1. Automatic Data Processing (ADP)

Last week we covered Broadridge Financial (BR), so today I thought it would be fitting to cover its former parent company, Automatic Data Processing (ADP). ADP is a leading global cloud based human capital management solution provider. It offers a full suite of Human Resource related services spanning from payroll to talent acquisition, also extending to areas such as insurance and retirement. The company has been around for over 75 years and had their initial public offering on September 12, 1961.

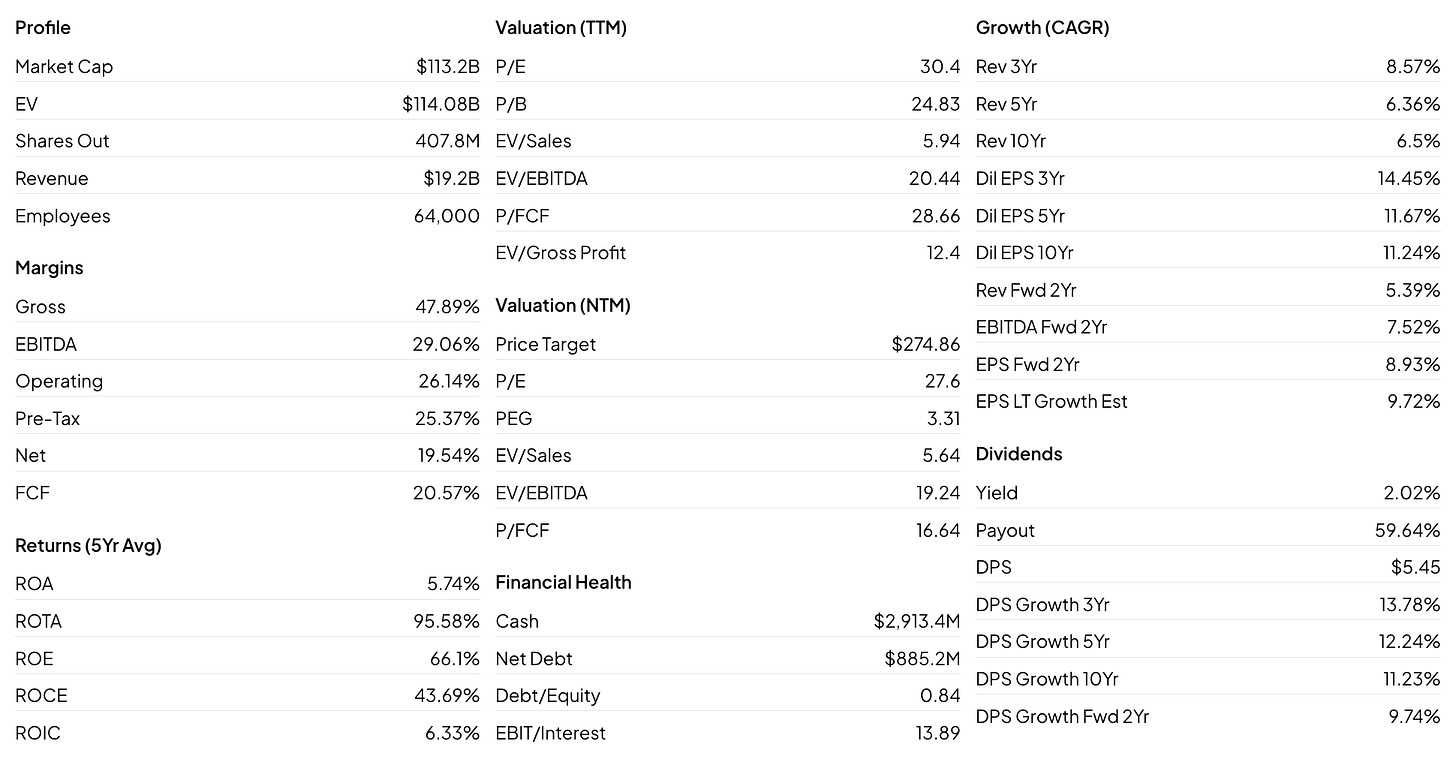

Here is a snapshot of some high level financial metrics.

2. Is It A Winner?

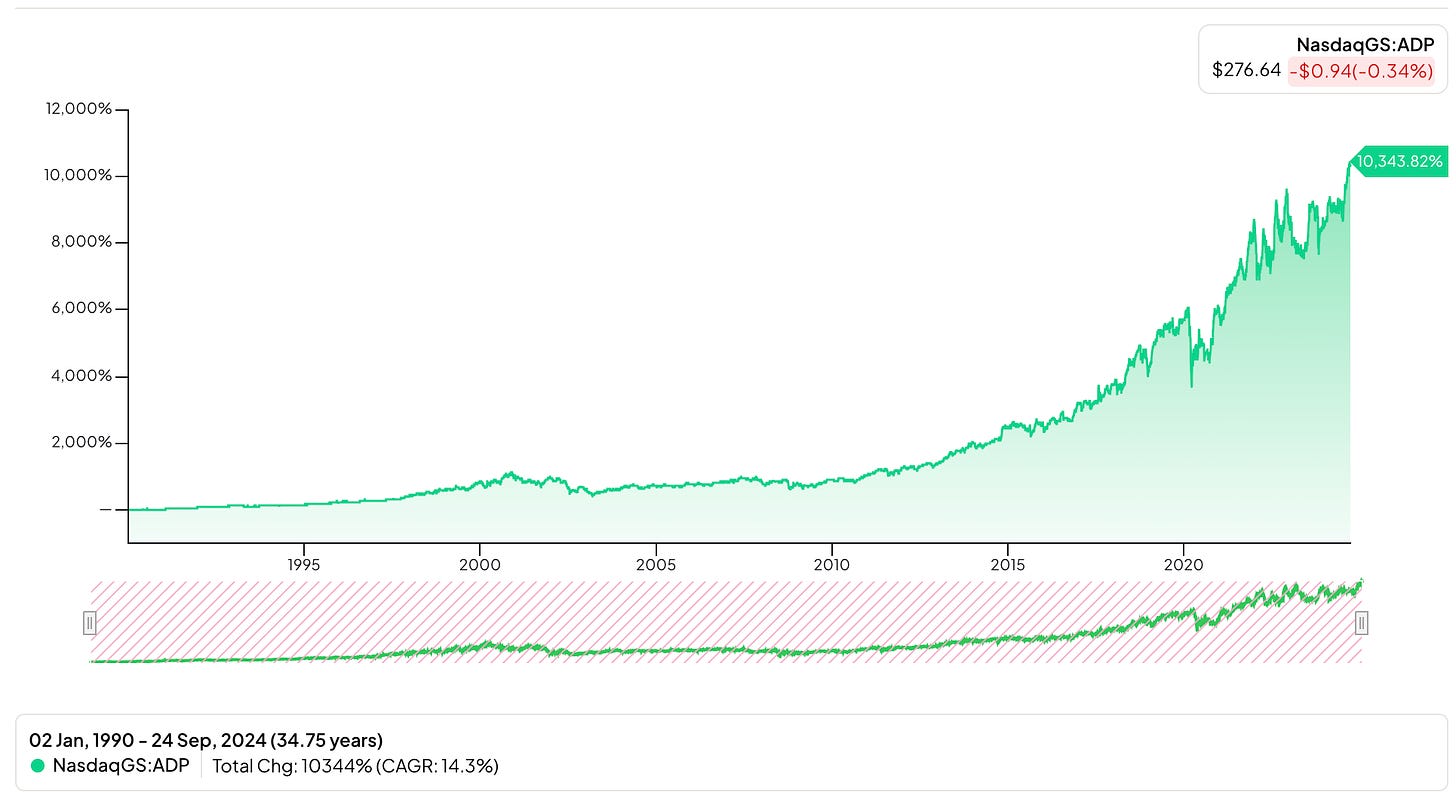

The best kind of high quality company is one that is already a winner. The best way to determine if a company is a “winner” is to look at its long-term track record. As the chart below shows us ADP has grown by over 10,000% since 1990 or a 14.3% CAGR.

That’s a pretty stellar track record in my opinion.

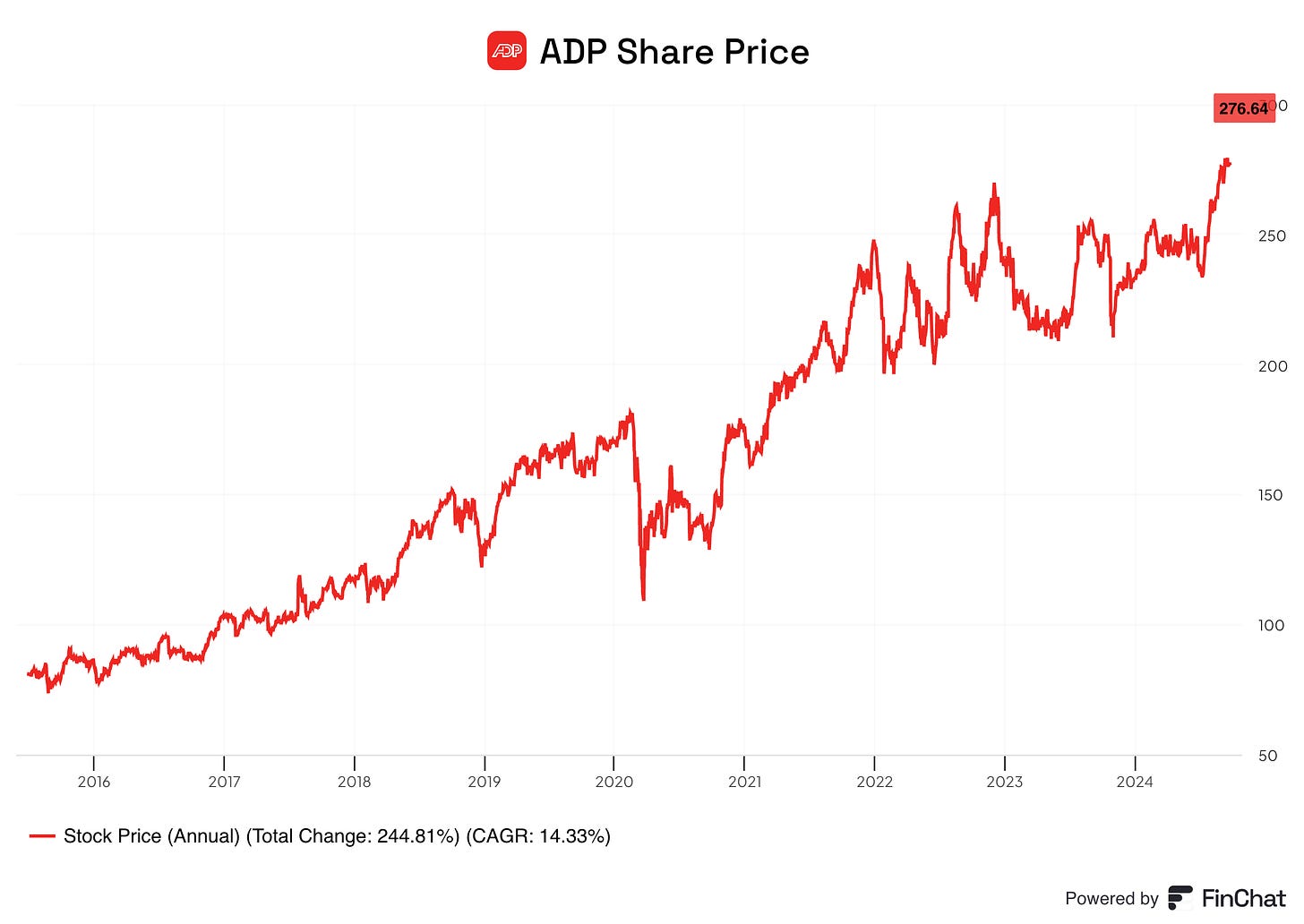

ADP has held this stellar pace of growth intact more recently as well, as shown in the 10 year chart below. You’ll notice the CAGR of 14.33% is right inline with ADP’s long term rate of return.

3. Dividend Data

Since we are looking for a Quality Dividend stock it only makes sense that we consider the company’s dividend history.

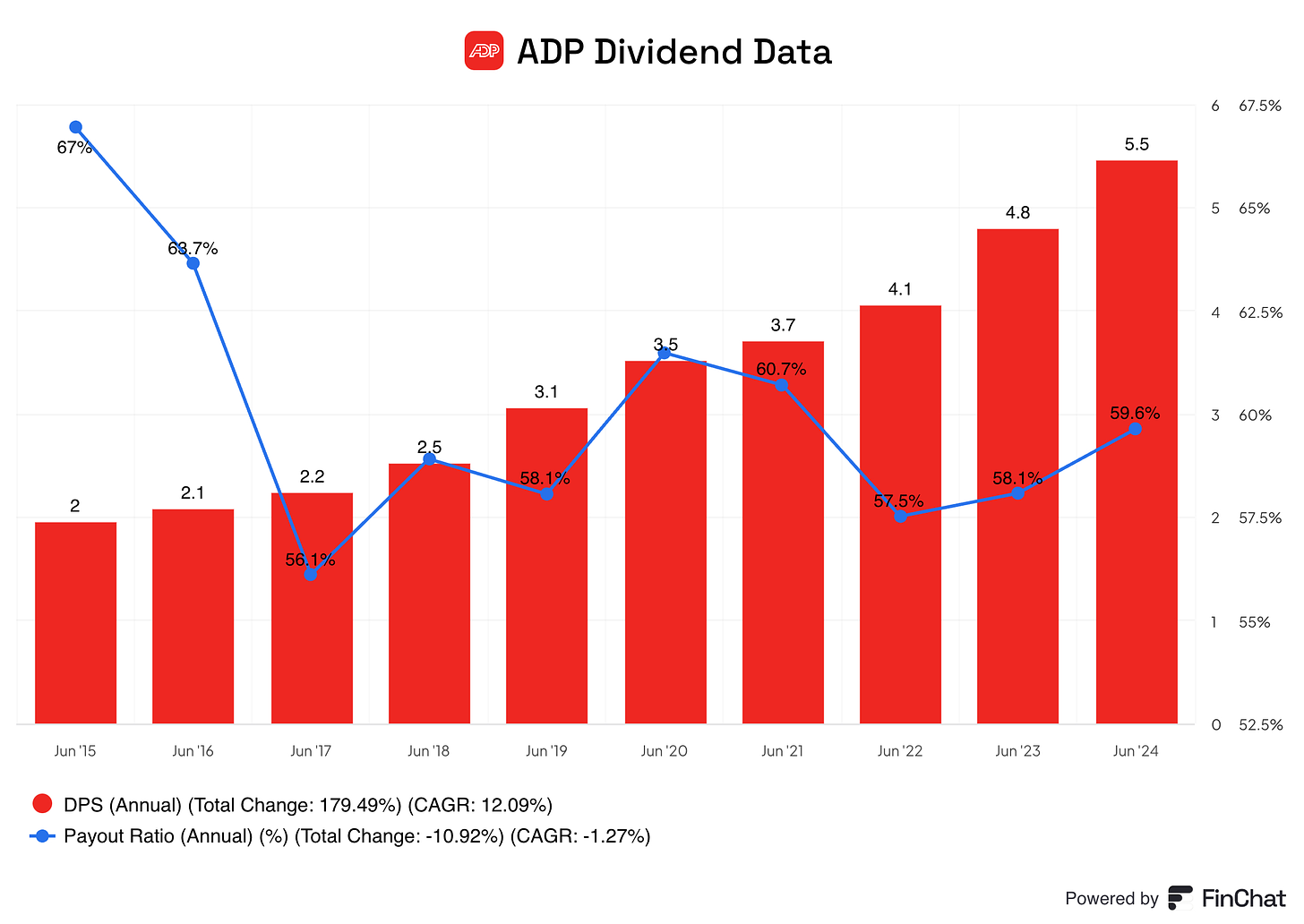

ADP has grown its dividend at a very strong rate, averaging 13.78% during the past 3 years, 12.24% during the past 5 years and 11.23% over the past decade.

Historically the company has raised its quarterly dividend in Q4, typically announcing a dividend increase in early November. In a few months we will know whether or not ADP’s long-term dividend growth rate will remain intact.

As the chart below shows, ADP’s payout ratio has generally improved over the past decade. Holding it’s payout ratio at or below 60% while maintaining a healthy pace of dividend growth is a great achievement.

4. Quality Metrics

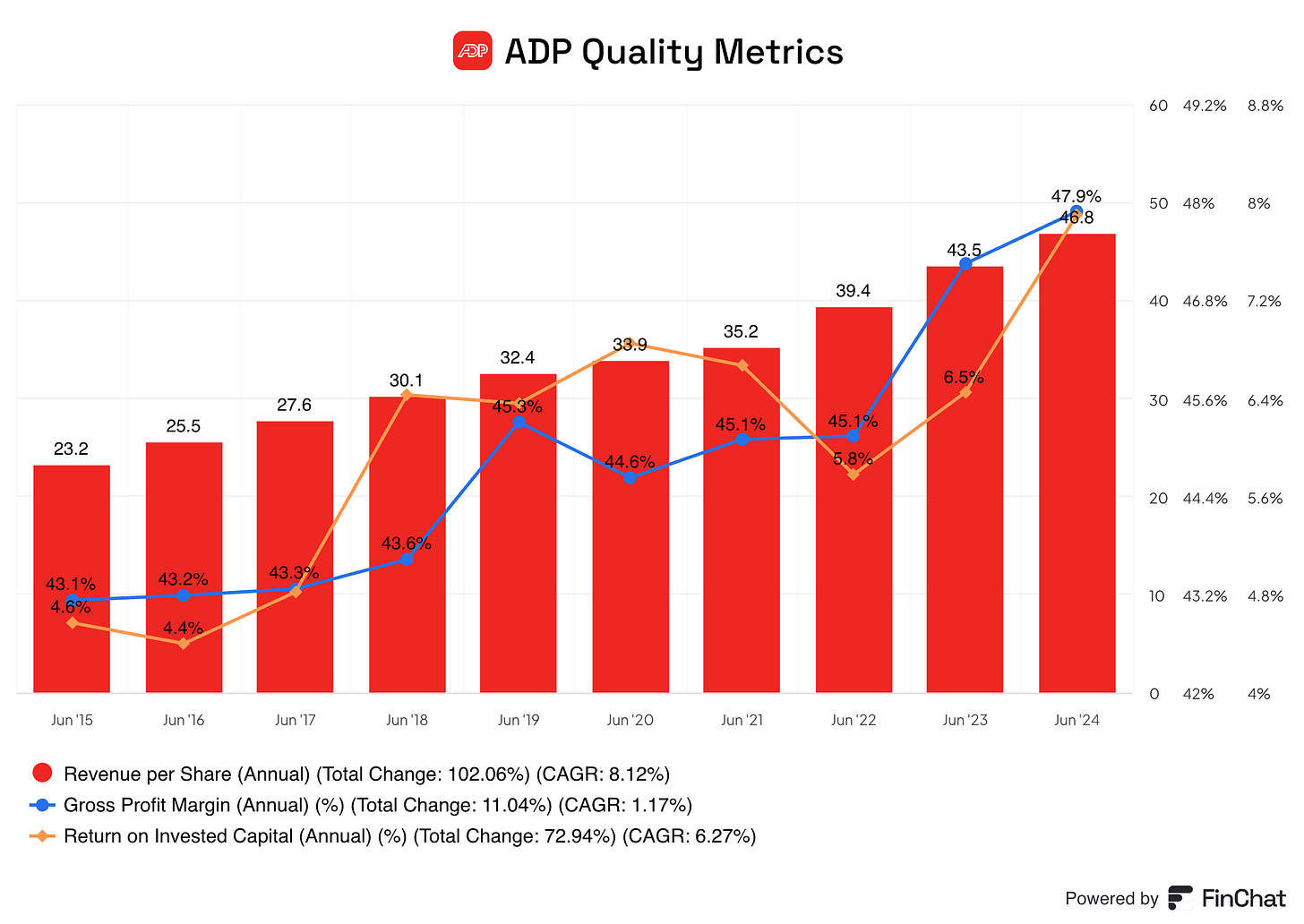

In my opinion the three most important metrics that all high quality businesses should have in common are: a growing revenue stream, a strong and steady gross profit margin and a robust return on invested capital.

Take a look at the chart below to see how ADP stacks up.

Revenue has grown consistently year-over-year during the last decade, averaging a healthy pace of 8.12%.

The gross profit margin has generally improved from the low 40% range to the high 40% range. In my opinion a steady gross profit margin is excellent and an increasing gross profit margin is superb.

The return on invested capital is not too attractive, sitting well below 10%. While this ROIC is not ideal of the type of stock I seek out, it has improved over the last decade, on average. Certain Financial stocks do not have high a ROIC mainly due to the nature of their business. I wouldn’t necessarily discount or reject ADP due to its low ROIC.

5. Valuation

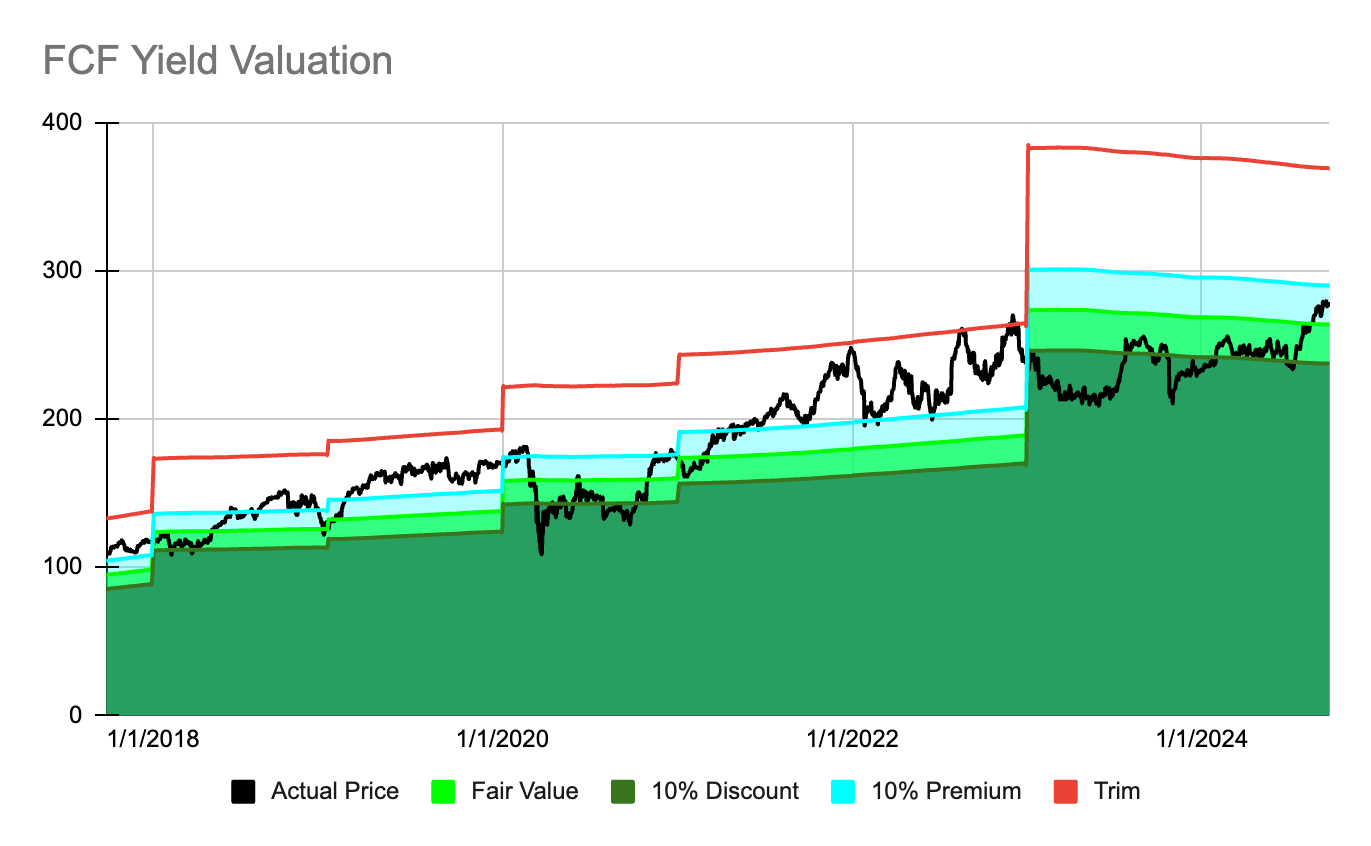

The last consideration is whether ADP is trading for an attractive price today. As the custom FCF valuation tool below suggest ADP is currently trading for approximately a 5% premium to fair value. While this isn’t ideal I believe the company still presents an attractive entry point. A more timely entry point would have been a few weeks ago, before the recent price rally. Hindsight is always 20/20, however we must make investing decisions in present time with uncertainty of what the future has in store.

ADP currently has a long-term expected rate of return of 10.17%, this ROR is broken down as follows:

2.02% dividend yield

-0.98% return to fair value

9.13% expected earnings growth rate

Overall I think ADP is a strong business with a great long-term history, it boast solid financials and has grown at a healthy pace. It has a stellar dividend record and presents a decent opportunity at today’s price.

Quick Announcement

Starting next week I will be launching a paid version of this newsletter. While there will still be plenty of free content shared each week, some of the new content will be hidden behind a paywall.

Paid subscribers will receive the following benefits.

Access to our High Quality Investable Universe with live Valuation Ratings

Updates and live Access to all Model Portfolios

Full Stock Analysis

Alerts of Valuation Rating Upgrades

Access to our custom Free Cash Flow Valuation Tool

All of my Patreon members will also receive a complimentary paid subscription in addition to the benefits they currently receive through Patreon.

If this sounds interesting to you please consider upgrading to a paid subscription or joining the Patreon community. Patreon memberships are currently $5 per month and the paid newsletter subscription will be the same price.

Have a wonderful rest of your day!

I appreciate the insightful analysis on ADP. I'm pleased with my investment and look forward to holding it long-term. Thank you for such a comprehensive Article!