Quality Stocks - 2/7/25 Recap

High Quality Stocks - February Performance

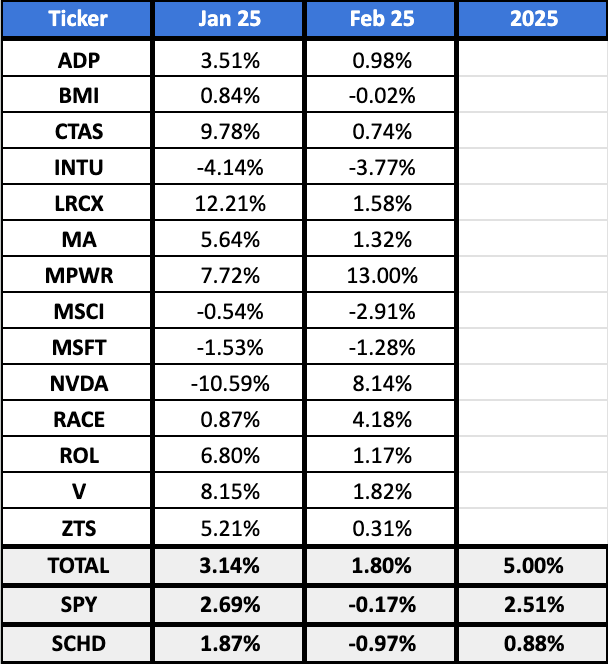

February kicked off on a positive note for the 14 high quality stocks in my investable universe. Collectively these 14 stocks are up 1.8% during the first 5 days of February, but this gain is largely driven by just 2 stocks, I’ll get into the details in just a moment. The S&P 500, as measured by SPY 0.00%↑, is down 0.17% in February, and Schwab’s U.S. Dividend Equity ETF SCHD 0.00%↑ is down 0.97%. Here are the year-to-date returns.

The best stock in the investable universe in February has been Monolithic Power Systems MPWR 0.00%↑that is up +13%. MPWR 0.00%↑ has been a great stock pick this year as it also posted a hefty win in January with a return of +7.72%.

The second best stock in February was Nvidia NVDA 0.00%↑ with a gain of +8.14%. Nvidia has recovered some its January losses, -10.59%, following the DeepSeek news.

Here is the performance for the full investable universe.

If you’d like to see how these returns change the valuation ratings and expected rate of return you can check them out here. While each of these companies is a high quality business, today may not be an opportune time to invest in them.

If you’re wondering how these 14 stocks found their way into this investable universe, here is exactly how that happened.

I tested 770 stocks with my “Quality Score” that reviews the short and long-term track record of these 6 metrics:

Revenue Growth

Free Cash Flow Growth

Return On Invested Capital

Gross Profit Margin

Dividend Growth

Payout Ratio

Only 14 out of the 770 dividend growth stocks I tested earned a long-term quality score of 90% or more.

Stock Valuation Tool v2.0 Preview

Here’s a quick preview of version 2.0 of the Stock Valuation Tool.

The tool will be available later this week once I have a chance to record an explainer video to show you exactly how it works.

It will come pre-populated with data for 227 dividend growth stocks and more stocks can be added upon request.

I wish you all a great week!