The Power of Dividends and Compounding

Whether you identify as a dividend enthusiast or not, the undeniable influence of dividends and their reinvestment on total returns demands attention.

Spanning the period from 1960 to 2022, an impressive 69% of the S&P 500’s total returns are are directly attributed to dividends and compounding through reinvestment. To put this into a dollar context, a $10,000 investment in the S&P 500 without dividends would have grown to approximately $641 thousand. Factoring in dividends and dividend reinvestment that same $10,000 would have grown to more than $4 million. While investing in an S&P 500 index fund left little room for discretion in receiving dividends, the decision was what one chose to do with those dividends, reinvesting was clearly the most lucrative option.

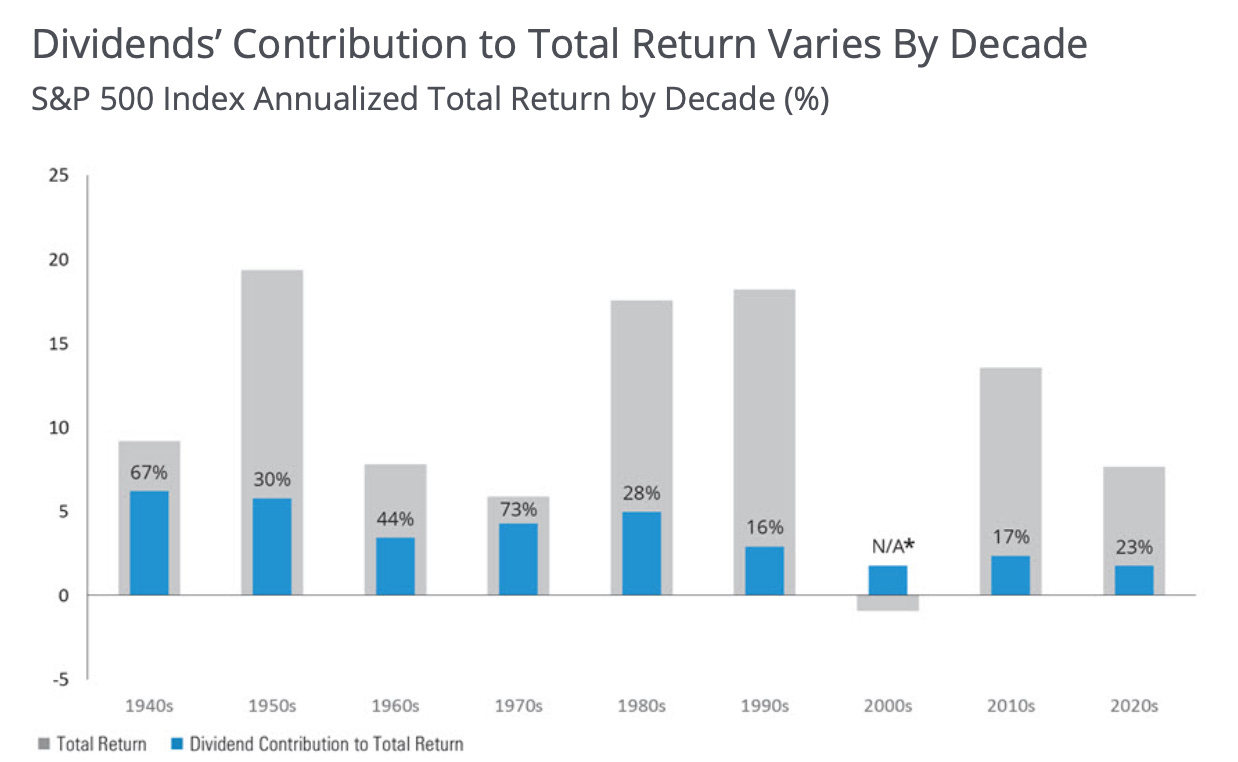

Reviewing total returns for the S&P 500 by decade reveals that dividends did not uniformly contribute to total returns. In periods of modest total returns, less than 10%, dividends played a more important role, whereas in exceptionally prosperous decades, their contribution was less significant.

An important shift in the dividend landscape took place during the 1990’s, vividly reflected in the historical dividend yield of the S&P 500 index. The 1960’s witnessed a dividend yield oscillating between 3% and 4%, climbing to a peak slightly above 6% in the early 1980’s. The 1990’s marked a progressive decline, with the dividend yield bottoming out near 1% just before the dot-com bubble burst. In the early 2000’s the dividend yield was revived, climbing as high as 3.5% near the lows of the Financial Crisis. The subsequent decade marked relative stability around 2%, with the dividend yield dipping briefly in recent times. While the days of the 1970’s and 80’s high yields seem distant, dividends may yet emerge as a steadfast anchor during prolonged economic downturns.

Many investors captivated by dividends are naturally drawn to high-yield stocks and funds, enticed by the prospect of accelerated income and the allure of speeding up the “dividend snowball.” However, conventional wisdom cautions against chasing yield. Historical analysis reveals that stocks with high, rather than highest yields, managed to generate stronger total returns. A study by Wellington Management, breaking up dividend stocks into quintiles by their level of dividend payouts, found that stocks in the second quintile managed to outperform the S&P 500 more often than the rest, 78% of the time. A key factor contributing to this success may be the sustainability of payout ratios; the second quintile boasted an average payout ratio of 40%, outshining the first quintile’s 74%.

A more prudent approach than fixating on high yields is to pivot towards dividend growth. A comprehensive study by Ned Davis Research dissected dividend paying stocks into three categories; growers and initiators, no change in dividend policy, and cutters and eliminators. Over the period from 1973 to 2022, the unequivocal winners were dividend growers and imitators, exhibiting not only superior returns but also lower volatility. The subsequent best-performing group was the collective dividend payers, followed by stocks with no change in dividend policy. Unsurprisingly, cutters and eliminators found themselves at the bottom of the performance spectrum. Even non dividend payers outperformed this group, but they failed to surpass all other dividend paying categories. In comparison to an equal weighted S&P 500 index, both dividend payers and dividend growers and initiators demonstrated outperformance.

What does this historical treasure trove mean for you? If you’re a dividend investor, the compass points to companies exhibiting robust dividend growth policies, maintaining healthy payout ratios, and offering high but sustainable dividend yields. For those indifferent to dividend stocks, this insight may not dramatically alter your trajectory. However, for the skeptics dismissing dividends outright, a reconsideration might be in order, recognizing that historical returns bear witness to the impact of dividend stocks.

Whether you revel in dividend stocks or remain indifferent, the ultimate investing strategy converges on a common ground - focus on high quality companies.

The data and images are all attributed to a report published by Hartford Funds, linked below.

https://www.hartfordfunds.com/insights/market-perspectives/equity/the-power-of-dividends.html