact, a dividend snowball works faster during a market crash, provided of course that we do not experience any dividend cuts.

Tips For The Calculator And Portfolio

Keep the sum of capital appreciation and dividend yield realistic (no higher than 10%-11%).

Don’t chase yield if you don’t have to. If you don’t plan on using your dividend income for 30 years, target a lower dividend yield portfolio that is more tax advantageous.

Design the simplest portfolio that will meet your goals (its very difficult to mess up a simple strategy).

Set your portfolio on auto-pilot and remain patient through any rough periods (if you stay invested long enough - you will see a rough period or two).

If anyone has any suggestions to make this calculator better, I’d love to hear your feedback in the comments section.

If you found this content insightful consider upgrading to a paid subscription. Paid subscribers can see the live valuation ratings for what I believe to be the Highest Quality Dividend Growth Stocks here, at any time. Additionally, you’ll gain access to a complimentary Stock Valuation Tool for 227 Quality Dividend Growth Stocks. The paid subscription is only $5 per month and you can cancel any time.

In case you’ve been hiding under a rock for the past month, here are some recently covered stocks:

Texas Roadhouse Inc. TXRH 0.00%↑

Follow Me On Social Media Platforms

Link to Youtube

Link to X @LongacresFin