About a month ago I presented to you 3 high-quality stocks that were trading close to their estimated fair value. Consequently, I’d like to present 3 more that are trading below their estimated fair value, but also have a forward expected rate of return of at least 11%.

Additionally, if you remember from the prior post here I discussed how there are now 3 ratings; Hold, Buy, and Strong Buy (Trim was eliminated as I rarely actually “Trim” a position). The reason “Strong Buy” is in the title relates to that previous article where a Strong Buy was defined as a company that was undervalued in the FCF model AND has a forward expected rate of return of at least 10%, as mentioned above all 3 of these have expected RoR’s of 11% or more.

So without further ado, let’s dive into these companies!

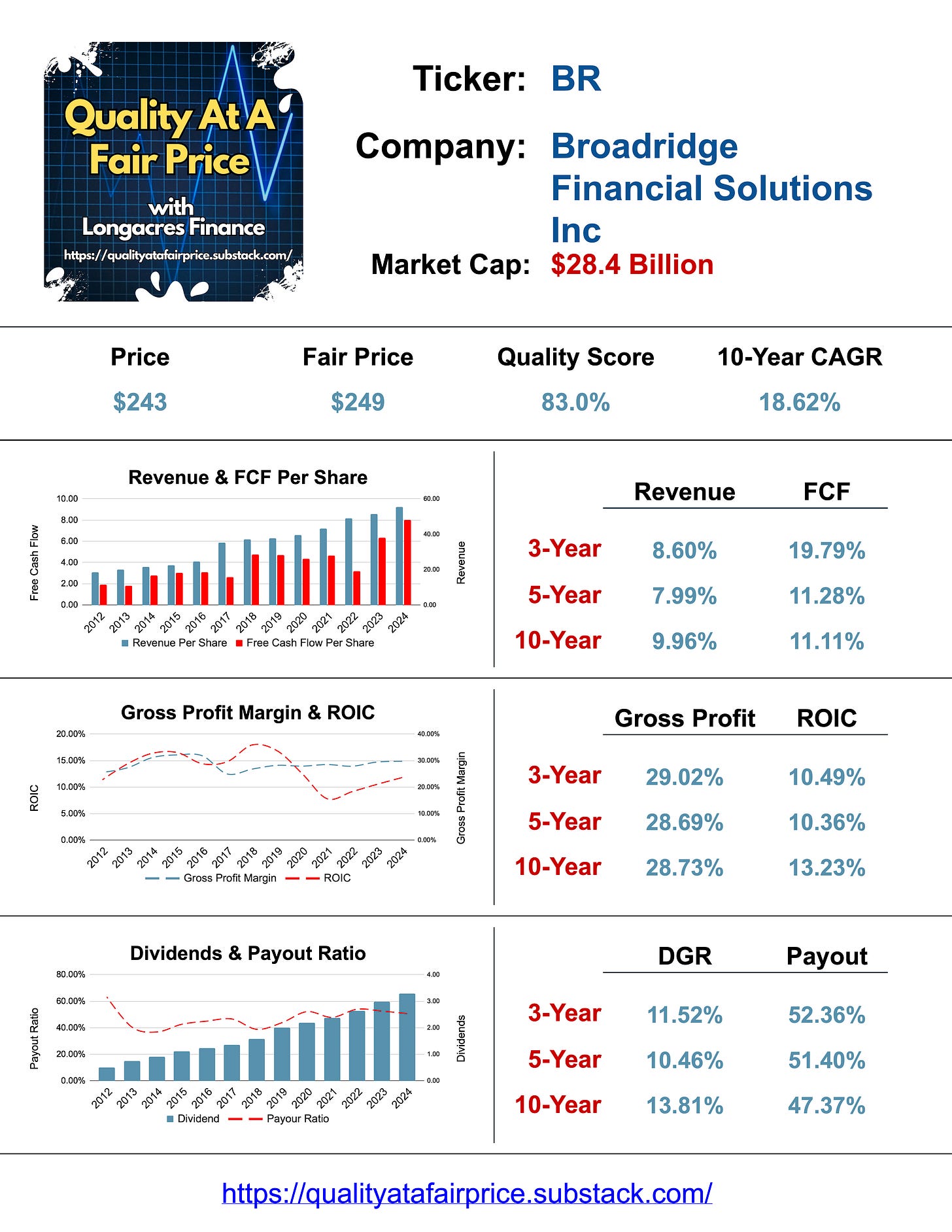

1. Broadridge Financial Solutions BR 0.00%↑

Broadridge Financial Solutions plays a crucial role in the financial services industry by offering technology and support services that enhance operational efficiencies and regulatory compliance. Its large client base and commitment to innovation makes it a key player in the financial technology landscape.

Over the last 10 years the company has a total return of more than 18% annually or slightly more than 450% overall.

Thus far in 2025 the stock has seen its share price rise by about 7.5%, while the S&P 500 ETF SPY 0.00%↑ is up closer to 4%. Additionally, over the past year BR 0.00%↑ & SPY 0.00%↑ are up nearly identical amounts, about 23.5%. Although Broadridge has already seen a nice run up over the last little bit, based on the valuation above, it might have a little more room to run.

2. MSCI Inc. MSCI 0.00%↑

MSCI was originally known as Morgan Stanley Capital International and is a leading global provider of financial market indices, portfolio risk, and performance analytics tools. The company is headquartered in New York City and has a significant influence on investment strategies worldwide.

Over the past 10 years, MSCI 0.00%↑ has a total return of more than 1,000%, leading to a CAGR of 27.5%, nearly double that of SPY 0.00%↑.

MSCI 0.00%↑ has some rock solid financial metrics, the 3-, 5- and 10-year FCF growth rates are all around 20%, a consistent GPM above 80%, and a ROIC that has been continuously improving over the past decade. Additionally, the dividend has doubled since 2021 and the payout ratio is low enough that MSCI 0.00%↑ should continue to reward shareholders with inflation beating dividend hikes. Regarding the valuation, the stock has struggled so far this year after rebounding from its lows in mid-2024. The weak Q4 earnings report in late January is culprit for slow start to the year; however, due to its strong financials and the fact that it offers the best forward expected rate of return out of the three listed here at 16.02%, this should be a strong consideration from any serious dividend investor.

3. Zoetis ZTS 0.00%↑

Zoetis Inc. is a global leader in the field of animal health. The company develops, manufactures, and commercializes medicines, vaccines, and diagnostic products for livestock and companion animals. Zoetis has established itself as a key player in the veterinary industry, with a broad portfolio aimed at improving the health and well-being of animals worldwide.

Over the past 10 years ZTS 0.00%↑ has grown at a nearly 14% clip annually.

ZTS 0.00%↑ reached an all-time high in late 2021 and early 2022, since then the stock has struggled mightily. The company finished 2022 down almost 40%; however, it rebounded nicely in 2023, making up for most of the losses it incurred the prior year. The stock again declined in 2024 by almost 17% and is down YTD by 3.5%. As you can see from the chart above, the stock price has fluctuated quite a bit over the last few years but overall has been essentially flat. Similar to MSCI, the company has some very good financial metrics, couple that with a possible undervaluation by more than 25%, along with an expected rate of return of more than 15% and it’s hard to ignore this dividend growth stock.

If you found this content insightful consider upgrading to a paid subscription. Paid subscribers can see live valuation ratings for what I believe to be the Highest Quality Dividend Growth Stocks here, at any time. Additionally, you’ll gain access to a complimentary Stock Valuation Tool for 227 Quality Dividend Growth Stocks. The paid subscription is only $5 per month and you can cancel any time.

Check out these Dividend Tools to help you on your investing journey:

Follow On Other Social Media Platforms

Link to Youtube

Link to X @LongacresFin