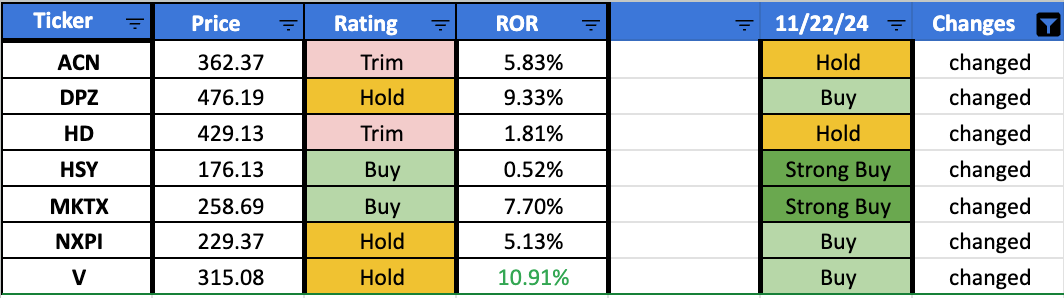

Valuation Rating Changes - Week of December 2nd + Model Portfolio Selections for December

After a strong month for the stock market in November the valuation changes are all downgrades this week.

Every Friday evening I update the valuation for each company in the Investable Universe. This process starts with updating the free cash flow per share and forward dividend yield for any of the companies that reported earnings or announced a dividend hike during the week. Afterwards each company is put through the custom FCF valuation model and new “fair price” estimates are saved in the valuation rating tracker.

If you’re a paid subscriber you can access the live valuation ratings at any time here. You can also find a copy of my custom Free Cash Flow valuation tool currently covering 202 dividend growth stocks and gain access to the model portfolios designed around this investable universe.

Let’s take a look at which stock had a valuation rating change last week.

Accenture ACN 0.00%↑

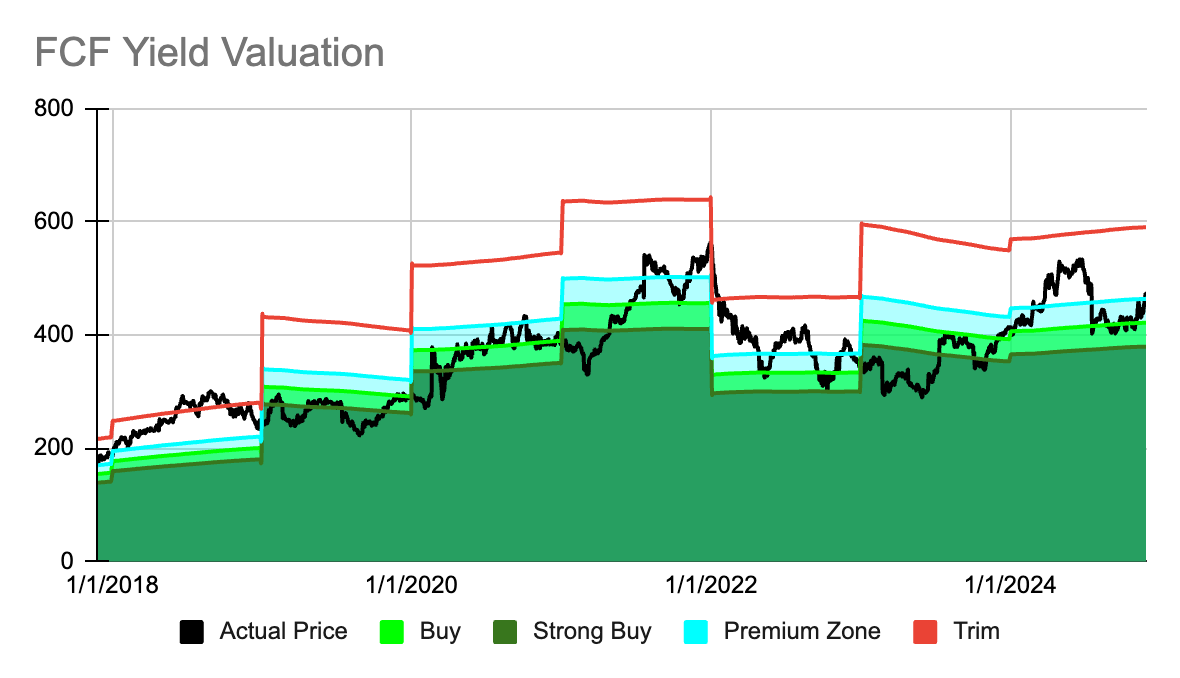

Accenture has been downgraded from a “Hold” to a “Trim” primarily due to the stock price rising last week. The “Trim” rating is triggered earlier than indicated by the red line in the chart above due to a low expected rate of return for the stock of +5.83%.

Domino’s Pizza DPZ 0.00%↑

Domino’s Pizza has been downgraded from a “Buy” to a “Hold” primarily due to the stock price rising as well. The stock currently has an expected rate of return of +9.33%.

Home Depot HD 0.00%↑

Home Depot has been downgrade from a “Hold” to a “Trim” also primarily driven by the share price rising. Home Depot currently has an expected rate of return of just 1.81%, not making it a very appealing investment opportunity.

Hershey HSY 0.00%↑

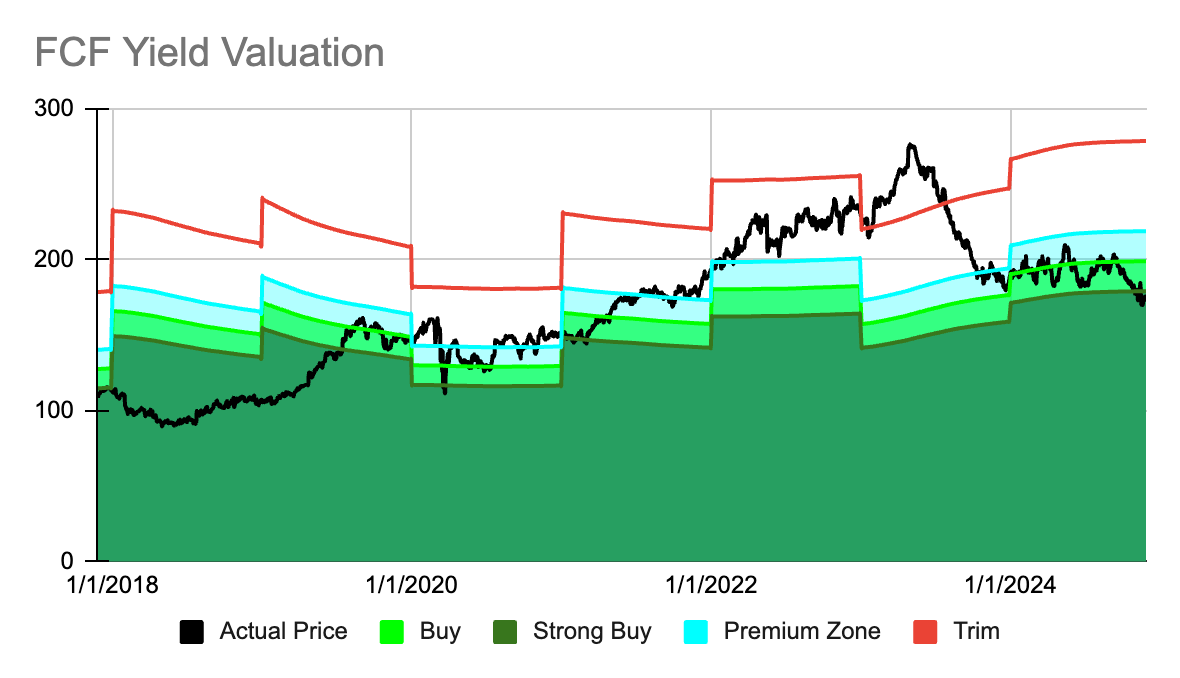

Hershey has been downgraded from a “Strong Buy” to a “Buy” primarily due to a revised Free Cash Flow figure. Hershey saw its TTM FCF revised down from $10.49 to $8.17, driving down the valuation zones in my model. This also impacts its expected rate of return that currently stands at a very low +0.52%.

MarketAxess Holdings MKTX 0.00%↑

MarketAxess Holdings has been downgrade from a “Strong Buy” to a “Buy” primarily due to a revision in its Free Cash Flow figure. MarketAxess Holdings saw its TTM FCF revised down from $8.78 to $7.59, driving down the valuation zones in my model. This also impacts its expected rate of return that currently stands at a moderate +7.70%.

NXP Semiconductor NXPI 0.00%↑

NXP Semiconductor has been downgraded from a “Buy” to a “Hold” primarily driven by a revision in its Free Cash Flow figure. The FCF has been revised from $12.91 down to $10.10, driving the valuation zones down.

Visa V 0.00%↑

Visa has been downgraded from a “Buy” to a “Hold” primarily by the share price climbing higher. Even though the stock is now rated as a “Hold” it still has an attractive expected rate of return above 10%.

Please note that the valuation model is based on quantitative data and therefore does not factor in any qualitative information. As such it is very important to perform further due diligence on each stock to make sure there isn’t a valid reason driving the valuation upgrade.

As a reminder all paid subscribers can access live valuation ratings here.

Now onto the selection for the model portfolios for December 2024.