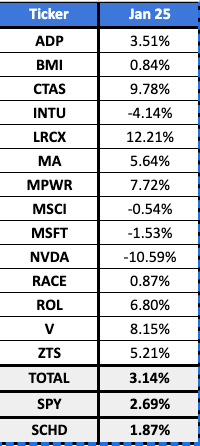

January 2025 is on the books and the stock market kicked off the new year on a rather positive note. The SPDR S&P 500 Trust ETF SPY 0.00%↑ posted a healthy gain of 2.69% last month. The popular dividend ETF Schwab’s U.S. Dividend Equity ETF SCHD 0.00%↑ finished with a more modest gain of 1.87%. Let’s take a quick look at how the new Quality Stocks lists performed.

I shared these lists with Paid subscribers a few weeks ago. They were the result of reviewing over 700 dividend growth stocks and finding the best stocks using my Quality Score.

The cream of the crop were stocks that yielded a long-term quality score above 90%. On average they generated a total return of 3.14% in January, outpacing the average market return.

Not all of these stocks were “winners” as INTU 0.00%↑, MSCI 0.00%↑, MSFT 0.00%↑ and NVDA 0.00%↑ all finished January in the red.

Offsetting the less than desirable returns shown in the table below were: LRCX 0.00%↑, CTAS 0.00%↑, V 0.00%↑ and MPWR 0.00%↑.

The second tier of quality stocks were those that had a long-term quality score above 85%.

On average, they performed a little better, generating an average return of 4.02%. It’s worth noting that only 2 out of these 26 stocks experienced a negative return in January.

DFS 0.00%↑ and AMAT 0.00%↑ were clear winners in this quality stock subset, each posting a double digit gain to kick-off the year.

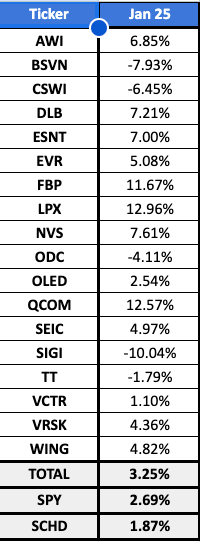

The final crop of quality stocks were those that had a short-term quality score above 90%. These are more forward looking selections that have recently seen solid financial results.

On average, these 18 stocks posted a gain of 3.25% to start the year. However, the range of individual returns varied significantly for this particular list. 3 stocks on the list kicked-off the year with double digit gains: FBP 0.00%↑, LPX 0.00%↑ and $QCOM. While 5 stocks posted losses, some quite significant, with the worst being SIGI 0.00%↑.

January came and went rather quickly and these returns are already on the books. Therefore the more important question is how attractively valued these stocks are today and what type of return can they generate in the long-term.

In my opinion the best and safest way to build a long-term high quality dividend growth portfolio is by investing in the highest quality dividend growth stocks when they are trading for attractive prices and when they present a lucrative forward looking rate of return.

Paid subscribers can see my custom valuation and expected rate of return, updated live for each of these stocks here.

Here is a snapshot of the valuation, expected rate of return and my custom models rating for each stock. Updated as of February 3rd, 2025.