Quality Dividend Stock: Starbucks Corporation (SBUX)

Company

Starbucks is one of the most recognizable brands in the world with more than 35,000 locations in over 80 countries. It is well-known for its wide variety of coffee products but also sells teas, pastries and other single serve items for both breakfast and lunch.

Here is a snapshot of some high level financial metrics

2. Is It A Winner?

The best kind of high quality company is one that is already a winner and the best way to determine if a company is a “winner” is to look at its long-term track record. As the chart below shows SBUX has grown by almost 37,000% since inception in mid-1992 or a CAGR of 20.1%

That’s an incredible track record over the past 30+ years, returning approximately double what the market returns on average.

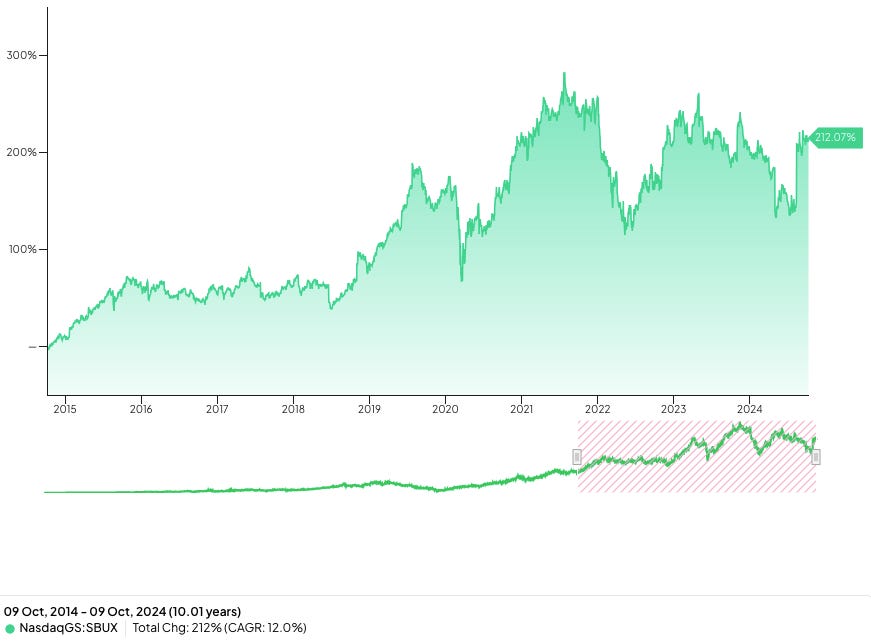

Over the past decade it has been a tale of two stories. Roughly the first half of the past decade there was little in the way of price movement with a minimal return. However since late 2018/early 2019 the stock price has had a lot more movement, both up and down. Collectively, SBUX has returned a little more than 200% over the past 10 years, equating to a CAGR of roughly 12%.

3. Dividend Data

Since we are looking for a quality Dividend stock it only makes sense that we consider the company’s dividend history.

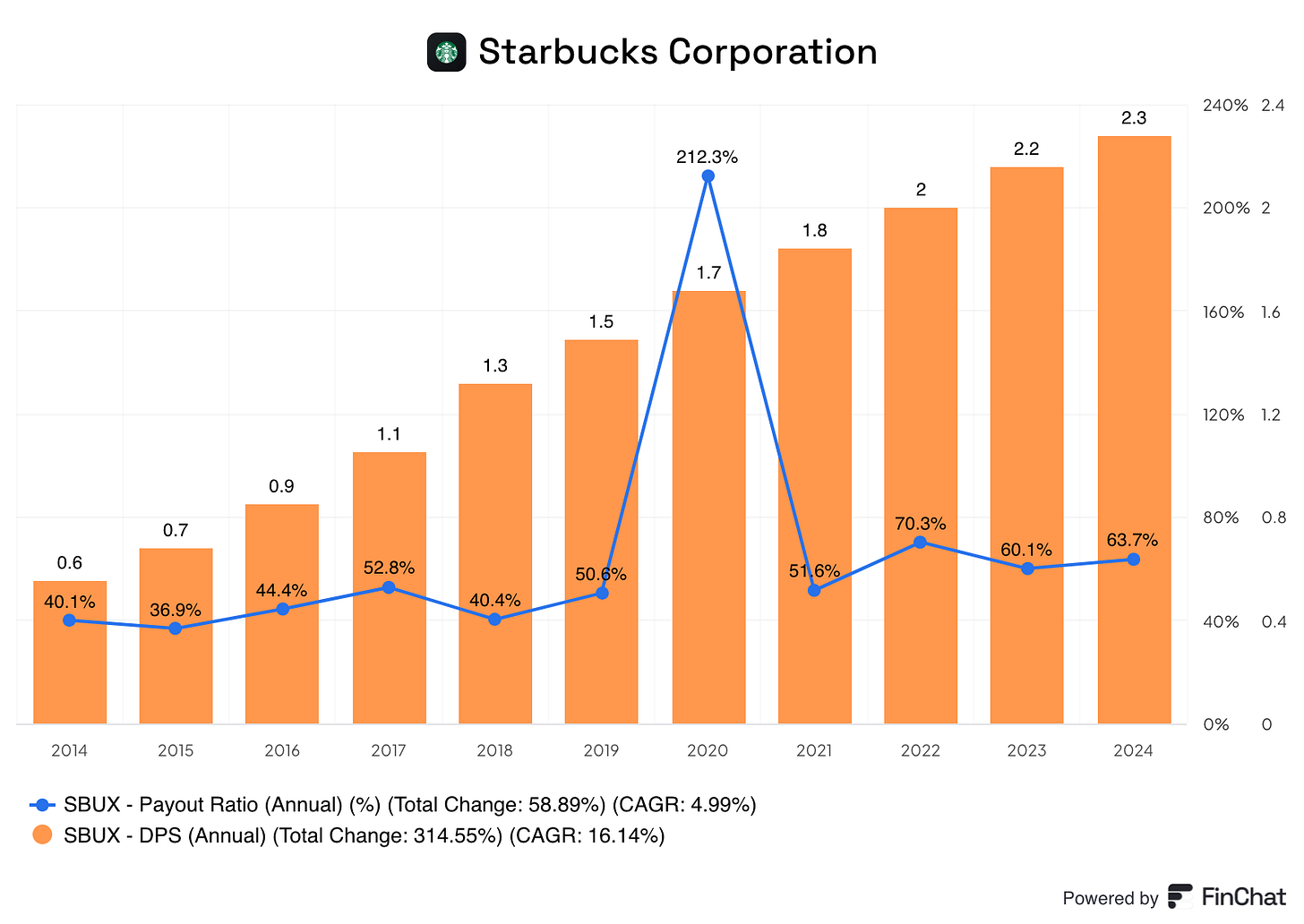

SBUX has grown its dividend nicely over the past 3-, 5- and 10-year marks, at 8.2%, 9.63% and 15.93% respectively. It’s worth noting the dividend growth does seem to be slowing somewhat in more recent years.

As the chart below shows, the payout ratio for SBUX has increased by 50% since 2014, from about 40% to more than 60% in the most recent fiscal year. Obviously, at this point the dividend is still safe but investors should keep an eye on the payout ratio in the coming years to see if it continues to climb to a potentially unsafe level.

4. Quality Metrics

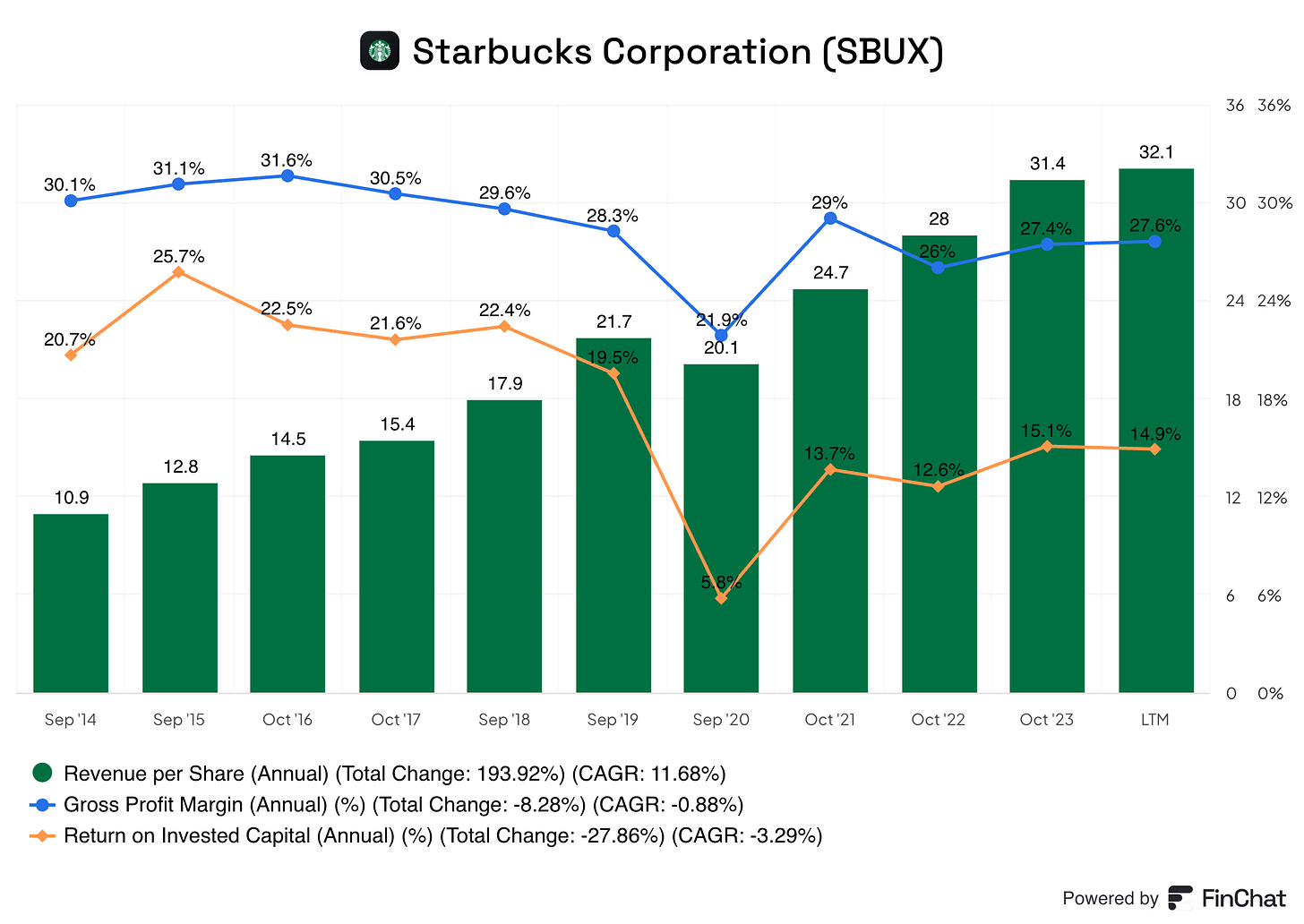

In my opinion the three most important metrics that all high quality businesses should have in common are: a growing revenue stream, a strong and steady gross profit margin and a robust return on invested capital.

Take a look at the chart below to see how SBUX stacks up.

Revenue per share growth has been consistent with the exception of some hiccups around the height of the pandemic. Other than those few years it has been on a steady climb, growing at a CAGR of about 12%.

The gross profit margin has oscillated between the low 30’s down to the mid to high 20’s, again with the exception of 2019 where it dipped close to 20%. This metric has remained relatively stable over the past decade and I would expect this to continue into the future.

The return on invested capital was sitting nicely above 20% pre-pandemic. However once the pandemic hit, it declined sharply in 2020 all the way down to about 6%, before rebounding in the subsequent years. Ideally, SBUX can drive this metric back to pre-pandemic levels north of 20%.

5. Valuation

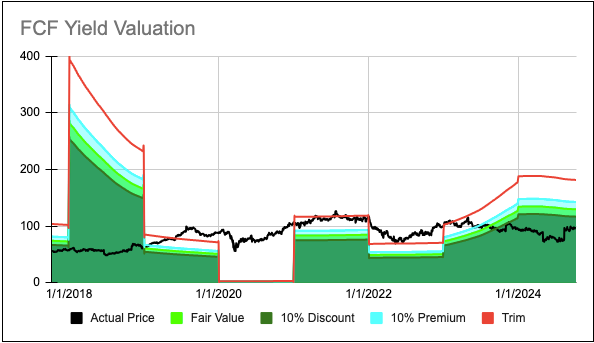

The last consideration is whether SBUX is trading for an attractive price today. As the custom FCF valuation tool below suggests the stock is currently trading for about a 26% discount to fair value. We can see that since just before the pandemic the stock has been overvalued nearly the entire time. Only about a year ago did it come back down to a more reasonable level. In fact, since the beginning of this year, as free cash flow improved, the stock has been in the STRONG BUY territory.

SBUX currently has a long-term expected rate of return of 16.45%, this ROR is broken down as follows:

2.38% dividend yield

4.73% return to fair value

9.34% expected earnings growth rate

Overall, SBUX has been a juggernaut since inception, offering investors exceptional market-beating returns. The stable financial metrics combined with a safe and growing dividend is something all dividend investors should seek. Finally, according to the custom valuation tool it is trading at a significant discount to fair value that hasn’t been seen for almost 5 years; consequently, now may be a good time to add SBUX to your watchlist.

If you found this post insightful and would like to receive more Dividend Stock reviews directly to your inbox, subscribe below!