Pool Corporation $POOL

POOL 0.00%↑ corporation is the world’s largest distributor of swimming pool supplies, equipment, and related products. The company operates in the United States, but also has a significant presence internationally. Pool Corporation provides products to a wide range of customers, including swimming pool contractors, builders, retailers, and service companies. There are three main segments to the company, wholesale distribution, retail and e-commerce and other products and services.

Here is a brief review of some financial metrics:

Is POOL a winner?

Since mid-1995 when POOL 0.00%↑ went public the stock has a total return of nearly 55,000% or an astounding compound annual growth rate of 24.2%, approximately doubling the average market return. The ability of POOL 0.00%↑ to handily outpace the broad market since inception proves that, so far, POOL 0.00%↑ is undoubtedly a long-term winner.

Over just the past decade POOL 0.00%↑ has been able to closely mimic what’s been done since inception, returning 21.6% annually or just over 600% in total. From 2015 through 2021 the lowest return the stock produced was 15.97% in 2018, with the highest being 76.94% in 2020. The most impressive number during that 7 year stretch is the average return for POOL 0.00%↑ of about 38% per year, more than 2.5% SPY 0.00%↑ . However, in 2022 the stock struggled mightily with a 46% loss, it rebounded nicely in 2023 with a gain of 33.5% and through October of this year the stock has dropped 8.5%. For a long time the stock continued to rise again and again, with a rough couple of years recently now may be an opportune time for investors to consider this dividend growth stock.

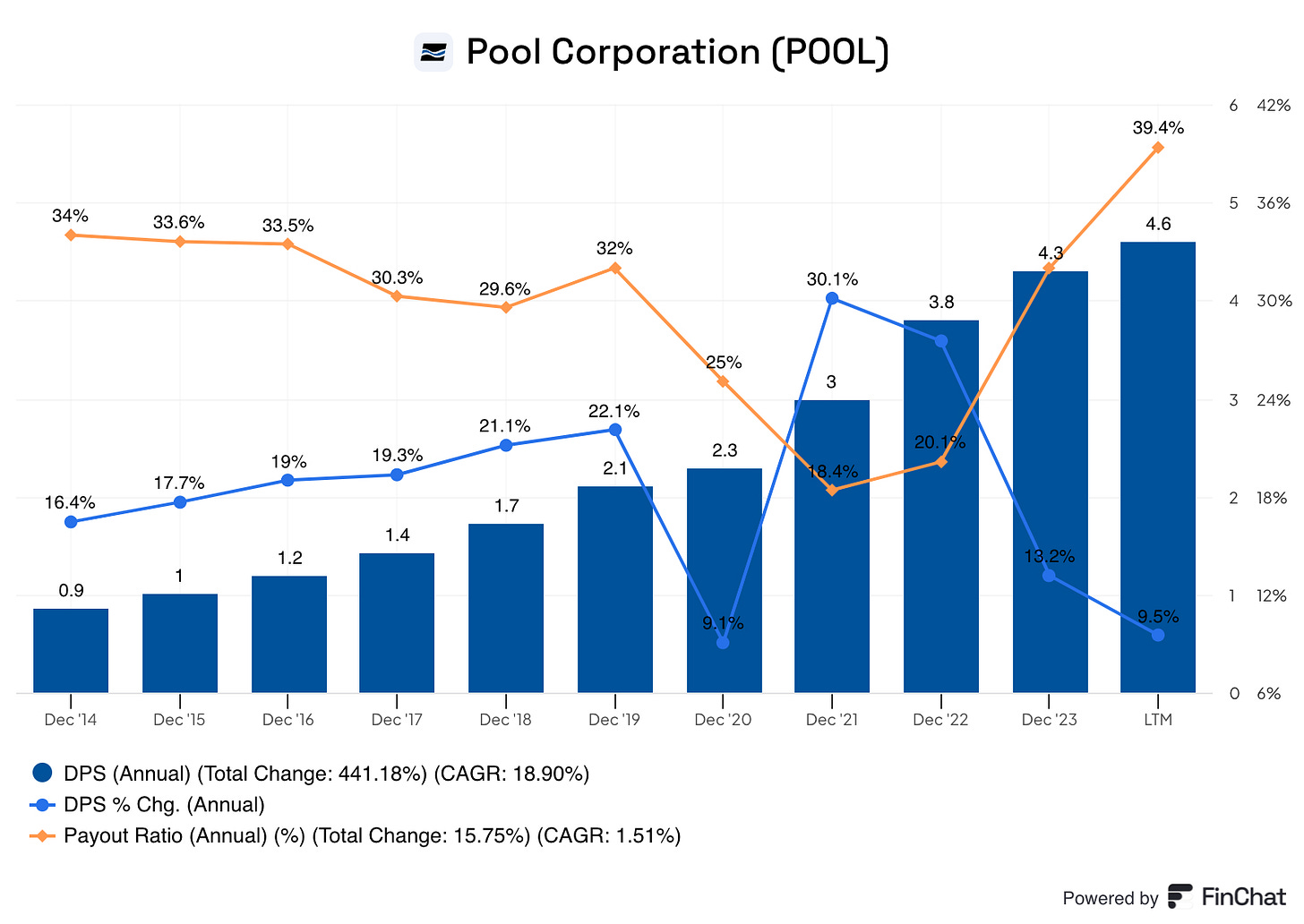

Dividend Data

Since we are exploring the market for a quality Dividend stock it only makes sense we examine a company’s dividend history.

POOL 0.00%↑ Corporation is a dividend contender having grown its dividend for 14 years now, including a 9% increase earlier this year in May. This was actually quite low when compared to its 3-, 5- and 10-year dividend growth rates which are 16.4%, 17.5% and 18.9%, respectively. Obviously it can be difficult for a company to continually grow its dividend well above inflation so a lower increase isn’t always a bad thing, assuming the increase still tops inflation and allows room for future dividend growth. Which brings us to the payout ratio was hasn’t exceeded 40% over the past decade, this is obviously a very good sign for dividend investors as there is plenty of room for future dividend increases.

Quality Metrics

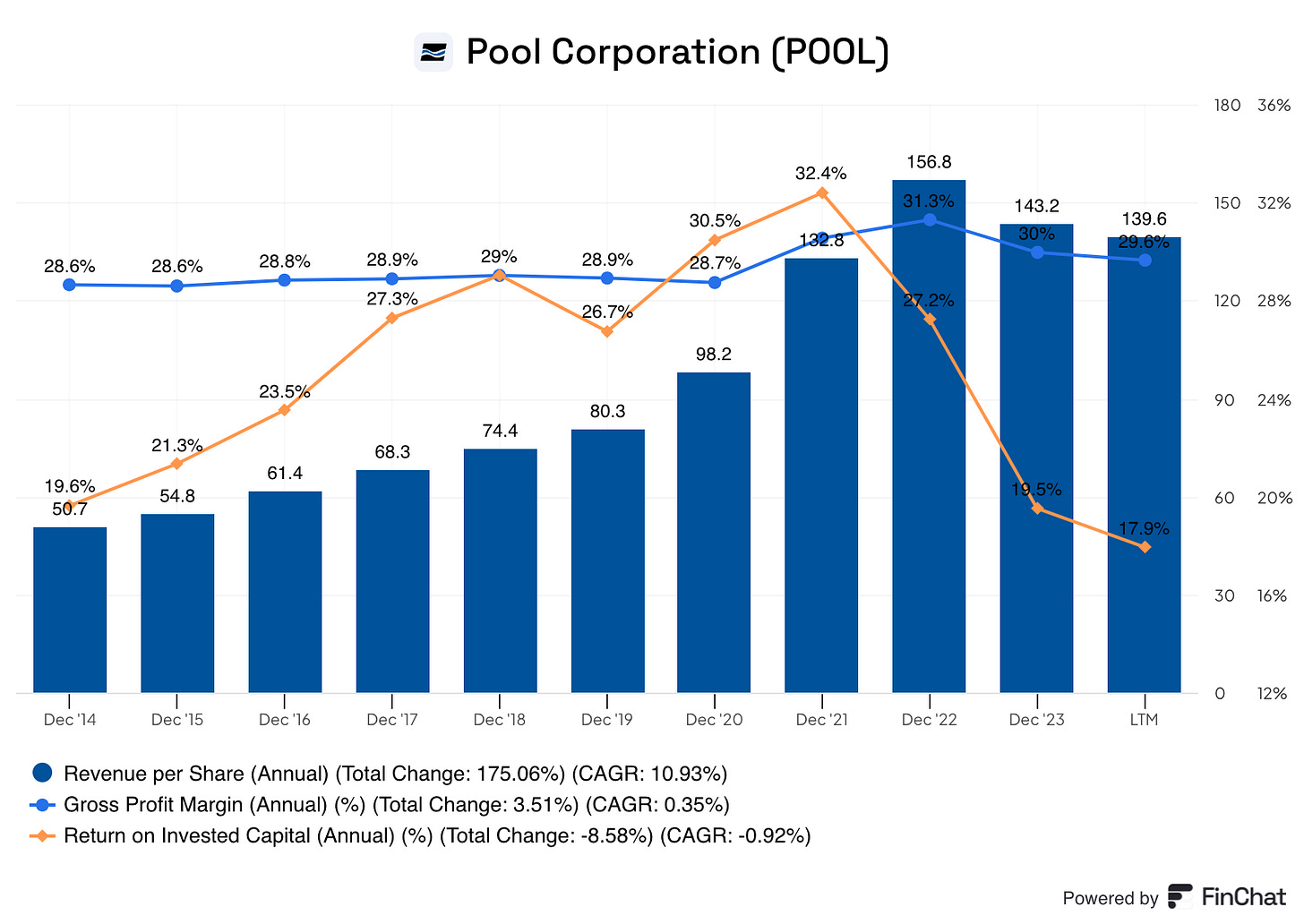

I believe there are three quantitative characteristics that all high quality companies should have, they are a growing revenue stream, a stable gross profit margin and healthy return on invested capital. Let’s examine these metrics and determine if POOL 0.00%↑ should be considered a high quality business.

POOL 0.00%↑ grew their revenue per share at a consistent clip during the first half of the past decade, anywhere between 8% to 12% per year. In 2020, their revenue per share rose more than 22% and in the following year it climbed another 35%! In FY 2022 revenue surged another 18%, before dropping nearly 9% in 2023 due to a hefty decline in new pool construction, in addition to a modest decline in renovations and remodels. It will be interesting to see if POOL 0.00%↑ can rebound in FY 2024 or if their revenue will see another down year.

The gross profit margin for POOL 0.00%↑ has been the most stable with very little fluctuation. Over the past decade, its gone from a low in 2014 & 2015 where it was 28.6% before rising in recent years to a high of 31.3% in FY 2022.

The return on invested capital in 2023 is essentially where it was in 2014, right around 19.5%. However, between those years the ROIC rose to a high of 32.4% in FY 2021 but has since dropped in the last two fiscal years, first to 27% in 2022 then to 19.5% in 2023. Ideally, POOL 0.00%↑ can get this metric back above 20% in the coming years and keep there for the foreseeable future.

Overall, these metrics are quite healthy, the revenue has been increasing, albeit with a blip in 2023 which is something investors should monitor. The gross profit margin is very stable, while the ROIC has dipped recently, but I think it’s reasonable to expect this metric to climb back above 20% in the very near future.

Valuation

The final piece of the puzzle is to decide if POOL 0.00%↑ is trading for an attractive valuation. As the custom FCF valuation tool suggests the stock is currently trading for a moderate discount to its fair value and is currently rated a “BUY”.

I can’t help but notice POOL’s valuation going through waves…in 2018 the stock was clearly overvalued even though it gained 16%. During 2019 & 2020 the FCF per share rose, as did the stock price, but still the valuation made sense for the majority of those two years relative to the FCF. In 2021, there was a 26% decline in the FCF for POOL 0.00%↑; however the stock continued to climb and became grossly overvalued. During the next two years the FCF per share surged 61% followed by another 91%; conversely the stock price declined by nearly 50% in 2022 but it rebounded quite well in 2023. As previously mentioned the stock has struggled this year with about an 8% decline and only a month left to try and turn this year green.

POOL 0.00%↑ unfortunately has a weak long-term expected rate of return of just 2.84% with the components this estimate as follows:

A current dividend yield of 1.27%.

A return to fair value factor of 1.36%.

Estimated EPS growth of just 0.20%.

In closing, POOL 0.00%↑ has had a very nice run since inception with the financials to back it up. The dividend has been growing steadily and there is still ample room for it to increase well into the future. The expected RoR leaves a lot to be desired, I usually aim for stocks that show a potential RoR of at least 10% and POOL 0.00%↑ falls well short. While this stock has been solid, the lack of potential growth is a hinderance and investors may way to consider other stocks with a potential healthier expected rate of return.

If you found this content insightful you should consider upgrading to a paid subscription. You’ll gain access to live valuations for the 50 stocks in our High Quality Dividend Growth Investable Universe, a complimentary Free Cash Flow Valuation Tool and access to our 3 model portfolios. The paid subscription is only $5 and you can cancel at any time.