Graco Inc. (GGG 0.00%↑ ) is a well-known manufacturer of fluid handling equipment, primarily serving the construction, automotive, and manufacturing industries. The company designs and produces products such as paint sprayers, sealant guns, and other equipment involved in the application of coatings or fluids.

Here is a brief review at some of their financial metrics:

Is GGG a winner?

Since 1990 GGG 0.00%↑ has returned nearly 37,000% equating to a compound annual growth rate of 18.5%, well above an average market return. In my opinion, a company that is consistently able to exceed standard market returns for an extended period of time is an obvious winner.

The previous decade for GGG 0.00%↑ has been very good as well, with an overall total return of almost 300%, this results a CAGR of about 14.3%. The stock was relatively flat for basically all of 2015 and 2016. Conversely, in 2017, the stock began to take off climbing by 64% and closing the year out at $46/share. From 2018 through 2019 the stock oscillated quite a bit, but by the end of 2019 there had been essentially minimal change. In 2020 GGG 0.00%↑ provided investors with another big year, rising almost 40% to about $70/share. From 2021 through mid-2023 there was again minimal change with the stock channeling up and down quite a bit but overall this time period was basically flat. Over the past 18 months GGG 0.00%↑ has a total return of about 7%, but has again fluctuated quite a bit during that time frame. The stock reached a low in Oct. 2023 of $70 and rose to a high in March of this year at nearly $95. These market swings have provided potential investors with great opportunities to own a wonderful company.

Dividend Data

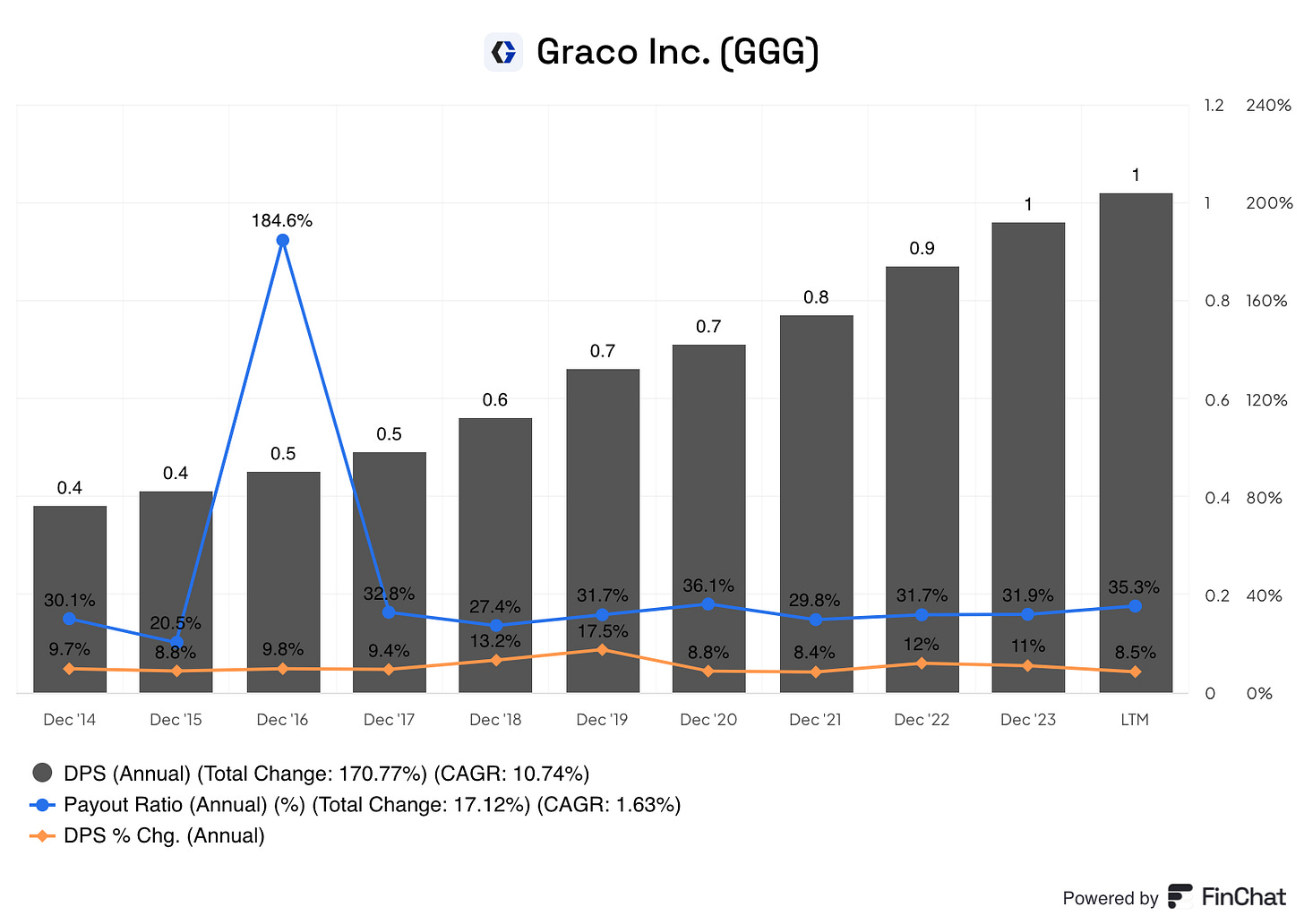

Since we are exploring the market for a quality Dividend stock it only makes sense we examine a company’s dividend history.

GGG 0.00%↑ has grown its dividend at a relatively predictable pace with some outliers. The company’s 3-, 5- and 10-year dividend growth rates are all in the neighborhood of 10%. As you can see from the chart below, GGG 0.00%↑ had a few better than average increases in 2018, 2019 and 2022. However, what impresses me the most about Graco is the payout ratio has remained very low, with 2016 being an outlier. The payout ratio has not surpassed 36% over the past decade leaving a considerable amount of room for future dividend increases.

Quality Metrics

In my opinion there are three important quantitative characteristics that all high quality business should have in common and they are as follows: a rising revenue stream, a steady gross profit margin and a robust return on invested capital.

Graco has grown its revenue per share for the majority of the years over the past decade. The growth has come at a clip of about 6.6% per year on average, but as you can see from the chart below there were some flat years too. A company’s ability to consistently increase their revenue is imperative for obvious reasons and with the exception of a couple fiscal years Graco has been able to do so.

The gross profit margin has been very steady, with only a minor slip in FY22. A company’s ability to maintain a steady GPM provides investors a clear understanding of a company’s production efficiency and pricing strategy. This allows for accurate forecasting and budgeting enabling a business to plan for the future.

Graco’s ROIC dipped from 2014 through 2016, but in 2017 this metric rebounded nicely, and grew again by 25% in 2018. Since then Graco’s return on invested capital has been able to stay north of 25%; however, there is a noticeable decline with this metric, dropping about 18% from FY 2018 to FY 2023.

In my opinion, GGG 0.00%↑ has some very healthy financial metrics. The company has been able to increase its revenue per share at a modest clip. The GPM has been very consistent and although the ROIC has dipped some over the past half decade, Graco has been able to keep it above 25% for an extended period of time which bodes well for the company.

Valuation

The final consideration we must determine is whether or not GGG 0.00%↑ is currently trading for an attractive valuation. As the custom FCF valuation tool suggests, the stock is currently trading for a slight discount to its fair value and is currently rated a “BUY”.

As you can see, Graco typically does not go “on sale", however, since the beginning of 2023 the stock has spent most of the time in the “BUY” or “STRONG BUY” range. This occurred because the company saw a dramatic decline in 2022 in its FCF, where it decreased by almost 50% but the stock did not follow, leaving it very much overvalued. In 2023, Graco’s FCF rose by more than 150% which caused the valuation range to shoot up as well. As previously mentioned the stock has remained relatively flat over the past 18 months with only a minor increase.

GGG 0.00%↑ currently has a long-term expected rate of return of 12.32%, the components of this ROR are as follows:

A current dividend yield of 1.15%.

A return to fair value factor of 1.17%.

Estimated EPS growth of 10%.

In summary, GGG appears to be a well-run company with consistent market returns and stable financial metrics. The company has shown an ability to reward its shareholders with inflation-beating dividend increases, typically around 10%. GGG 0.00%↑ has risen by just 2% YTD and the market appears to be ignoring this gem. At its current price, dividend investors may want to consider adding this stock to their watchlist.

If you found this content insightful you should consider upgrading to a paid subscription. You’ll gain access to live valuations for the 50 stocks in our High Quality Dividend Growth Investable Universe, a complimentary Free Cash Flow Valuation Tool and access to our 3 model portfolios. The paid subscription is only $5 and you can cancel at any time.