Before we dig into Domino’s, here are some recently covered stocks you might be interested in:

Company Description

Domino’s Pizza DPZ 0.00%↑ is one of the largest pizza chains throughout the world, with more than 20,000 locations operating in over 90 countries. The company revolutionized the pizza industry with innovations like the 30-minute delivery guarantee and, more recently, a robust online ordering and tracking system. Additionally, DPZ 0.00%↑ now offers AI-driven ordering and delivery tracking, alongside other technological advancements. The company has a market cap of just over $15B and has performed well over the past decade with a 10-year CAGR of 17.7%.

Furthermore, here are some current financial metrics for Domino’s Pizza.

Quality Financial Metrics

Next, let’s discuss some key financial metrics to determine if Domino’s Pizza is a high-quality business. Ideally, we’d like to see growing revenue, an expanding gross profit margin, as well as a healthy return on invested capital. Without further ado, let’s dive in.

As indicated by the red columns, revenue per share for DPZ 0.00%↑ has grown at a robust 14.2% annually over the past 10 years, though growth has slowed slightly in recent years. For the first four fiscal years on the chart, RPS grew at more than 20% annually, doubling from $41.2 per share to $82 per share. Revenue growth was 8% in FY19 before climbing nearly 20% again in FY20. Since then, the company has seen this metric rise by 10.9%, 8.4%, 0.5% and 6.2%, respectively. The 2023 RPS growth is somewhat concerning, but the company rebounded nicely last year. It’s worth noting DPZ 0.00%↑ has a share repurchase program; and during the first half of the past decade the company’s total shares outstanding shrank by about 6% annually. Over just the past five years, the company has repurchased an average of 2.5% of its outstanding shares.

The gross profit margin for DPZ 0.00%↑ has been fairly steady, with some minor fluctuations. As indicated by the blue line, the first three years on the chart showed margins above 30%, but since then, this metric has hovered closer to 27%. There was an off year in 2022 were it dipped to 25.6%, but it has climbed back above 28% over the past two fiscal years.

Domino’s return on invested capital is easily the highest I’ve seen, when conducting these deep dives. This metric rose from an impressive 61% at the beginning of the chart to more than 80% in FY18. Although it has declined significantly since that peak, it still stood at an astounding 42.5% last year. As you know, I typically aim to find companies with a ROIC above 20%, and DPZ 0.00%↑ doesn’t disappoint here.

It’s hard to find a weak spot in these financial metrics. You could probably argue the slowed revenue growth could be a concern, but even that doesn’t worry me much. The gross profit margin is solid and has improved recently, and while the ROIC has come down from its highs, it remains well above that of other companies I’ve reviewed.

Dividend Data

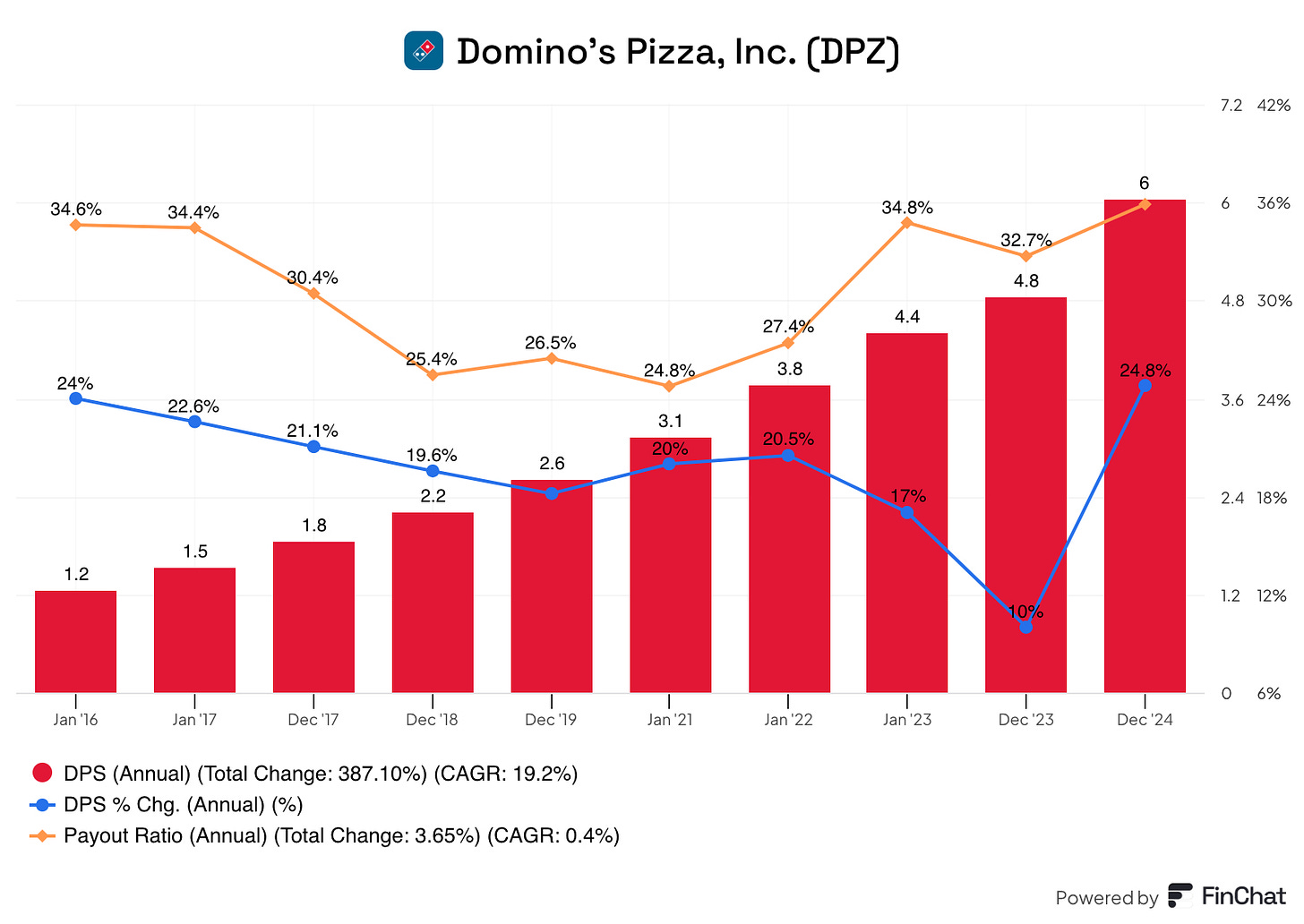

DPZ 0.00%↑ has grown its dividend for more than 10 years, including a 15% increase announced in late February this year. This raised the quarterly payout from $1.51 to $1.74, equating to an annual payout of $6.96. The current dividend yield for Domino’s is a tick above 1.5%, well above its 4-year average of 1.12%. Although the stock doesn’t offer a high yield, the dividend growth for this pizza chain has been impressive. The 3 & 5-year dividend growth rates are 16.95% and 18.09%, respectively, both lower than the 10-year DGR which stands at 19.2%. Finally, as shown in the chart below, the payout ratio is not a concern, as it hasn’t exceeded 35% over the past ten years, leaving ample room for DPZ 0.00%↑ to continue growing its dividend.

Risks

As a global fast-food chain, the company faces numerous risks that could impact its operations and profitability. Let’s discuss some of these below and explore challenges DPZ 0.00%↑ might encounter.

The obvious one for me is intense competition in the pizza industry, with rivals like Pizza Hut, Papa John’s, and numerous local chains in cities and neighborhoods across the country. Similarly, non-pizza fast food options and third-party delivery platforms like Uber Eats could erode market share as well. These competitors may offer lower prices, more innovative or unique menus, or faster delivery, especially in markets where Domino’s relies on its delivery edge.

As someone who enjoys pizza, I’m all too aware of how unhealthy it can be, and this could have a detrimental effect on Domino’s business. Over the past decade, there has been a noticeable shift in consumer eating habits, with many people opting for healthier choices whenever possible. For example, there’s a growing interest in low-carb options or even plant-based foods, which might steer customers away from traditional pizza. Ultimately, if Domino’s fails to adapt its menu effectively—despite efforts like introducing vegan options in some regions—the company may struggle to meet evolving consumer demands.

These are just a few of the major risks I see for DPZ 0.00%↑. Although the company has been resilient thanks to its technological innovation and franchisee support, staying ahead requires constant adaptation.

Recent Earnings

In late February, DPZ 0.00%↑ announced Q4 2024 earnings with a double miss—GAAP earnings per share was $4.89 for the quarter, coming up a penny short of analyst expectations, on revenue of $1.44B, which missed by $30M, but was a nearly 3% increase YoY.

U.S. stores saw sales rise 2.3% for the quarter, while International grew 6.4%. Combined, the company saw an increase of 4.4%, when excluding the impact on foreign currency. For the year, U.S. sales grew more than 5% to $9.5B, while International stores had even better growth, at 6.5%. Something I didn’t realize until digging into this company, although it isn’t by much, DPZ 0.00%↑generates more revenue Internationally than within the U.S.

Same store sales growth for U.S. franchise stores rose 0.5%, while company owned stores saw sales dip 0.7%. Conversely, International locations had same store sales growth of 2.7%. Looking at the full-year, company-owned stores had sales rise 3.5%, slightly better than franchise locations which were 3.2% higher. International same-store sales rose 1.6% for the year.

As mentioned above, GAAP EPS was $4.89 for the quarter, a 9.2% increase YoY. While fiscal earnings per share was $16.69, a whopping 13.8% increase when compared to the prior year when EPS was $14.66.

During the earnings call, the aforementioned 15% dividend increase was announced as well, along with share repurchase numbers. DPZ 0.00%↑ repurchased more than 250,000 shares during the 4th quarter for more than $110M; and for the year retired more than 750,000 shares for a total cost of a little more than $325M. As of the earnings call, the company had $814.3M remaining on its share repurchase program.

Overall, the earnings report was well-received by the market, with shares climbing more than 3% for the day. The full earnings call can be read/listened to here.

Quality At A Fair Price is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.