The hunt for new quality stocks has been on since the beginning of the year. I’ve already looked at 313 unique companies with another 458 slated for review. The goal is simple, I want to leverage my quality score to build a desirable universe of stocks I can track, value and add to my portfolio at opportune times.

The updated High Quality Investable Universe will be revealed in a few weeks but I thought it would be useful if I shared some of the more interesting finds along the way. So, today I present to you 3 potentially high quality stocks I found that are currently not in the investable universe that can be found here.

If the link does not work for you that’s likely because you aren’t a paid subscriber yet. If you’d like to see the investable universe that is updated live while the stock market is open, you can upgrade to a paid subscription for just $5 per month here:

Now let’s move on to the 3 High Quality Stocks!

1. Automatic Data Processing ADP 0.00%↑

Automatic Data Processing, Inc. (ADP), founded in 1949 and headquartered in Roseland, New Jersey, provides cloud-based human capital management solutions globally. It operates through two segments: Employer Services, offering payroll, HR outsourcing, and integrated HCM solutions, and PEO Services, providing HR outsourcing for small and mid-sized businesses via a co-employment model.

During the last decade the stock has grown at a healthy rate of 15.67%.

After a strong second half of 2024 the share price has taken a bit of a breather, once again dipping below $300. Based on the custom free cash flow valuation model ADP appears to be slightly undervalued. The stock also presents an attractive long-term expected rate of return of 11.41%.

2. Intuit INTU 0.00%↑

Intuit Inc., founded in 1983 and headquartered in Mountain View, California, offers financial management and compliance products for consumers, small businesses, self-employed individuals, and accounting professionals worldwide. It operates four segments:

Small Business & Self-Employed: Provides QuickBooks solutions, payroll processing, payment processing, and small business financial services.

Consumer: Offers TurboTax for income tax preparation and personal finance tools.

Credit Karma: Provides a personal finance platform with recommendations for loans, credit cards, and insurance products.

ProConnect: Offers tax preparation software and services for professionals.

Intuit distributes its products through websites, mobile apps, retail, and other channels.

During the last decade the stock has grown at a market beating rate of 22.86%.

The past 12 months, barring some minor volatility, have seen the share price remain rather flat. More recently, following an upward move that saw the share price breach the $700 mark in mid-November 2024, we have seen the share price pull back. Based on the custom free cash flow valuation model the price of Intuit is very close to being fairly valued. In my opinion Intuit is already attractive with a long-term expected rate of return of 14.47%, but given that the price is currently in a downward trend we may see even more opportune entry points in the near future.

3. Booz Allen Hamilton Holding Corp. BAH 0.00%↑

Booz Allen Hamilton, founded in 1914 and based in McLean, Virginia, provides consulting, analytics, engineering, digital, and cyber services to governments, corporations, and non-profits worldwide. It specializes in AI, data science, automation, cyber risk management, and modernizing complex systems.

During the last decade the stock has grown at a very healthy rate of 18.79%.

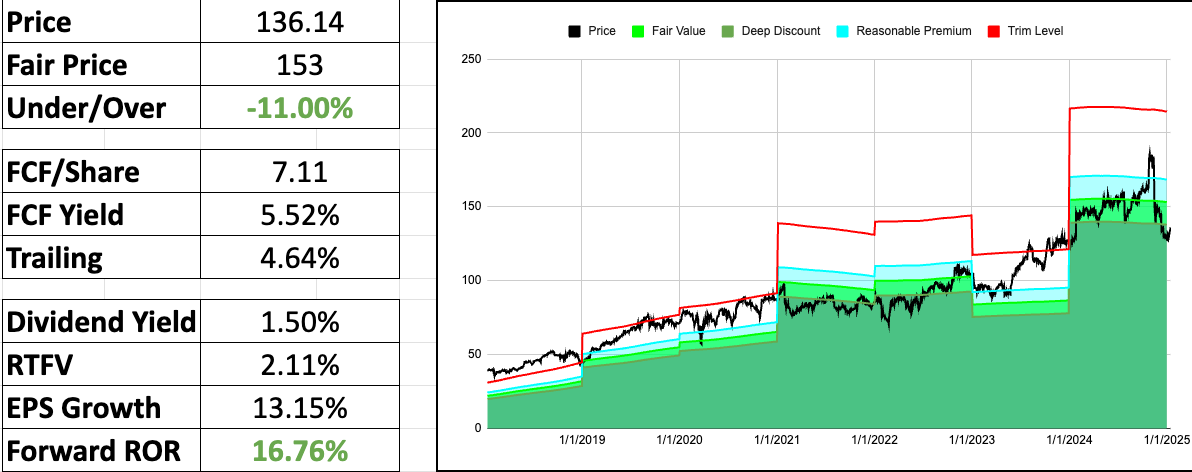

After hitting an all-time high in October of 2024, the share price has taken a tumble. Based on its free cash flow history the stock appears to be trading for an 11% discount with a pretty healthy long-term expected rate of return of 16.76%.

If you found this content insightful consider upgrading to a paid subscription. You’ll gain access to my complimentary Free Cash Flow Valuation Tool for over 200 stocks, as well as gain access to the 50 stock High Quality Investable Universe that is updated live when the stock market is open. The paid subscription is only $5 per month and you can cancel any time.

ADP is high on my radar, I've just been waiting for the right entry point after missing out last year. I have been slowly DCAing into INTU. I am hoping for an upward pop soon. I have not looked too closely at BAH, sounds like its similar to ACN, but interesting that the quality score for BAH is much higher. Thanks for these updates!

Nice article. I commented about BAH on your article thread. You can also see my write-ups on Amentum (AMTM) for more context around names like BAH in the defense service contractor industry.

https://www.safeharborstocks.com/p/amentum-decoding-the-backlog-decline