Tractor Supply Company: A High Quality Retailer That Consistently Outperforms

Intro

While there are many ways to find success in the stock market, I believe there is a singular path to build great wealth in the long term. This path, is to follow these three fundamental rules.

Invest in High-Quality Businesses.

Purchase them for a fair or better price.

Retain these positions as long as the integrity of the first rule endures.

Today I am going to tell you about Tractor Supply Company, why I believe it is an outstanding business, currently trading for a reasonable price.

Background

Tractor Supply Company is a retail chain that focuses on serving the rural lifestyle and needs of farmers, ranchers, and suburban and rural homeowners. The company was founded in 1938 and is headquartered in Brentwood, Tennessee. They offer a wide range of products, including agricultural supplies, livestock and pet care products, lawn and garden items, tools and hardware, home improvement and maintenance products, outdoor and recreational items, and clothing and footwear. The business operates in a store format that typically features large, standalone stores. These stores are primarily designed to cater to the needs of individuals living in rural and suburban areas. The company aims to provide a one-stop shop for their various needs.

Tractor Supply derives the bulk of its revenue from retail sales of products in its stores. It has also developed and sells products under its private label brands. These brands offer consumers alternatives and choices within various product categories. In addition to brick-and-mortar stores Tractor Supply has an online presence and drives revenue from its official website. Some stores also offer services such as pet grooming and small engine repairs as well as other related services.

Tractor Supply continues to expand its store count targeting rural areas where consumers have above-average income and below-average cost of living. This targeted expansion should drive profitability and growth for the company in the future.

Boasting a respectable market capitalization of $24.4 billion, Tractor Supply secures its position as the 300th largest company within the S&P 500 index. During its 30+ year history as a publicly traded company, Tractor Supply has delivered a generous, market beating total return.

Track Record

Tractor Supply made its public debut on February 17, 1994. The company did not get off to a great start, underperforming the S&P 500 index during its first three years on the market. It’s first major beat came in 1998, the stock rose by 62.71% relative to a 28.62% gain for the S&P. Tractor Supply cemented its market dominance between 2001 and 2003, delivering three straight years of 100% plus returns.

Examining Tractor Supply’s monthly returns against those of the S&P, the stock has shown superior performance 52.51% of the time, as measured by calendar month returns. Notably, investors who exercised patience and retained their shares for longer durations saw even more favorable outcomes. Over a rolling 12-month period, Tractor Supply outperformed the index 58.21% of the time. This outperformance continued to strengthen over a rolling 36-month horizon, reaching 60.06%. Moreover, on a rolling 60-month basis, the margin of outperformance has been even more impressive with 68.56% success.

While a history of remarkable returns is undoubtedly commendable, the crucial question at hand is whether Tractor Supply remains the exceptional business it has proven to be. Let’s find out.

Quality Quadrant

Let’s start by evaluating how attractive Tractor Supply looks through the lens of business quality. I believe a great place to start evaluating the quality of a business is what I like to call the quality quadrant. This quadrant comprises four key financial metrics that serve as reliable indicators for gauging the operational strength of a business. These metrics are the return on capital employed, total revenue, gross margin and the free cash flow conversion ratio.

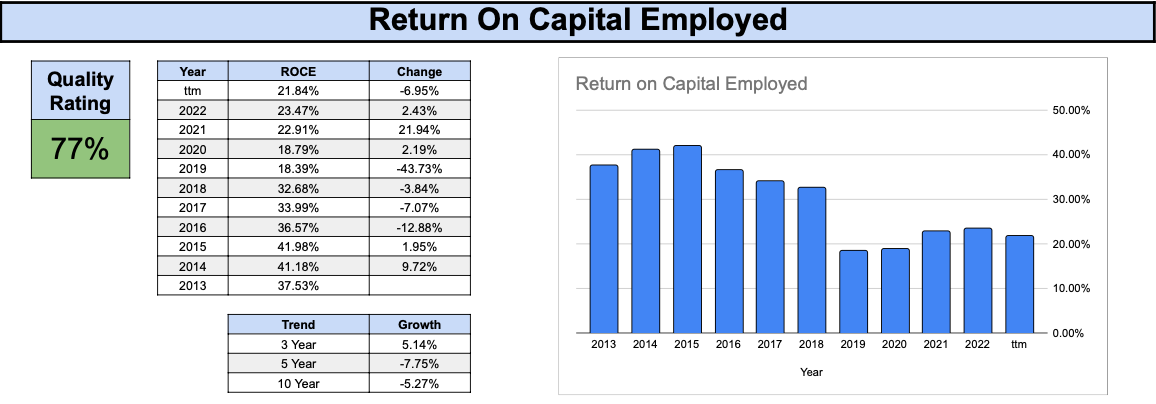

The Return on Capital Employed (ROCE) tells me how profitable a company is and how well it has utilized its capital. Effectively turning capital into profits is the primary driver of generating shareholder value.

Over the last decade, Tractor Supply has seen its ROCE decline but remain at a fairly healthy level. Between 2013 and 2015 the ROCE improved each year, climbing to slightly above 40%. Between 2016 and 2018 the ROCE declined, falling to 32%. Then in 2019 the ROCE dipped even further, declining to 18%, quite a noticeable drop. However, since 2020 the ROCE has generally improved, climbing back above 20%. This positive trajectory is underscored by the notable short-term (3 year) trend, boasting an impressive 5.14% improvement. In sum, Tractor Supply earns a modest 77% quality rating for its historical ROCE, primarily hampered by its long-term (10 year) negative trend.

Revenue represents the financial inflow generated by a business through its operations. Positioned at the forefront of the income statement as the top-line figure, revenue provides a key indicator for assessing the pace of a business’s growth when analyzed across historical values.

Over the last decade, Tractor Supply has achieved an exceptional 188% growth in revenue, translating to an impressive annualized growth rate of approximately 11.18%, a commendable pace by any standard. Tractor Supply has a perfect streak of consecutive year-over-year revenue growth since 2013. More impressive, is the acceleration in growth the company experienced between 2020 and 2022, averaging double digit growth rates during each year. In sum, the company earns a perfect quality rating of 100% for its superb revenue history.

Gross margin is the portion of revenue that is left over after direct costs are subtracted. It is one of the most important indicators of a company’s financial performance. This metric shows the cash available for various crucial purposes, including sustaining operations, servicing debt, distributing to shareholders, and fueling future growth.

Over the last decade, Tractor Supply has consistently maintained a respectable and steady gross margin, residing in the mid 30% range. Notably, in the prior year, the gross margin improved gradually, rising by 7.68%. This marked the highest gross margin level the company has seen during the last decade. The company earns a notable 91% quality rating for its very strong gross margin history.

The free cash flow conversion ratio is a measure of a company’s capability in transforming profits into free cash flow. In straightforward terms, free cash flow reigns supreme, and companies adept at generating robust levels of free cash flow enjoy greater financial flexibility.

Over the last decade, Tractor Supply has done a commendable job at turning profits into free cash flow. While a bit more year-to-year consistency would be ideal, the free cash flow conversion ratio has predominantly held above the 80% mark, with two exceptions 2015 and 2021. Despite these fluctuations, Tractor Supply still earns a decent quality rating of 79% in this category.

By combining the quality ratings for all four metrics, Tractor Supply earns an respectable composite quality score of 86.75%. In my opinion, any company boasting a score surpassing 90% resides in the highest tier of business quality. Furthermore, businesses garnering scores above 80% still merit classification as high-quality enterprises While there are many aspects that need to be considered in sound due diligence, screening for the quality quadrant is an excellent starting point. I leave the rest up to you.

Dividend History

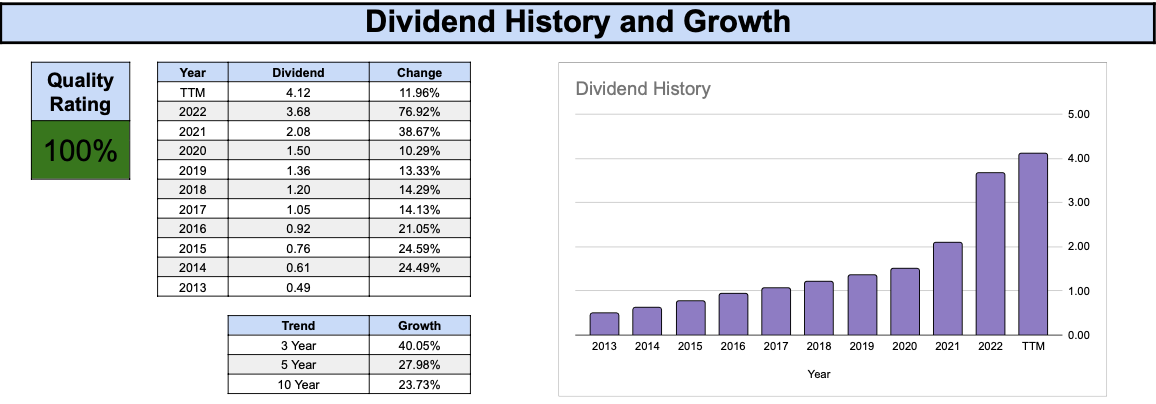

Tractor Supply has a 12 year history of dividend growth, despite being a publicly traded company for 3 decades. While its growth streak is relatively short it has been rather impressive.

During its 12 year history of increasing dividends, Tractor Supply has consistently maintained an annual dividend growth rate in the double digits. While the pace of dividend growth has gradually cooled since 2010, shareholders received a positive surprise with the 2021 and 2022 dividend increase, exceeding 38% and 76%, respectively. Last year the company announced a more modest, yet still above-average, dividend hike of 11.96%. As long as the business will be able to sustain its impressive growth trajectory, shareholders can anticipate continued above average dividend growth.

Throughout the last decade, Tractor Supply has consistently maintained a healthy payout ratio, but one that has slowly crept higher. During the early part of the last decade, Tractor Supply’s payout ratio hovered around 20%, today it has almost doubled, sitting closer to 40%. This level of payout ratio is still considered healthy, and should allow for ample room for prospective dividend growth in the future. It’s quite impressive that despite doubling its annual dividend payout since 2021, Tractor Supply still boasts a below-average payout ratio for a dividend growth stock.

Valuation

Valuation, though more art than science, requires us to establish a baseline for fair value. To help me with this task, I leverage two techniques to evaluate the attractiveness of a particular stock: dividend yield theory and the price-to-earnings multiple valuation.

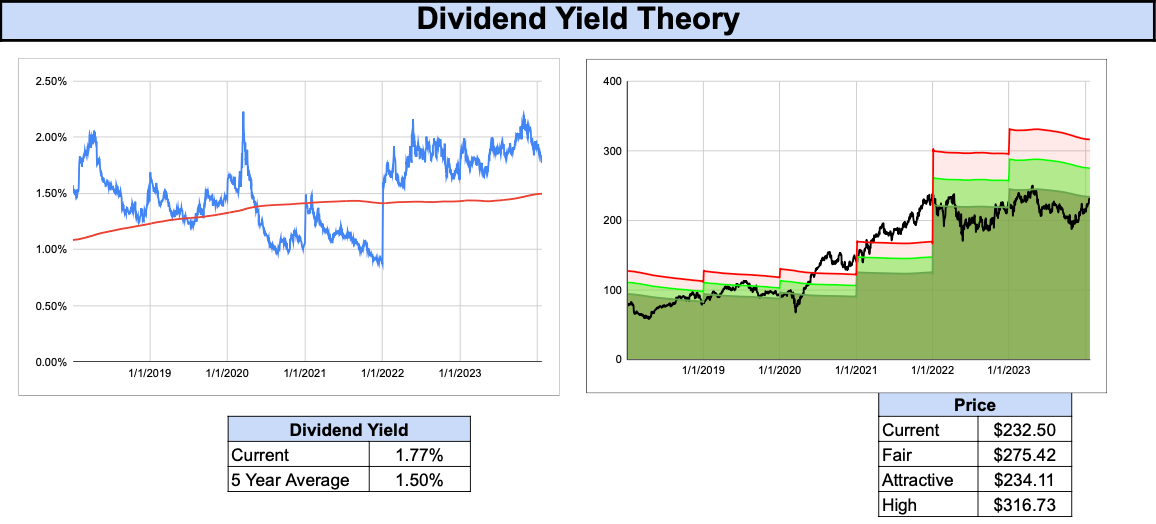

Let’s take a look at dividend yield theory first.

This valuation method operates on a simple principle: if the current dividend yield exceeds the trailing average dividend yield, the stock is deemed undervalued, and conversely, overvalued if the inverse is true. In the chart on the left, Tractor Supply’s historical dividend yield (blue line) is juxtaposed with its 5-year rolling average dividend yield (red line). The dividend yield has mainly oscillated within the narrow 1% to 2% range.

Presently, the 5 year trailing average dividend yield stands at 1.50%, about 15.25% lower than the current dividend yield of 1.77%. According to dividend yield theory, this suggests that a fair valuation for Tractor Supply today falls within the range of $275.

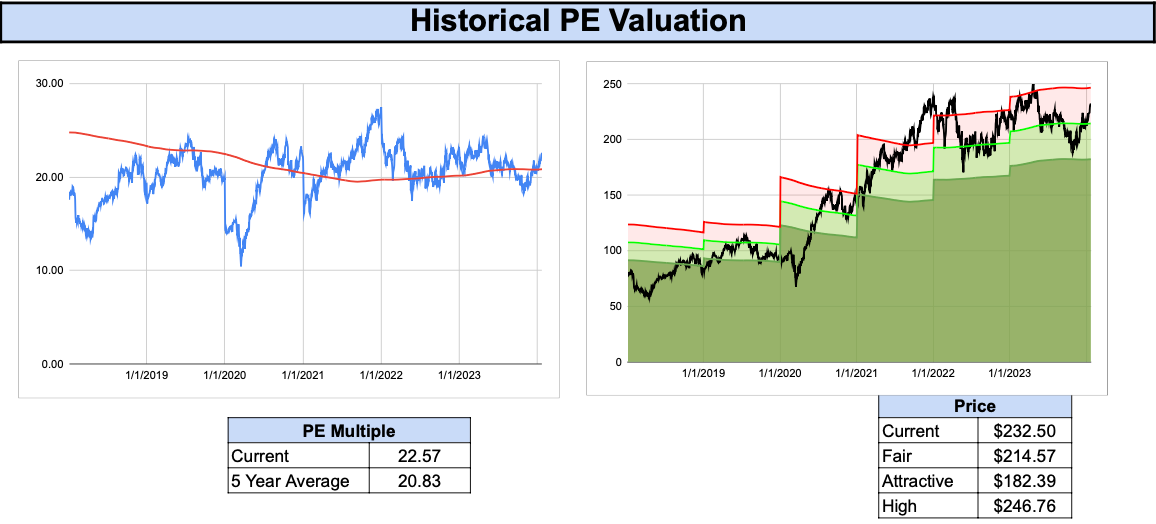

Now let’s see what the price to earnings multiple can tell us.

During the past 7 years, Tractor Supply’s P/E ratio has trended higher, reaching a peak near 27 during 2021. Since 2021, the P/E ratio has trended lower and leveled out right around 20. The chart on the right illustrates that the share price got ahead of a fair valuation in 2021, but has trended back to a more reasonably level. Currently, with a P/E ratio of 22.57 slightly above the trailing average of 20.83, it suggest that Tractor Supply is marginally overvalued. Based on the trailing P/E multiple we come up with a fair price of around $214 today.

Combining both valuation methodologies, we arrive at an average fair price for Tractor Supply of $245, approximately 5% above the current market price of $232.50 as of market close on Tuesday, January 23, 2024. (Note: the price fell another $6.47 on Wednesday January 24, 2024 after I pulled my report, giving us a slightly larger discount of 7.7%). A 7% margin of safety may not sound like much, however given Tractor Supply’s strong history, competitive strategy and excellent future prospects, it is considered a bargain at today’s value.

Final Thoughts

I currently hold a long position in Tractor Supply, with intentions of holding on to my shares for as long as I find it to be a high quality company. I strongly recommend conducting your own in-depth due diligence beyond the brief analysis I shared with you today. This way, you can assess whether you share my belief in Tractor Supply as a high quality business and whether the current valuation aligns with your own investment criteria.