Before we dive into Equifax, here are some recently covered stocks you may be interested in:

Background

Equifax Inc. EFX 0.00%↑ is a global data, analytics, and technology company that provides credit reports, risk management, and fraud prevention solutions.

EFX is headquartered in Atlanta, GA and began operating in 1899 under the name Retail Credit Company, but changed its name to Equifax in 1975.

The company maintains 3 operating segments: Workforce Solutions, U.S. Information Solutions, and International.

Over the past decade, the stock has returned a little more than 200%, or about 11.7% annually, essentially in-line with the broad market

Quality Financial Metrics

Let’s examine Equifax’s financial metrics to determine how the company has performed in recent years.

Revenue Per Share:

Revenue per share for EFX 0.00%↑ has increased from $22.4 in 2015 to almost $46 in 2024, a total change of more than 100%, and a corresponding CAGR of 8.3%.

There’s a noticeable acceleration after 2019, with this metric climbing from $29 to the aforementioned $46 per share.

Although the growth has been a little uneven, the overall upward trend is obviously encouraging.

Gross Profit Margin:

The GPM has slipped a little bit over the past decade, but is still above the 50% mark.

One potential cause for the decline in the GPM is the company’s ongoing investments made in new products, data, analytics, and AI capabilities.

Return on Invested Capital

Although this metric has declined, as mentioned regarding the GPM, the company is making significant investments in Cloud Technology, with increased capital expenditures likely leading to average ROIC numbers for now, in hopes they pay dividends later.

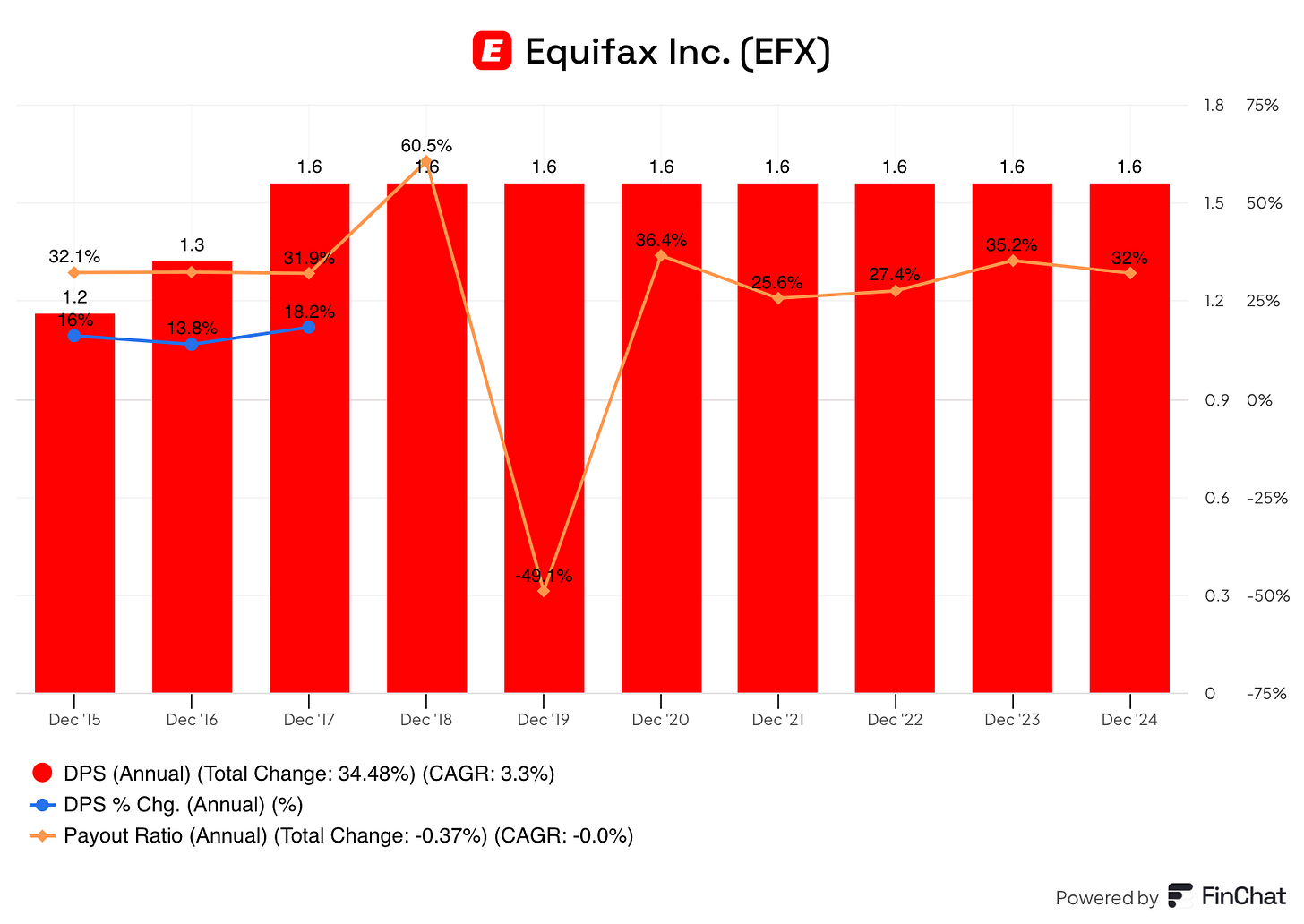

Dividend Data

Equifax went a long time without a dividend increase, but in mid-April this year raised its dividend 28%.

The company also announced a $3B stock buyback program that is expected to be completed over the next four years.

As indicated by the orange line, the payout ratio is at a very reasonable level and ideally we’ll see more dividend growth for years to come.

Potential Headwinds

Mortgage Market Decline: The U.S. mortgage market, a critical segment for EFX 0.00%↑, is projected to decline 7% thanks to elevated mortgage rates. This decrease, coupled with economic slowdowns in important markets like Australia, the U.K., Canada, and Brazil is likely to lead to reduced demand for credit reporting and thus pressuring revenue growth. A recent 10-Q also mentioned a 19% revenue drop in Employer Services due to lower Employee Retention Credit revenue, which further exacerbates the impact of the global economy.

Increased Technology Costs: I realize I mentioned this topic before but it’s worth mentioning again, that EFX 0.00%↑ has made massive investments in the EFX Cloud initiative. In Q3 2024, management mentioned significant restructuring charges as a result of this transformation, which has continued into 2025 as the company prepares to complete its cloud migration (approximately 85% completed). Although these investments should help with long-term growth, they have increased COGS, as well as contributed to the decline in the GPM, hurting profitability in the short term.

Q1 2025 Earnings

Equifax has topped EPS estimates in 11 out of the last 12 quarters; however, revenue hasn’t been as resilient with the company only beating the revenue consensus 7 out of the last 12 quarters.

In late April, EFX 0.00%↑ announced their Q1 earnings with a double beat, GAAP EPS was $1.06 for the quarter, exceeding analyst expectations by $0.10, on revenue of $1.44B which also beats the consensus by $20M and was a 3.6% YoY increase.

Total revenue for the Workforce Solutions segment increased 3% to $618.6M. Within this segment, Verification Services was $502.2M up 5% YoY, while Employer Services decrease 8% to $116.4M for the quarter.

Revenue for the U.S. Information Solutions portion of the company rose 7% to almost $500M. The pieces of that pie are: Online Information Solutions grew 7% to $448.1M, while Financial Marketing Services revenue surged 10% YoY.

Last but not least, the International segment saw revenue rise 1% on a reported basis, and 7% on a local currency basis to $323.5M.

EFX 0.00%↑ spiked more than 13% following this earnings report, and is up almost 25% overall since then.

Also check out some tools to help with your investing journey

Follow on other social media platforms

Link to Youtube

Link to X @LongacresFin

Valuation

Let’s take a look at the FCF/Price ratio for EFX 0.00%↑ and determine if the stock is trading for an attractive valuation at its current levels.