Beat The Market: Driving Alpha with Data - This Is It!

We are finally in the home stretch for this little investment project I’ve embarked on. It’s time to select the final model strategy that will be put to the live test starting in a few days. The optimal model I decided to go with is model #7, ultimately I chose not to deviate from my initial gut feeling as this was the strategy I liked the most after finishing the backtest.

Quick Recap of Model #7

This model portfolio looks for stocks that are “better than median” for each of the 5 metrics (ROIC, ROCE, DGR, EPS & Revenue). The stocks are then sorted by the number of metrics that exceed the median value of the universe, with the secondary sorting criteria being the ROCE. Each stock is assigned a rank from 1 to X. Next I sort all of the stocks by their FCF Yield and also assign each stock a rank from 1 to X. Then I average out both rankings and sort the stocks again to find the top 20 stocks with the lowest combined ranking. These 20 stocks are then included in the model portfolio.

Here’s a quick recap of how the investable universe will be created.

Investable Universe

I will screen all of the dividend paying stocks on the NYSE and NASDAQ for the following 8 criteria.

5 Year Revenue CAGR >= 5%

5 Year Diluted EPS CAGR >= 5%

Return Since Inception CAGR >= 8%

5 Year Dividend Growth Rate >= 5%

5 Year Average Gross Margin >= 20%

Return on Capital Employed >= 15%

1 Year Dividend Growth Rate >= 1%

3 Year Dividend Growth Rate >= 1%

The last two metrics are mainly to weed out any companies with inconsistent dividend growth streaks. The “meat and potatoes” of this process are the first 6 metrics.

Ideally this screening process finds a good number of potentially high quality dividend growth stocks that can be further screened for the 20 most opportune ideas.

Why I Believe This Strategy Will Work

I believe this strategy will work because to me it makes conceptual sense that a strategy focused on investing in high quality companies trading for reasonable valuations is the ideal path to seeing strong returns. I believe the screening process for the investable universe helps identify a shortlist of potentially high quality companies. And the model #7 strategy framework helps identify the potentially 20 most opportune ideas from this list.

Since this is a completely rules based approach there are emotional decision being made here. However, no rules based model is perfect, and as such there is room for errors. I believe that at least a few of the stocks identified for this portfolio will not deliver on my expectations. That being said, I have confidence that the portfolio as a whole has the potential to deliver and possibly exceed my expectations.

Only time will tell how things shake out.

Portfolio Launch

Next week on Tuesday April 30th, after the stock market closes for the day I will run this screener and analyze the stocks to find the 20 best ranked dividend growth stocks. On May 1st I will fund the actual portfolio with each of these 20 stocks receiving an equal 5% of the invested capital. I’ll be doing this automatically in M1 Finance using their rebalance option, so it’ll be as close to 5% per stock as the tool can get us to. These 20 stocks will be held for a duration of 1 year (until April 30th, 2025). At which point the process will start all over, I’ll run the screener to get the new investable universe and use the model #7 strategy to find the 20 best stocks. During the next 12 months there will be no selling or buying or rebalancing. All dividends will be reinvested back into the most underweight stock to try to keep the portfolio in line with its intended equal weight allocation.

I’ll document this portfolio in the newsletter regardless of how it performs. My expectations are for this portfolio to outperform the original investable universe and the S&P 500 in the long run. By long run I am giving this strategy a 5 year test window during which I expect it to deliver alpha over both previously mentioned benchmarks. I expect that this portfolio will not beat the investable universe or the S&P 500 every month, perhaps not even every year, but it will be evaluated based on its long term annualized rate of return.

I’m very excited to get this strategy started!! I’ll have a special edition of the newsletter go out on the evening of Tuesday April 30th to announce the 20 constituent stocks, for full transparency.

Here’s Some More Data From My Analysis

This past weekend I analyzed more data for the sample model portfolios as well as the potential impact of adopting this strategy in a taxable brokerage account. I’ve already shared this data with my Patreon community and I’d like to share it with you as well.

In last weeks newsletter I presented two hypothetical model portfolios selected for April 15th. I was curious what stocks would be included in this strategy if it were launched on tax day (in the U.S.). If you missed it, it’s linked at the beginning of this paragraph.

Suffice it to say April has been a pretty rough month for the stock market. And I bet some of you are curious, as I was, how these two model portfolio would have performed thus far.

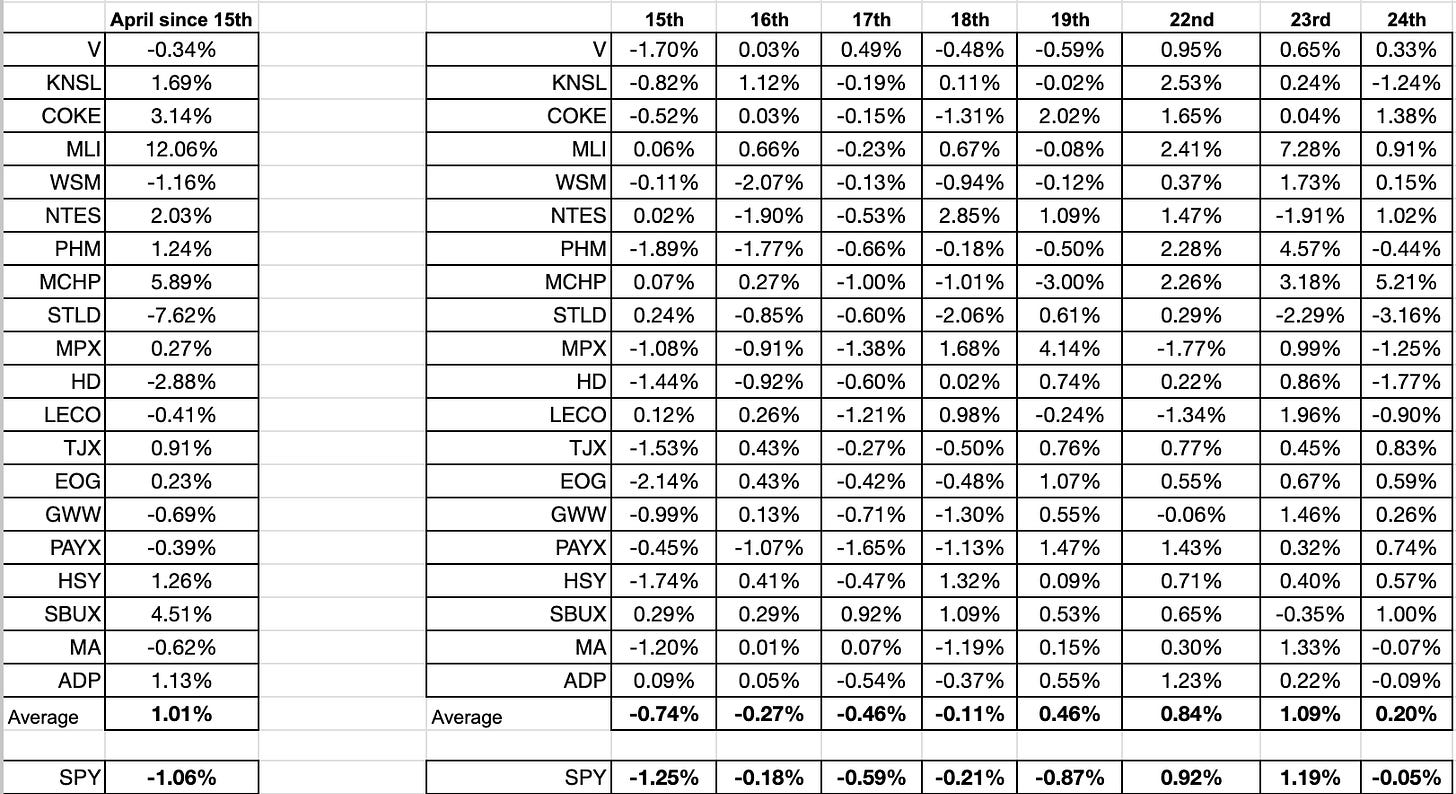

Model strategy #7 has a return of +1.01% between 4/15 and 4/24, relative to -1.06% for SPY.

Model strategy #10 is also performing admirably with a return of +0.88%.

In reality 8 trading days are irrelevant in a 5 year test period, but it’s always nice to start out on the right foot. Hopefully the actual portfolio will do the same.

Now for the more interesting piece of analysis, the potential tax drag. This took a while to analyze with the high turnover and keeping track of each individual stocks cost basis over a 5 year test window. The tax drag was significant but I’m pleased to say the strategy was still able to deliver alpha over the investable universe and the S&P 500 between 2019 and March of 2024.

Here are the returns.

The capital tax rate assumed in the backtest was a long term rate of 15%. The annual tax obligation ranged from a low of 2.52% to a high of 5.27%, with the average being 4.49%. That’s quite a lot of alpha to give up to the tax man. The ideal application of this strategy will be in a tax free or tax deferred account, that is where I will be deploying the actual portfolio.

I am not recommending for anyone to adopt or invest in this strategy, I am sharing this purely for informational purposes. Please conduct your own due diligence prior to making any investing decisions.