Last week the stock market took a nose dive shortly after the FED announcement that it might move slower than previously indicated in cutting rates next year. The S&P 500 finished the week down 2.19% with many individual stocks following suit.

This downward push for the stock market triggered 7 valuation rating changes in the High Quality investable universe. All 7 of these rating changes were favorable upgrades given the overall direction of the market last week.

If you’re a paid subscriber you can see the live valuation ratings here, at any time. Additionally, there is a copy of my custom Free Cash Flow valuation tool currently covering 202 dividend growth stocks, and furthermore you will have access to the model portfolios designed around this investable universe.

Let’s take a look at which stocks had a valuation change since last week.

Cintas CTAS 0.00%↑

Shares of CTAS 0.00%↑ dropped by 11.5% last week and as indicated in the valuation chart above the stock has moved into our Hold zone. While the stock still looks overvalued in my model the 8.78% forward rate of return is getting closer to my desired 10%.

Fastenal FAST 0.00%↑

Shares of FAST 0.00%↑ dropped by 5.12% last week pushing the stock back down into my Hold zone. Despite this moderate pullback the forward rate of return of 5.42% is still rather low.

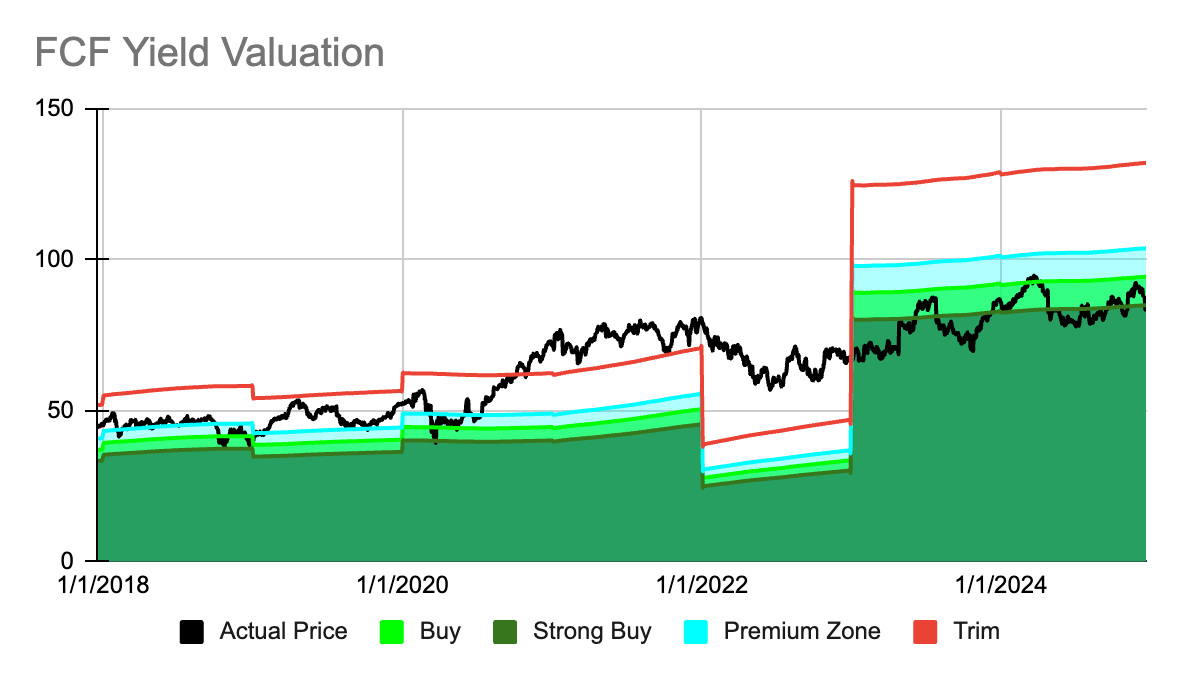

Graco GGG 0.00%↑

Shares of GGG 0.00%↑ fell by 3.69% last week pushing the stock down into my Strong Buy zone. To complement this attractive valuation the stock also has a very good forward rate of return of 13.22%.

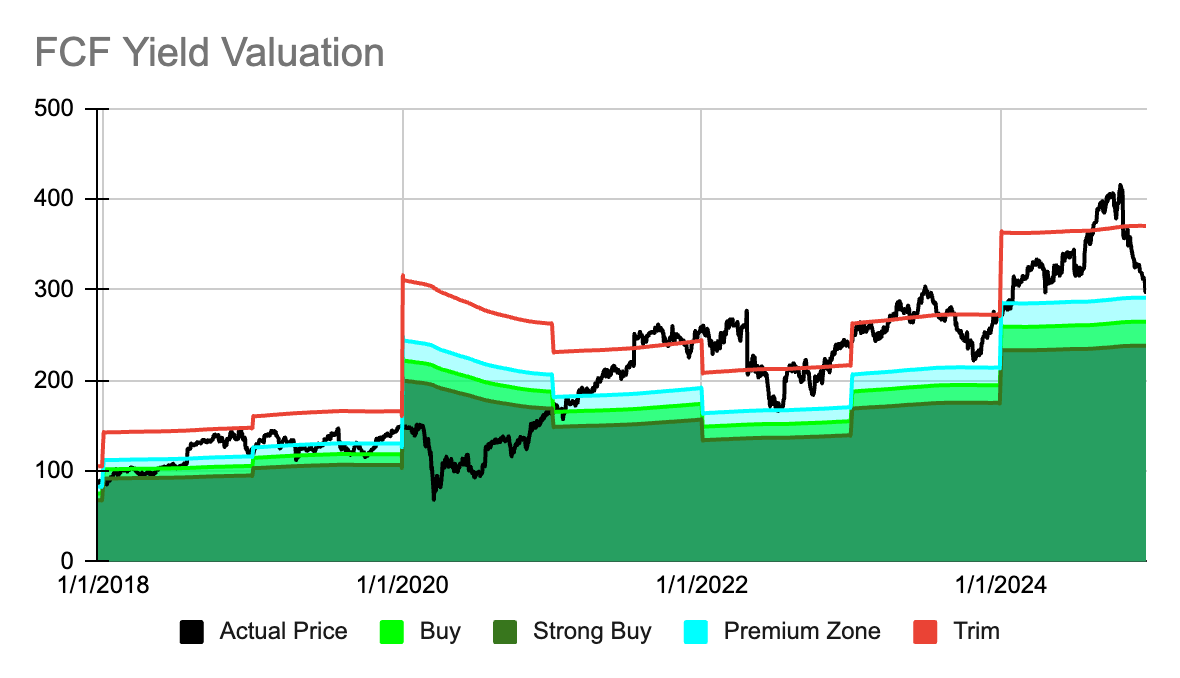

HCA Healthcare HCA 0.00%↑

Shares of HCA 0.00%↑ fell by 2.18% last week as the stock continues its recent descend, dropping from above $400 to nearly $300 as of last Friday. The stock has finally reach the Buy zone in my valuation model and the forward rate of return has improved to 10.03%.

Lam Research LRCX 0.00%↑

Shares of LRCX 0.00%↑ dropped by 5.86% last week as the stock continues to decline and find a bottom in the tail end of 2024. The forward rate of return has increased to nearly 20% based primarily on optimistic earnings growth on the horizon.

NXP Semiconductor NXPI 0.00%↑

Shares of NXPI 0.00%↑ fell by 3.36% last week and the stock has once again been pushed down to a Buy zone in my valuation model. The forward rate of return stands at just 7.15% and adds a bit of hesitation to go along with this favorable valuation rating.

Qualcomm QCOM 0.00%↑

Shares of QCOM 0.00%↑ fell by 3.31% last week pushing the stock down into my Strong Buy Zone. Additionally the forward rate of return has improved and currently stands at 10.16%

Please note the valuation model is based strictly on quantitative data and therefore does not factor in any qualitative information. As such it is imperative you perform your own due diligence on each stock to ensure there isn’t a valid reason for the valuation change. Lastly, as a reminder all paid subscribers can access live valuation ratings at any time here.

Thank you for reading and have a great week!

Here are the 13 highest rated stocks in the investable universe at the moment, 4 of them are rated as a Strong Buy with 6 more rated as a Buy.