Visa a very High Quality Business trading for a Reasonable Price

Intro

While there are many ways to create success in the stock market, I believe there is only one simple way to passively build wealth in the long run. That way is by adhering to the following three rules.

Invest in High Quality Businesses.

Purchase them for a fair or better price.

Hold these positions for as long as rule 1 continues to be true.

These rules are simple to understand but they are not easy to apply. The difficulty lies in learning how to find quality businesses and figuring out whether they are attractively valued. Once you master this art, then comes the hard part, learning to patiently wait for these ideas to pay off. What I would like to accomplish with this newsletter, is to share with you what I believe are high quality businesses based on what I call the quality quadrant, and determine whether they are currently trading for fair or better prices. I’m going to kick this series off with one of my favorite businesses, a company I believe is of the highest quality, Visa. Continue reading if you’d like to find out why I think so.

Background

Visa can trace its origins all the way back to 1958, when Bank of America launched its first consumer credit card program, BankAmericard. In 1976 BankAmericard changed its name to Visa, a name that sounds the same in all languages. By this time Visa had already launched the first debit card and expanded its business operations internationally. By 2007, Visa Inc. was formed with regional businesses around the world merging to form one major payment processing network. In 2008 the company went public and continued to expand to become the largest payment processor globally.

Visa is one of the 4 largest payment processors in the United States, but it alone has the biggest market share at nearly 62%. It’s closest rival is Mastercard that controls roughly 26% of the market share. American Express accounts for 10% and Discover is the distant fourth with only 2% of the market share. Globally Visa controls roughly 40% of the market with Chinese based UnionPay being its largest rival, accounting for 32% of the global credit card market.

Visa is not a credit card issuer but simply provides and maintains the largest network for processing payments globally. This is an important distinction to make because Visa is not in the business of servicing debt but rather you can think of it as a toll booth in the global payment superhighway, skimming fractional fees from every transaction processed on its network. It is the largest payment technology company in the world with a very profitable business model and one that I believe will continue to grow in the years to come.

Track Record

Since its IPO on March 19, 2008, Visa has grown by more than 1,700%, much faster compared to the roughly 367% growth the S&P 500 has delivered in the same span of time. This equates to roughly twice the annual rate of return as the S&P 500 over the span of approximately 15 years. Not every part of the last 15 years was a great time to own shares of the company, but patient investors generally faired better owning Visa than the broad US equity market. On a single calendar month basis Visa outperformed the S&P 500 61% of the time. On a rolling 12-month basis it bested the index 71% of the time. On a rolling 36-month basis the success rate of outperformance improved to 80%. And on a rolling 60-month basis Visa beat the S&P 99% of the time. If you held a position in Visa long enough, it didn’t matter if you initially purchased when shares were cheap or expensive, you ended up with a market beating return.

Quality Quadrant

Having an excellent track record is great and all but how do you know if Visa is still the same high quality business it was 5 or 10 years ago. I believe a great place to start evaluating the quality of a business is what I like to call the quality quadrant, 4 financial metrics that help me gauge the operational strength of a business. These metrics are: the return on capital employed, total revenue, gross margin and the free cash flow conversion ratio. Let’s take a look at how Visa stacks up and let me explain why these 4 metrics matter.

The return on capital employed tells me how profitable a company is and how well they utilize their capital. Turning capital into profits is the primary driver of creating value for shareholders.

During the past decade Visa has maintained a healthy average ROCE of about 23.6%. The only exceptions were a small dip in 2016 with the ROCE declining to 14.08%, and more recently an improvement in ROCE. In 2022 the return increased to 29.1% and 31.16% over the last trailing twelve months. Generally a ROCE above 20% is deemed to be very healthy. Additionally I like to evaluate the consistency and growth over the past decade in coming up with my quality score. Visa performed very admirably with an almost perfect quality rating of 97%.

Revenue is the money a business generates from operations. It is the top line figure of the income statement, and by comparing historical values you can gauge how quickly a business is growing.

During the past decade Visa has maintained a healthy level of top line revenue growth year after year with the exception of one small hiccup in 2020, where the company saw revenue decline compared to the prior year. Since 2013 revenue for Visa has nearly tripled, growing at an annualized rate of more than 10%. In determining my quality score what I like to see is steady and consistent growth. For its 10 year revenue history Visa has earned a very good quality rating of 93%.

Gross margin is the portion of revenue that is left over after direct costs are subtracted. It is one of the most important indicators of the company’s financial performance. It tells you how much cash the company has to fund operations, service its debt, distribute to shareholders and fund future growth.

During the past decade Visa has maintained a very healthy gross margin right around 80%. There were a few bumps here or there with the gross margin dipping slightly below 80% but generally it has remained very steady. I generally like to see a gross margin of at least 50% but also measure consistency and improvement when coming up with my quality score. Visa earns a quality rating of 92% for its exceptional gross margin track record.

The free cash flow conversion ratio measures a company’s efficiency at turning profits into free cash flow. The point is simple, free cash flow is king, and companies that generate healthy levels of free cash flow have more financial flexibility.

During the past decade Visa has done an exceptional job at converting profits into free cash flow. The FCF conversion ratio has oscillated between a low of 57% in 2020 and a high of above 100% on three occasions, 2013, 2022 and the trailing twelve months. What I like to see is a conversion ratio above 60%, consistency and improvement. While Visa’s FCF conversion ratio wasn’t very consistent during the past decade, it was very healthy and improved over the past few years. For this, Visa earns a quality rating of 97%.

Combining the quality ratings for all 4 metrics Visa earns a composite quality score of 94.8%, one of the highest I have come across thus far. I believe that companies with exceptional track records across all 4 of these financial metrics stand out as higher quality businesses. While there are many other aspects that need to be evaluated when performing sound due diligence, screening for the quality quadrant is a great place to start. I leave the rest up to you.

Dividend History

Visa has paid quarterly dividends since going public and has raised that dividend annually for 15 consecutive years. While its dividend yield of 0.81% does not make it an attractive dividend stock, it has an exceptional streak of double digit long term dividend growth. During the last ten years it only once failed to raise its dividend by more than 10%, in 2021. Last month the company announced yet another increase to its quarterly dividend, increasing the payout amount from $0.45 to $0.52, or 15.55%. With this latest increase the final 2023 dividend rate will be $1.87, an increase of 18.73% over the 2022 annual dividend paid of $1.575.

What makes the super fast dividend growth streak even more impressive is that Visa has managed to maintain a very healthy payout ratio at the same time. During the past decade the payout ratio has oscillated between the high teens and the low-to-mid twenties. While the payout ratio is slowly creeping higher it is still very low and leaves plenty of room for future dividend growth.

Valuation

Valuation is more art than science but at the end of the day you do have to come up with some baseline for fair value. I like to leverage two techniques to help me gauge how attractive a given stock is. Those techniques are dividend yield theory and the price to earnings multiple valuation.

Let’s take a quick look at dividend yield theory first.

This valuation technique is quite simple to understand, if the current dividend yield is higher than the trailing average dividend yield the stock is presumed to be undervalued, and vice versa. In the left chart below you can see Visa’s historical dividend yield (blue line) compared to its 5-year rolling average dividend yield (red line). As you can see the dividend yield hasn’t moved much, staying comfortably within the 0.55% to 0.8% range for the past 7 years. Since early 2022 the dividend yield has trended higher and remained elevated compared to trailing average, implying a period of undervaluation. The accompanying chart on the right shows Visa’s actual share price (black line) compared to its dividend yield theory valuation zones. The top of the light green zone is the fair value point, the dark green zone starts at a 15% discount and the red line on top of the red zone points to a 15% overvaluation. The data below the charts indicates the current dividend yield as 0.7% (TTM dividend yield) compared to a 5 year average of 0.68%. This equates to a marginal undervaluation at the time I am writing this with a fair price for Visa of roughly $264. With the latest dividend increase Visa’s forward dividend yield is 0.81% which would imply a forward fair price of roughly $305, indicating an even larger potential discount.

Let’s see what the price to earnings multiple can tell us.

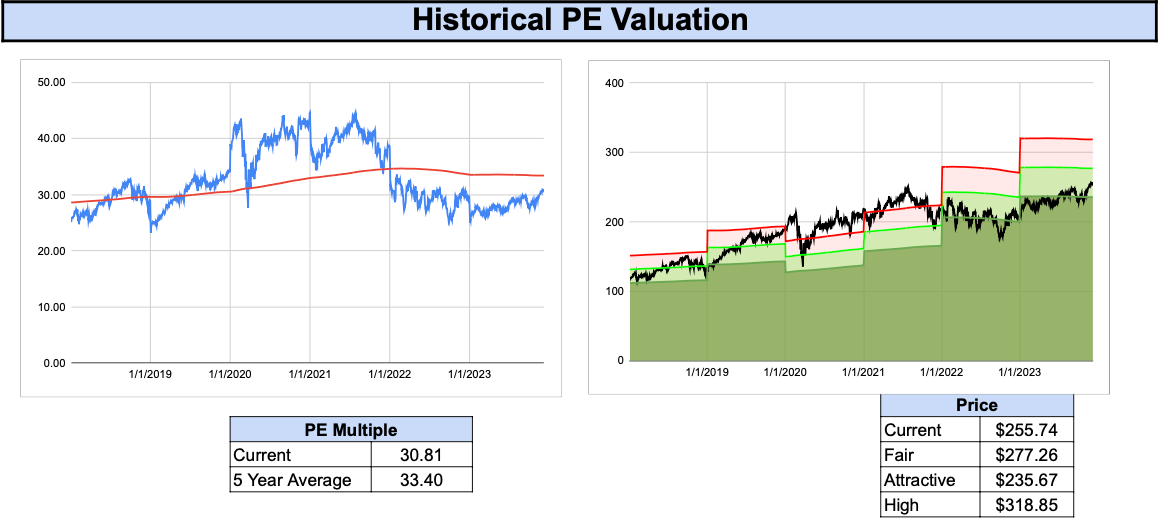

Visa has a strong track record of growth, as such the stock has demanded a pretty high multiple on earnings from the market. During the past 7 years, on average, Visa has traded for a P/E multiple between 25 and 45, a pretty wide range. The current P/E multiple of 30.81 sits slightly below the rolling 5-year average of 33.40. Using these two multiple to determine valuation we can come up with a fair price of $277 for the stock today, roughly a $21 discount to its current price of $255.74. So long as Visa continues to grow at a rate roughly twice that of the average S&P member company it will likely demand an above average P/E multiple.

While both valuation methods indicate Visa is potentially undervalued today I don’t like to put too much emphasis on their accuracy. Therefore I would conclude that Visa is reasonably valued today and may potentially be slightly undervalued as indicated by dividend yield theory and the trailing P/E multiple.

Final Thoughts

I have a long position in Visa with the intention of owning the business so long as I believe it to be quality company. I encourage you to do your own due diligence beyond the scope of the brief analysis I presented, to determine for yourself if you also believe that Visa is a great business and whether or not the valuation today makes sense to you.