Valuation Rating Update - Week of December 30th + Quality Score Update

Last week the stock market rose moderately but the week was capped with a pretty sizable drop on Friday. The Santa Rally is certainly not playing out as it has in recent years.

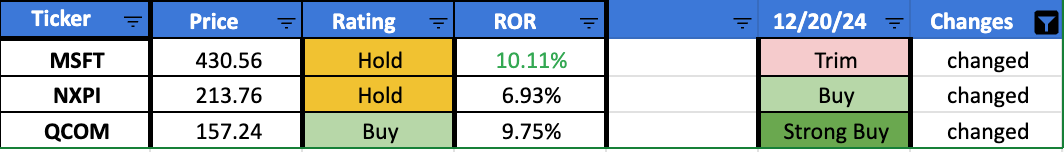

This moderate shift in the market triggered 3 valuation rating changes in the High Quality investable universe. We have one rating upgrade and two downgrades.

If you’re a paid subscriber you can see the live valuation ratings here, at any time. Additionally, there is a copy of my custom Free Cash Flow valuation tool currently covering 202 dividend growth stocks.

Let’s take a look at which stocks had a valuation change since last week.

Microsoft MSFT 0.00%↑

Microsoft had an overall negative week around Christmas capped by a decline of 1.72% last Friday. This minor decline brought the stock down from a Trim rating to a Hold rating primarily because Microsoft’s forward rate of return improved to more than 10%. If you recall from prior updates the valuation rating ranges shown in the chart above change based on the expected forward rate of return.

NXP Semiconductor NXPI 0.00%↑

NXP Semiconductor had a positive gain last week and as a result has been downgraded from a Buy to a Hold. Because the stock does not present a forward expected rate of return of at least 10% today, my custom valuation model is applying more conservative price points.

Qualcomm QCOM 0.00%↑

Qualcomm had a positive return last week and has been downgraded from a Strong Buy to a Buy. I know this isn’t reflective of the chart above but again this early downgrade is related to the forward expected rate of return being less than 10%. The current Strong Buy price point for Qualcomm is $148 and if the expected rate of return was at least 10% that price point would be $167.

Please note the valuation model is based strictly on quantitative data and therefore does not factor in any qualitative information. As such it is imperative you perform your own due diligence on each stock to ensure there isn’t a valid reason for the valuation change. Lastly, as a reminder all paid subscribers can access live valuation ratings at any time here.

Quality Score Update

In last weeks valuation rating post I shared with you the 13 stocks in this investable universe that currently have a quality score of more than 90%. I’m still working on compiling a list of companies that rank very high in my custom quality score model. I hope to start sharing that list here sometime in January.

Recently I performed a small backtest of my quality score applied to the current list of Dividend Kings. I shared a quick overview on my YouTube channel, if you haven’t had a chance to see it here is the video.

And if you don’t care to watch the video here’s a brief summary of the results.

The image above shows the results of a nearly 9 year backtest (2016 - 12/23/2024). The top row labeled “92%” shows the returns of investing in Dividend Kings that had a quality score of at least 92%. The test ran based on calendar years where the preceding year was used to compute a quality score for each Dividend King and the selected Kings were held for the duration of the following calendar year.

The test portfolio outperformed the S&P 500 (as measured by SPY) by 301.60% or a CAGR of 8.37%. This was a very concentrated portfolio that held on average just 1.9 stocks each year.

The second row in the image above are the returns for all of the Dividend Kings that were not chosen.

The third row is the average return for all of the Dividend Kings with the fourth row being the return for SPY.

This next image shows the average returns for the top 5 deciles of quality scores compared to the average return for all of the Dividend Kings.

There is a clear pattern in Dividend Kings with higher quality scores generating higher rates of return. The next step in this take this backtest one step further and apply it to a larger universe of stocks. I’ll share that analysis with you in the near future.

The long term goal is to create a list of stocks with excellent quality scores and use my custom Free Cash Flow valuation tool to figure out an opportune time to invest in these fantastic businesses.

Have a great week and a Happy New Year!!