Valuation Rating Update - Week of December 9th + Investable Universe Pivot

Last week was a good week for the stock market with the S&P 500 rising by +0.83%. Within the High Quality Investable Universe we had 8 stocks see a change in their valuation rating, 5 improvements and 3 downgrades.

If you’re a paid subscriber you can access the live valuation ratings at any time here. You can also find a copy of my custom Free Cash Flow valuation tool currently covering 202 dividend growth stocks and gain access to the model portfolios designed around this investable universe.

Let’s take a look at which stock had a valuation rating change last week.

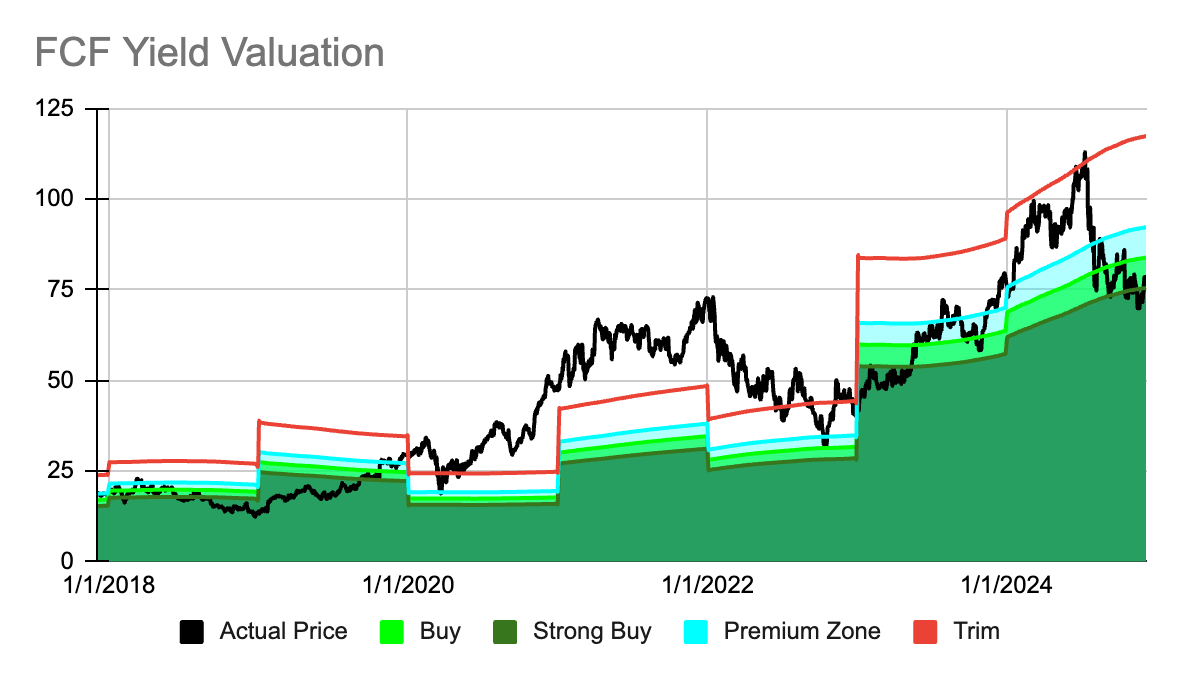

Dominos Pizza DPZ 0.00%↑

Shares of DPZ 0.00%↑ fell by 3.16% last week in turn pushing the stock back into our target buy zone. To boot DPZ 0.00%↑ also presents an attractive +10.12% long term forward rate of return.

EOG Resources EOG 0.00%↑

Due to negative free cash flow in 2015 & 2016 the custom valuation chart for EOG 0.00%↑ is not very presentable. The stock dipped 4.27% last week and received an upgrade to a strong buy in my custom valuation model. The long term forward expected rate of return of 9.42% is a little bit below my minimum threshold of 10% but definitely close enough to warrant a closer look at the stock.

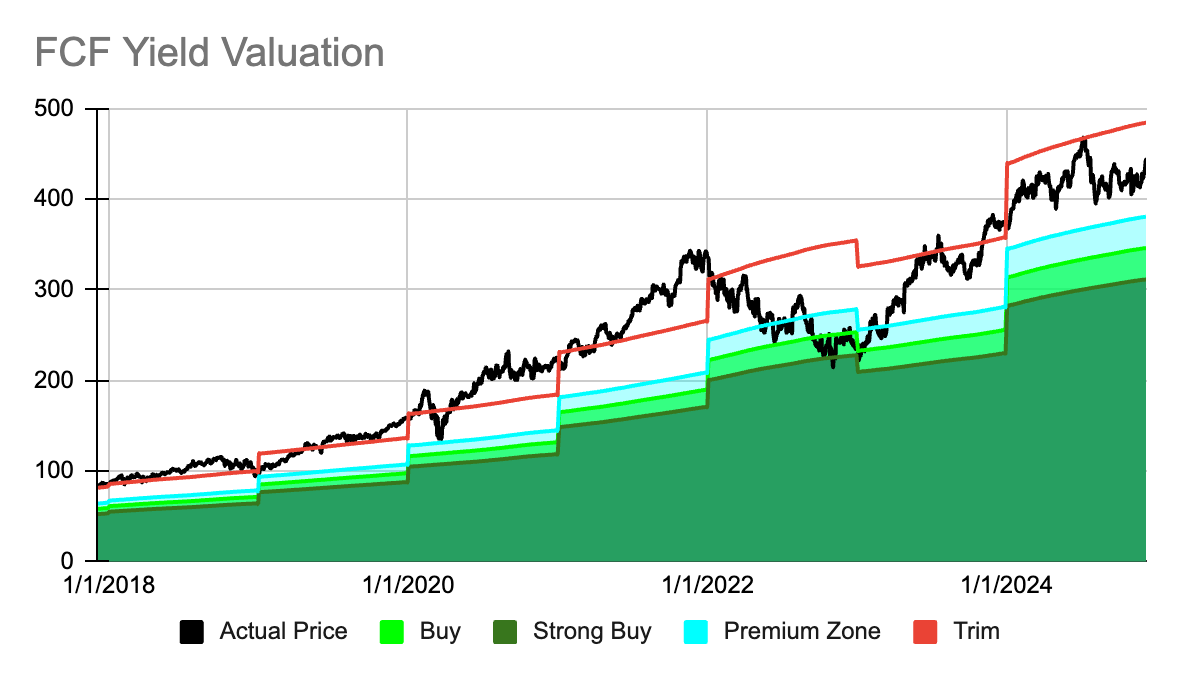

Lam Research LRCX 0.00%↑

LRCX 0.00%↑ climbed 3.53% last week and as a result is downgraded from a strong buy to just a buy in my model. The stock currently presents a very enticing long term forward expected rate of return of 20.13%, leaving plenty of margin of error for cautious investors.

MarketAxess Holdings MKTX 0.00%↑

Shares of MKTX 0.00%↑ fell by 7.54% last week pushing the stock back into our strong buy zone. While the price may be appealing the long term forward rate of return is a bit below our desired threshold.

Microsoft MSFT 0.00%↑

Shares of MSFT 0.00%↑ climbed 5.22% last week in turn pushing my valuation rating from a hold to a trim. Despite the potential overvaluation and the trim rating MSFT 0.00%↑ still presents an almost enticing forward rate of return of 9.43%.

Old Dominion Freight Lines ODFL 0.00%↑

ODFL 0.00%↑ fell by 10.16% last week and was upgraded from a trim to a hold in my model. Despite the large pullback the stock still seems pretty expensive and does not present an attractive forward rate of return that stands at just 5.25%.

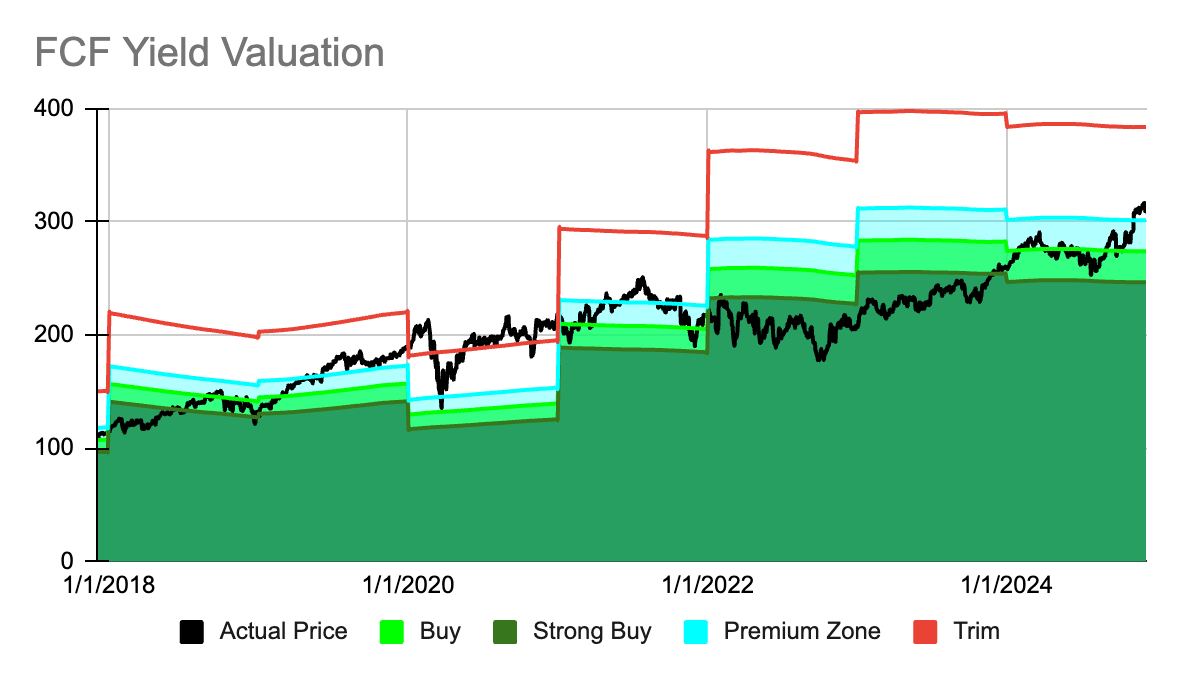

Visa V 0.00%↑

Shares of V 0.00%↑ fell by 1.89% last week and the stock flirts back into our desired buy zone. Even thought the stock has been flirting around the buy/hold range, it still presents a good forward rate of return of 11.1%.

Please note that the valuation model is based on quantitative data and therefore does not factor in any qualitative information. As such it is very important to perform further due diligence on each stock to make sure there isn’t a valid reason driving the valuation upgrade.

As a reminder all paid subscribers can access live valuation ratings here.

Investable Universe Update

Sometimes you have to box yourself into a corner to see the path out. When I started tracking this High Quality Dividend Growth Stock Investable Universe a few months ago it seemed like a great idea. Come up with a shortlist of potentially high quality dividend growth stocks, track their valuation and forward expected rate of return, and invest in the ones that appear more opportune than their peers. Its not a bad strategy, but by boxing myself into this corner of the market I was able to realize that the path out is a much better use of my time.

So, coming soon, and slowly, I will make a minor pivot to this strategy. Instead of focusing on the 50 stocks within this investable universe and reviewing them one at a time, I will focus on creating an investable universe of just the highest quality stocks using the entire stock market as my playing field.

You may have seen my “Quality Scores” in the one pagers I’ve shared here and through other platforms. I’m going to leverage this Quality Ranking process to identify and track only the absolute best businesses in the world.

The Quality Score looks at the short and long-term track record of each company across the following metrics:

Revenue per share growth

Return on Invested Capital

Gross Profit Margin

Free Cash Flow per share growth

Dividend Growth

Payout Ratio

The Quality Score is quite demanding and therefore should help me weed out only the best businesses of the last decade. But also companies that are growing and operating at the same fast pace they have historically.

Companies with Quality Scores above 90%, in my opinion, are the best businesses. Companies with scores above 80% are good businesses that deserve to be monitored and selectively chosen for investment. And companies with lower scores are less desirable and therefore I won’t waste my time reviewing them.

The current Investable Universe that paid subscribers can see at all times will slowly be morphed into a list of the best businesses based on my Quality Score. The list will be broken down by companies that exceed 90% and a separate list for companies that score above 80%. Reviews of all companies that will be added to this list will be shared with ALL subscribers. In addition to the individual company reviews, Paid subscribers will continue to see live valuation ratings and expected rates of return for all of the High Quality businesses that make their way into the investable universe.

The current model portfolios will also be updated into a track record of how well the valuation model performs over time. Each company that appears to be an opportune investment will have its performance tracked against the S&P 500 and SCHD 0.00%↑.

This change should make the content in this newsletter more actionable as I will only write about companies that are either of Very High Quality and deserve to be on your watchlist or better yet Very High Quality companies that also appear to be opportune investments right now!

39 stocks from the current investable universe have Quality Scores above 80% and only 9 of these stocks have Quality Scores above 90%.

Here is the initial list of stocks that will continue to be tracked.