Quality Dividend Stock: Broadridge Financial (BR)

1. Broadridge Financial (BR)

Broadridge Financial provides investor communications and technology solutions for the financial industry. Things like proxy and regulatory reports, class action material and corporate action event information. What you may not know about Broadridge is that this company is a spin-off from Automatic Data Processing (ADP).

2. Is It A Winner?

The best type of quality company is one that is already a winner. The best way to determine if a company is a “winner” is to look at its long-term track record. As the chart below shows us Broadridge Financial has grown by nearly 1,400% since inception or a 16.6% CAGR.

That’s a pretty stellar track record in my opinion.

3. Dividend Data

Since we are looking for a Quality Dividend stock it only makes sense that we consider the company’s dividend history.

Broadridge has grown its dividend at a very strong rate, averaging 11.64% during the past 3 years, 10.53% during the past 5 years and 14.31% over the past decade.

As the chart below shows, Broadridge’s payout ratio has crept higher during the past decade, from the mid 40% range to the mid 50% range. While this isn’t favorable, this payout ratio level is still quite attractively and sustainable.

4. Quality Metrics

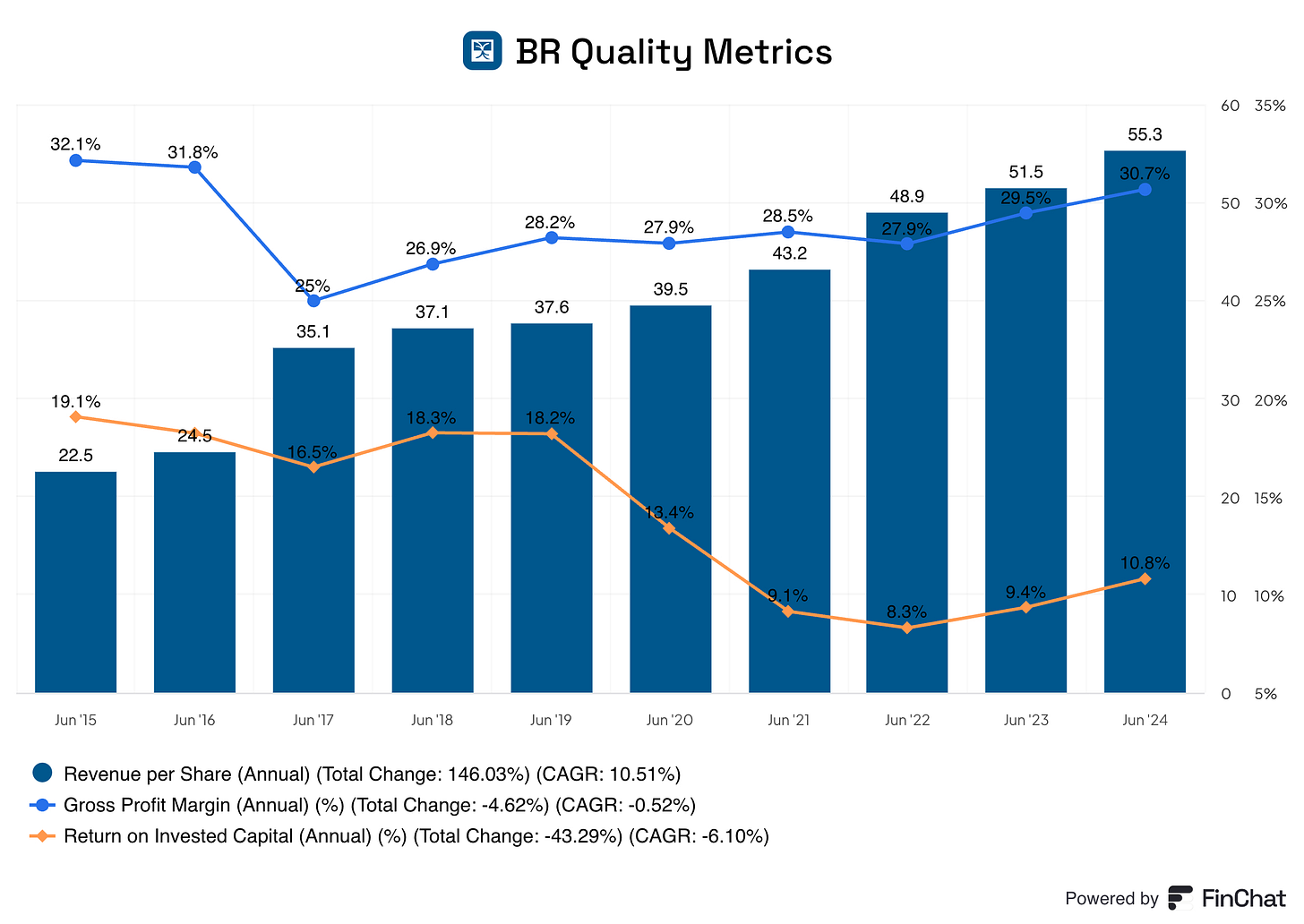

In my opinion the three most important metrics that all high quality businesses have in common are: a growing revenue stream, a strong and steady gross profit margin and a robust return on invested capital.

Take a look at the chart below to see how Broadridge Financial stacks up.

Revenue growth has been nice and consistent with a CAGR of 10.51%.

The gross profit margin has oscillated a bit but generally held steady between 25% and 30%.

The return on invested capital has dipped during the past few years. Ideally I’d prefer to see this figure return to the high teens/low twenties but a 10% ROIC is not too terrible.

5. Valuation

The last consideration is whether Broadridge Financial is trading for an attractive price today. As the custom FCF valuation tool below suggest BR is currently trading for approximately a 15% discount to fair value with an expected rate of return of 16.32%.

This ROR is broken down as follows:

1.69% dividend yield

2.83% return to fair value

11.80% expected earnings growth rate