MasterCard: High Quality Business for a Reasonable Price

Intro

While there are many ways to find success in the stock market, I believe there is a singular path to build great wealth in the long term. This path, is to follow these three fundamental rules.

Invest in High-Quality Businesses.

Purchase them for a fair or better price.

Retain these positions as long as the integrity of the first rule endures.

Today I am going to tell you about MasterCard, why I believe it is an outstanding business, currently trading for a reasonable price.

Background

MasterCard is one of the world’s leading global payment and technology companies, it has a rich history that dates back to the mid-20th century. In 1966, a group of banks formed the Interbank Card Association (ICA) to develop a new credit card system that would compete with BankAmericard (now Visa). Their goal was to create a universal credit card that could be accepted by multiple banks. In 1969, the ICA introduced “Master Charge: The Interbank Card” as a competitor to BankAmericard. The name was eventually changed to MasterCard in 1979 to better align with its global focus. MasterCard rapidly expanded its operations internationally, forming alliances with various banks and financial institutions, establishing a truly global network. This expansion allowed cardholders to use their MasterCard for transactions in different countries. MasterCard placed great focus on technological advances and pioneered many of the secure technologies we enjoy with credit cards today. In 2006, the company went public through an initial public offering on the New York Stock Exchange. This provided the company with capital to support its rapid growth. Since going public MasterCard has evolved to become more than just a credit card company, they are a technology driven payment solutions provider. Today, along with Visa, MasterCard controls a significant share of the credit card and digital payment market share. Both companies are recognized globally and enjoy acceptance and recognition from the global payments market.

The bulk of MasterCard’s revenue is derived from transaction related fees and services it provides. Here are the 8 key ways MasterCard generates revenue:

1. Transaction Fees on its network

2. Cross-Border Fees

3. Assessment Fees on member banks

4. Licensing Fees for the use of its logo and network

5. Data and Analytics Services

6. Innovation and Technology Services

7. Partnerships and Collaborations

8. Interest on Deposits

It’s important to note that MasterCard operates as a payment network, and it does not directly lend money to cardholders. The beauty of its business is that it benefits from debt but does not have to service it.

Believe it or not, but a significant portion of the world still does not utilize credit cards. Much of the developing world does not enjoy access to traditional banking services or credit facilities. Cash transactions persist as the primary mode of payment, underscoring the untapped potential that MasterCard could explore in the future.

The accelerating evolution of contacts and digital payment technologies positions MasterCard at the forefront of capturing emerging markets. With advancements in these areas, the company is well-poised to extend its reach and provide secure, efficient solutions for regions where cash has long been the norm.

As the global landscape of e-commerce expands, MasterCard stands at the gateway of opportunities to facilitate secure online transactions. The growth of online commerce presents a vast arena for MasterCard to play a pivotal role in enhancing payment experiences, ensuring both security and convenience for consumers worldwide.

Notably, MasterCard’s interest in blockchain technology and cryptocurrencies opens exciting possibilities. Exploring these innovative avenues positions the company at the forefront of financial technology, ready to adapt to the evolving needs of the digital age.

In essence, MasterCard’s strategic positioning, combined with its commitment to embracing technological advancements, not only acknowledges the current payment landscape but also underscores its readiness to shape and conquer future markets, marking a dynamic trajectory for growth and global financial inclusion.

Boasting a substantial market capitalization of $395 billion, MasterCard secures its position as the 17th largest company within the S&P 500 index. Despite its relatively brief stint as a publicly traded company, MasterCard has carved out an impressive track record or success.

Track Record

MasterCard made its public debut on May 25, 2006, at $39 per share. Right out of the gate the stock soared against the broad market, securing gains exceeding 100% during partial 2006 and 2007. It didn’t escape unscathed during the Financial Crisis, declining by more than 33% in 2008. Since its inception, the company boasts a remarkable compound annual growth rate (CAGR) of 30.17%, significantly outpacing the S&P 500’s 9.85%. This translates into an investment in MasterCard growing to a value twenty times greater than that achieved with the S&P.

Examining MasterCard’s monthly returns against those of the S&P, the stock has shown superior performance 60.66% of the time, as measured by calendar month returns. Notably, investors who exercised patience and retained their shares for longer durations saw even more favorable outcomes. Over a rolling 12-month period, MasterCard outperformed the index 75.5% of the time. This outperformance continued to strengthen over a rolling 36-month horizon, reaching 82.95%. Moreover, on a rolling 60-month basis, the margin of outperformance has been perfect with 100% success.

While a history of remarkable returns is undoubtedly commendable, the crucial question at hand is whether MasterCard remains the exceptional business it has proven to be. Let’s find out.

Quality Quadrant

Let’s start by evaluating how attractive MasterCard looks through the lens of business quality. I believe a great place to start evaluating the quality of a business is what I like to call the quality quadrant. This quadrant comprises four key financial metrics that serve as reliable indicators for gauging the operational strength of a business. These metrics are the return on capital employed, total revenue, gross margin and the free cash flow conversion ratio.

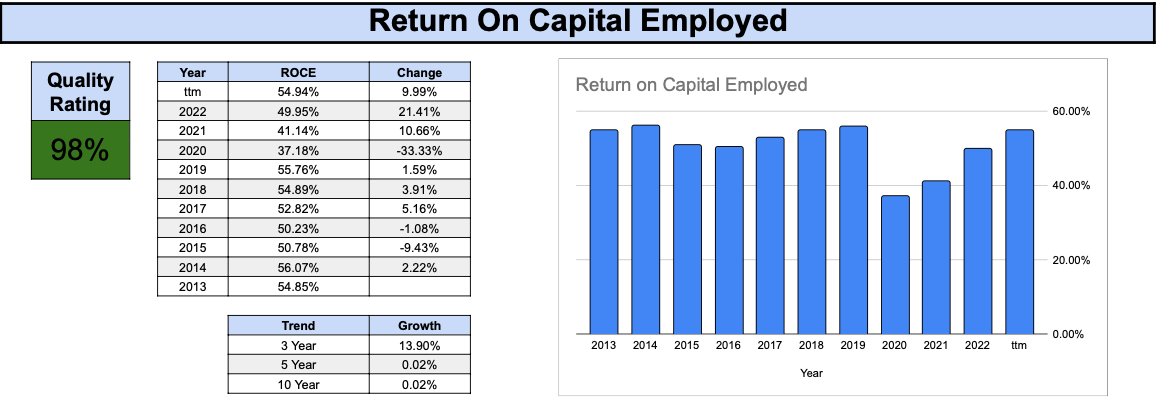

The return on capital employed tells me how profitable a company is and how well it has utilized its capital. Effectively turning capital into profits is the primary driver of generating shareholder value.

Over the last decade, MasterCard has maintained a very healthy Return on Capital Employed (ROCE), averaging an impressive 50%. Although 2020 witnessed a minor setback, with the ROCE temporarily dipping to 37%, subsequent years have showcased a gradual return to its long-term averages. This positive trajectory is underscored by the notable short-term (3 year) trend, boasting an impressive 13.9% improvement. In sum, Mastercard earns an outstanding 98% quality rating for its historical ROCE, affirming its enduring financial excellence.

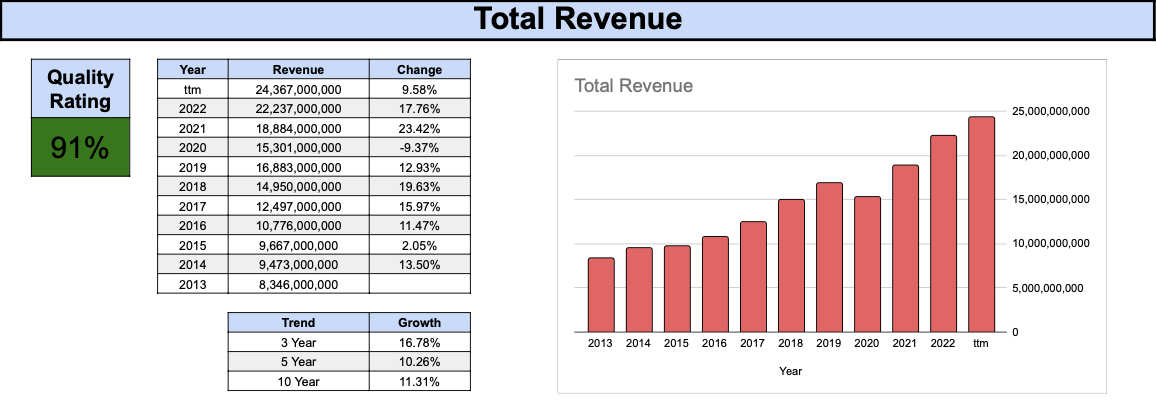

Revenue represents the financial inflow generated by a business through its operations. Positioned at the forefront of the income statement as the top-line figure, revenue provides a key indicator for assessing the pace of a business’s growth when analyzed across historical values.

Over the last decade, MasterCard has achieved an extraordinary 192% growth in revenue, translating to an impressive annualized growth rate of approximately 11.31%, a commendable pace by any standard. With the exception of a singular instance in 2020, marked by a temporary year-over-year revenue decline, MasterCard has consistently demonstrated a pattern of sustained growth in its total revenue. In sum, the company earns a notable quality rating of 91% for its robust revenue history.

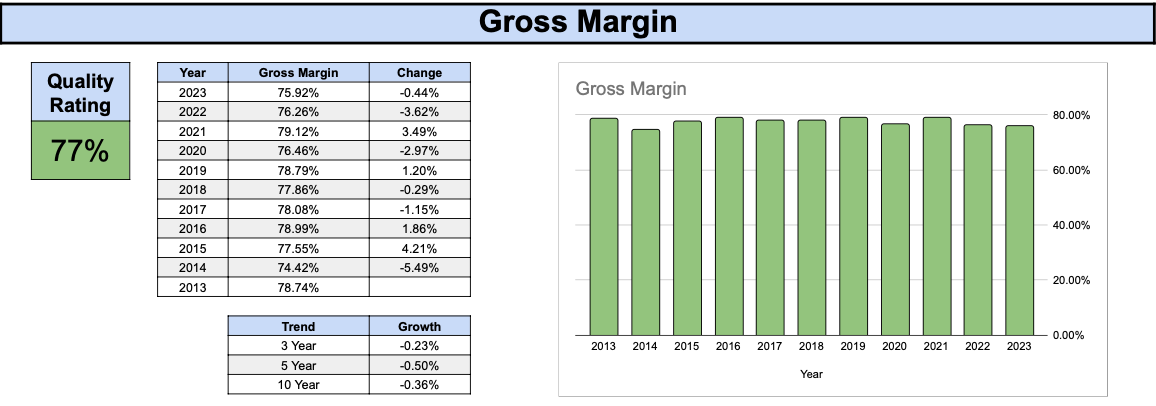

Gross margin is the portion of revenue that is left over after direct costs are subtracted. It is one of the most important indicators of a company’s financial performance. This metric shows the cash available for various crucial purposes, including sustaining operations, servicing debt, distributing to shareholders, and fueling future growth.

Over the last decade, MasterCard has consistently maintained a robust and stable gross margin, residing in the high 70% range. However, there has been a slow and steady decline in the gross margin, evident across short, mid and long-term periods, all displaying negative trajectories. Despite the high gross margin, MasterCard, earns a quality rating of 77%, primarily due to the downward trend observed over the last decade.

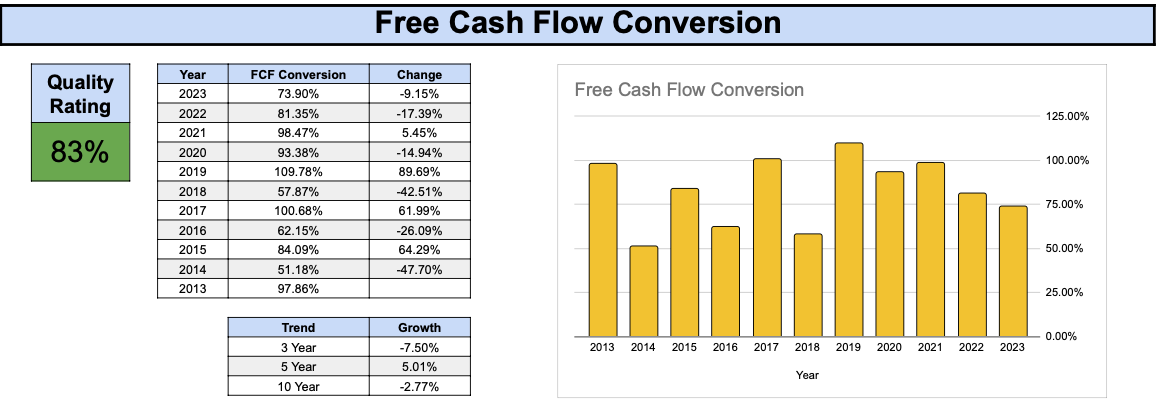

The free cash flow conversion ratio is a measure of a company’s capability in transforming profits into free cash flow. In straightforward terms, free cash flow reigns supreme, and companies adept at generating robust levels of free cash flow enjoy greater financial flexibility.

Over the last decade, MasterCard has shown great proficiency in converting profits into free cash flow. While a bit more year-to-year consistency would be ideal, the free cash flow conversion ratio has predominantly held above the 50% mark. However, a notable shift has occurred more recently, with the free cash flow conversion ratio displaying a downward trend, decreasing from over 100% in 2019 to just below 74% in 2023. Despite these fluctuations and the recent downward trend, MasterCard still earns a respectable quality rating of 83% in this category.

By combining the quality ratings for all four metrics, MasterCard earns an respectable composite quality score of 87.25%. In my opinion, any company boasting a score surpassing 90% resides in the highest tier of business quality. Furthermore, businesses garnering scores above 80% still merit classification as high-quality enterprises While there are many aspects that need to be considered in sound due diligence, screening for the quality quadrant is an excellent starting point. I leave the rest up to you.

Dividend History

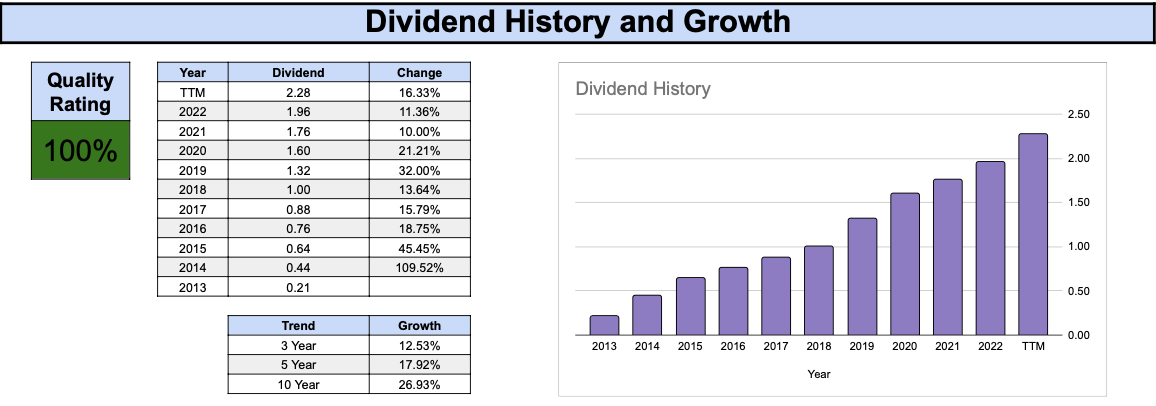

MasterCard paid its first dividend shortly after going public but it did not start its current dividend growth journey until 2012. It boasts an impressive 12 year history of consistent and above average dividend growth.

During its 12 year history of increasing dividends, MasterCard has consistently maintained an annual dividend growth rate in the double digits. While the pace of dividend growth has gradually cooled since 2012, shareholders received a positive surprise with the 2023 dividend increase, exceeding 16%. As long as the business will be able to sustain its impressive growth trajectory, shareholders can anticipate continued above average dividend growth.

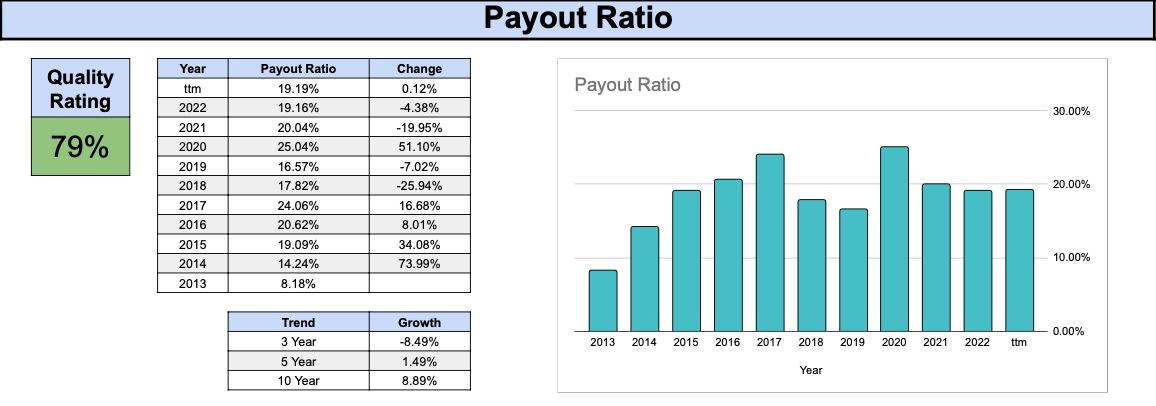

Throughout the last decade, MasterCard has consistently maintained a healthy payout ratio, hovering around 20%. This level of payout ratio not only allows for ample room for prospective dividend growth but also ensures a surplus of cash remains readily available for strategic reinvestment back into the business. This balanced approach positions the company favorably for sustained financial health and strategic flexibility.

Valuation

Valuation, though more art than science, requires us to establish a baseline for fair value. To help me with this task, I leverage two techniques to evaluate the attractiveness of a particular stock: dividend yield theory and the price-to-earnings multiple valuation.

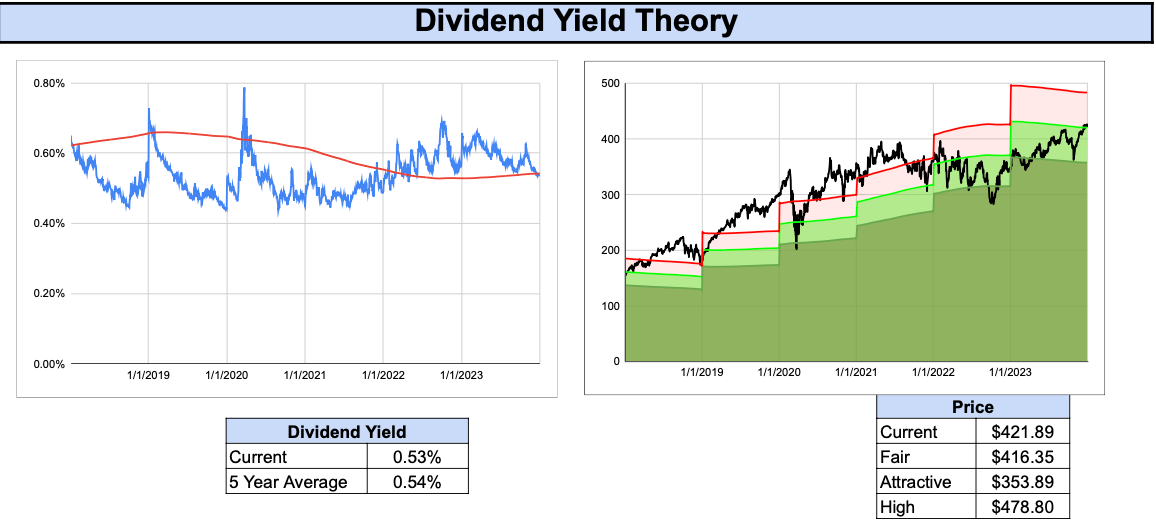

Let’s take a look at dividend yield theory first.

This valuation method operates on a simple principle: if the current dividend yield exceeds the trailing average dividend yield, the stock is deemed undervalued, and conversely, overvalued if the inverse is true. In the chart on the left, MasterCard’s historical dividend yield (blue line) is juxtaposed with its 5-year rolling average dividend yield (red line). The dividend yield has mainly oscillated within the narrow 0.4% to 0.8% range, with a general trend around 0.6%.

Presently, the 5 year trailing average dividend yield stands at 0.54%, aligning closely with the current dividend yield of 0.53%. According to dividend yield theory, this suggests that a fair valuation for MasterCard today falls within the range of $416.

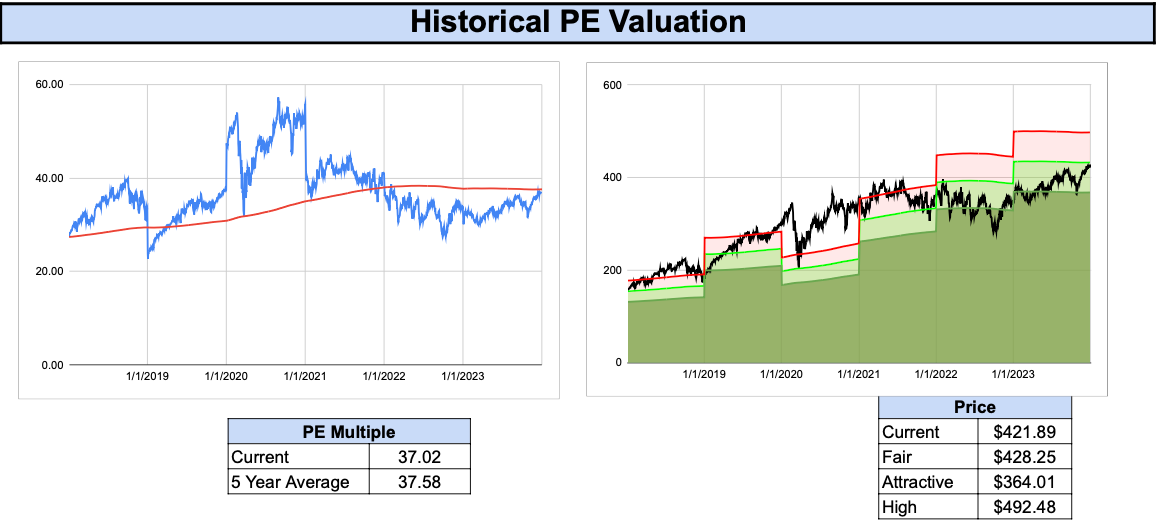

Now let’s see what the price to earnings multiple can tell us.

During the past 7 years, MasterCard’s P/E ratio has trended higher, reaching a peak near 60 during 2020. The chart on the right illustrates that this surge was influenced by lower earnings during that year, leading to a reduced fair valuation. Since 2020, earnings have consistently outpaced MasterCard’s share price growth, driving the P/E ratio below the trailing average. Currently, with a P/E ratio of 37.02 slightly below the trailing average, its suggests that MasterCard is marginally undervalued. Based on the trailing P/E multiple we come up with a fair price of around $428 today.

Combining both valuation methodologies, we arrive at an average fair price for MasterCard of $422, in-line with the current market price of $422.30 as of market close on Wednesday, January 3, 2024. Although this valuation leaves little margin of safety, MasterCard may be worth purchasing at a reasonable valuation based on its potential future growth prospects.

Final Thoughts

I currently hold a long position in MasterCard, with intentions of holding on to my shares for as long as I find it to be a high quality company. I strongly recommend conducting your own in-depth due diligence beyond the brief analysis I shared with you today. This way, you can assess whether you share my belief in MasterCard as a high quality business and whether the current valuation aligns with your own investment criteria.