3 Attractively Valued Dividend Aristocrats

AND they've raised their dividends already this year!

Defining A Dividend Aristocrat

Dividend Aristocrats are companies in the S&P 500 Index that have consistently raise their dividend payments for at least 25 consecutive years. That’s the definition most people know; however, it actually doesn’t stop there, an aristocrat must also meet two other criteria: a float-adjusted market cap of at least $3B, as well as an average daily trading volume of at least $5M for the three months prior to the rebalancing date.

As expected, these companies are typically recognized for their financial stability, disciplined management, and ability to generate reliable cash flow, making them very attractive for dividend-focused investors, like myself.

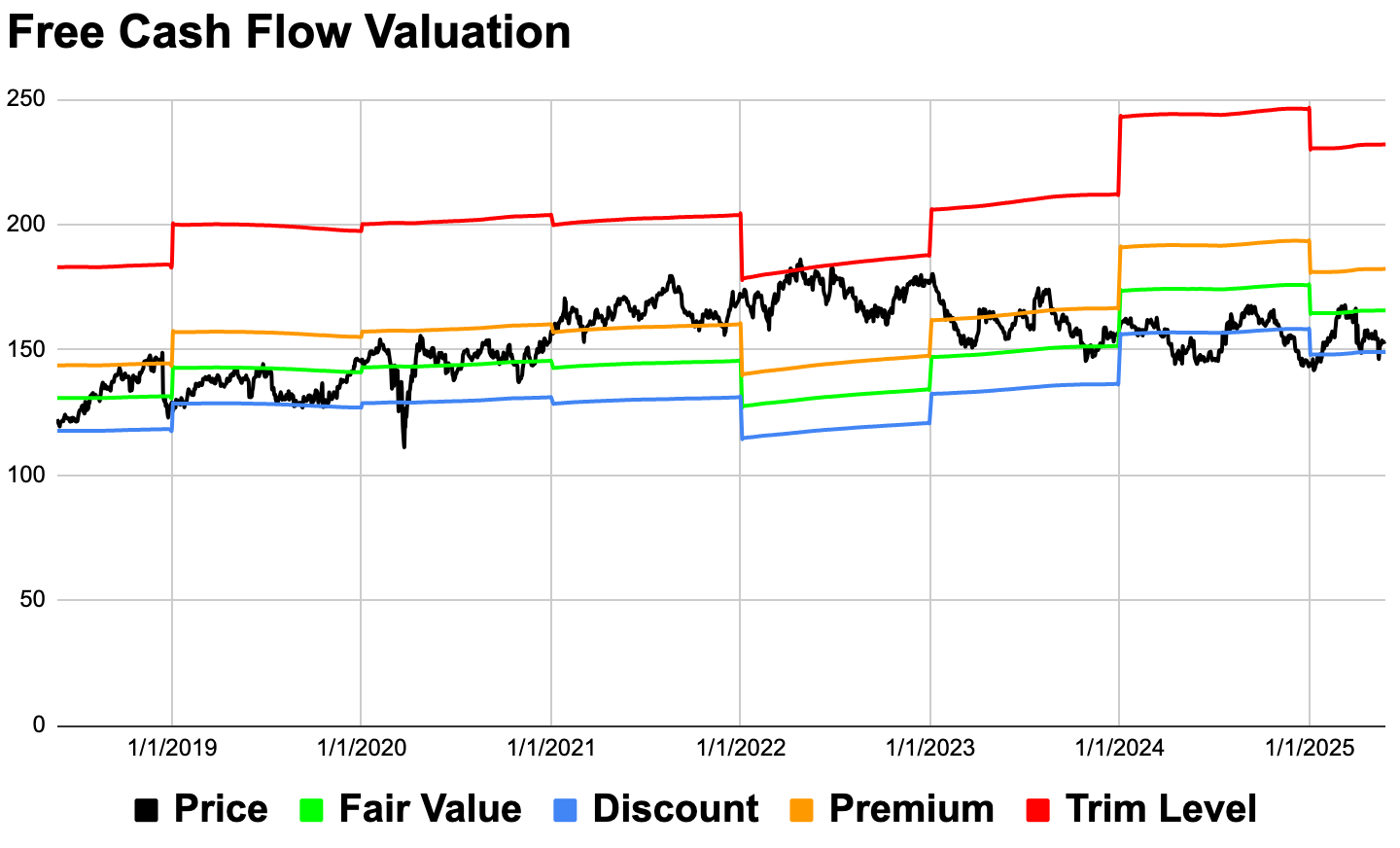

Before we dive into these companies I just want to add a little context…the reason I consider these companies to be attractively valued is because they are undervalued based on my custom FCF valuation tool I always use, AND they project to have a forward expected rate of return of at least 10%.

So without further ado, let’s go!

1. Johnson & Johnson JNJ 0.00%↑

64 years of dividend growth.

3-, 5- and 10-year dividend growth rates all above 5%.

Estimated Undervaluation: 8%

Forward Expected rate of return of 10.84%. (pieces of this estimate below)

3.39% Dividend Yield.

1.55% Return to Fair Value Factor.

5.90% Expected EPS Growth Rate.

Also check out some tools to help with your investing journey

Follow on other social media platforms

Link to Youtube

Link to X @LongacresFin