Valuation Rating Update - Week of January 13th

Another week another dip for the market. 2025 is off to a poor start with technology driving markets lower. The S&P 500 dipped by 2.6% last week despite there only being 4 trading sessions. This week, earnings season kicks off and it’ll be interesting to see how the numbers roll in, and more importantly how the overall market reacts.

Last week’s market dip triggered 6 valuation rating changes in the High Quality investable universe. There are 3 upgrades and 3 downgrades.

If you’re a paid subscriber you can see the live valuation ratings here, at any time. Additionally, there is a copy of my custom Free Cash Flow valuation tool currently covering 202 dividend growth stocks.

Let’s take a quick look at which stocks had a valuation change since last week.

EOG Resources EOG 0.00%↑

No valuation chart for the stock today as EOG 0.00%↑ has a mixed history of free cash flow. In 2015 and 2016 its free cash flow was negative, aside from this in 2020 and 2022 the free cash flow declined heavily relative to the prior year. This inconsistency doesn’t chart very well.

EOG 0.00%↑ was downgraded from a Strong Buy to a Buy following its positive return last week. The stock moved against the overall market, gaining +4.58% over the last 5 trading sessions.

Hershey HSY 0.00%↑

HSY 0.00%↑ dipped last week, along with the market, falling by nearly 7%. Following this decline the stock is now rated as a Strong Buy in my valuation model. However, dampening the optimism from the favorable valuation rating is a very poor forward expected rate of return of just 0.49%. The primary culprit of the poor ROR is a negative projected earnings growth rate, -6.86%, over the next 3-5 years.

KLA Corporation KLAC 0.00%↑

KLAC 0.00%↑ is downgraded from a Hold to a Trim after a modest positive gain last week. The stock rose by 1.53% last week, primarily on Monday followed by a rather flat rest of the week. Even though the share price is down heavily from its 2024 peak, based on my valuation model the stock still looks expensive relative to its historical free cash flow multiples.

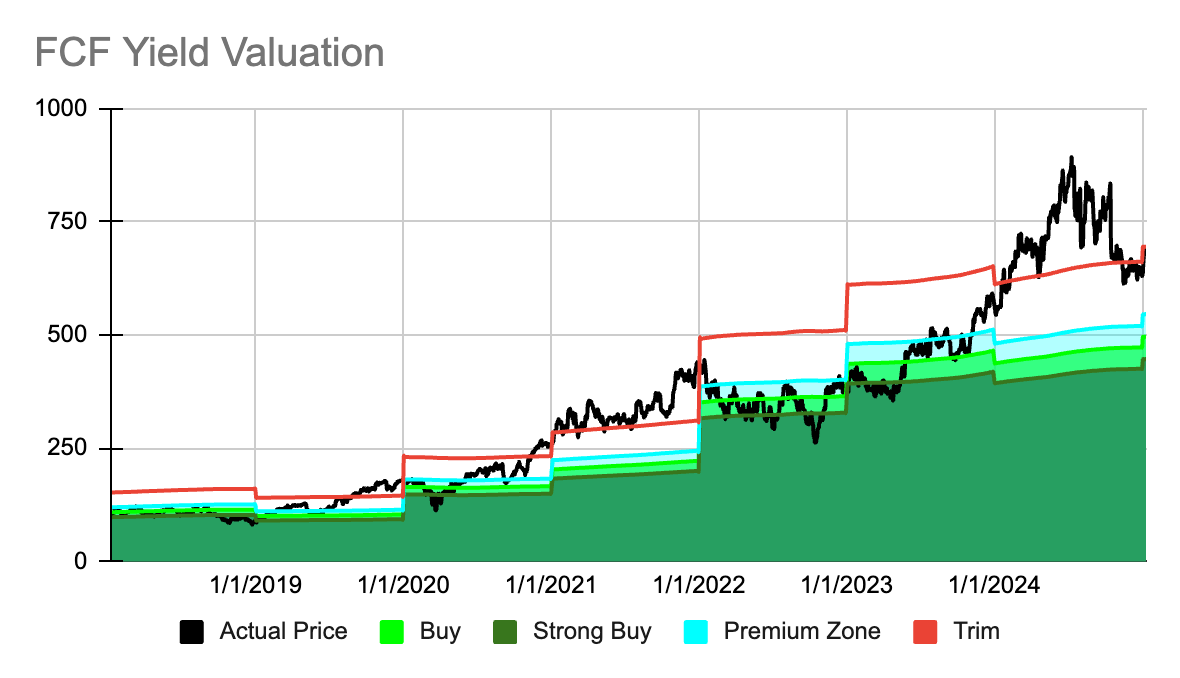

MSCI MSCI 0.00%↑

MSCI 0.00%↑ gets upgraded from a Buy to a Strong Buy following last weeks 5% decline in share price. The stock seems to have taken a breather on its attractive rise that started mid-2024, offering investors another opportunity to jump aboard. In addition to the attractive valuation MSCI 0.00%↑ currently presents a very good forward expected rate of return of 15.22%.

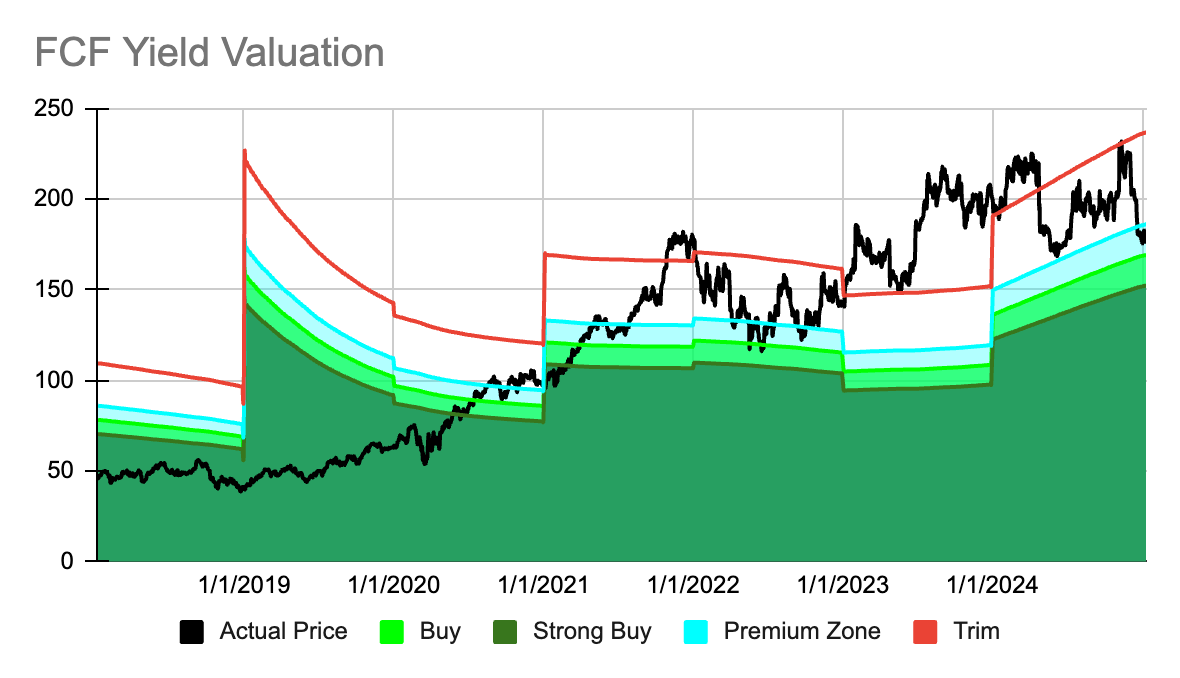

Old Dominion Freight ODFL 0.00%↑

ODFL 0.00%↑ gets upgraded from a Hold to a Buy after the stock dipped last week by 2.89%. ODFL 0.00%↑ had a very jittery 2024, actually since 2022 the stock has been very volatile. Perhaps today or in the near future, should the share price continue to trend lower, could be a good opportunity to initiate or add to ones position. Old Dominion’s forward expected rate of return is a little bit below my ideal 10% so perhaps its worth waiting a little bit to see if an even better entry point presents itself in the near future.

Ferrari RACE 0.00%↑

Another week and another valuation change for Ferrari. After a measly gain of 0.95% last week my valuation model has once again decided that Ferrari is just a Buy and not a Strong Buy anymore. With a forward expected rate of return of 14.69% the stock still looks pretty attractive.

Please note the valuation model is based strictly on quantitative data and therefore does not factor in any qualitative information. As such it is imperative you perform your own due diligence on each stock to ensure there isn’t a valid reason for the valuation change. Lastly, as a reminder all paid subscribers can access live valuation ratings at any time here.