MarketAxess Holdings (MKTX)

MarketAxess operates an electronic trading platform mainly for corporate bonds. In addition to their main service, the company also offers comprehensive market data and analytics, credit products such as credit default swaps and helps their customers to meet regulatory requirements.

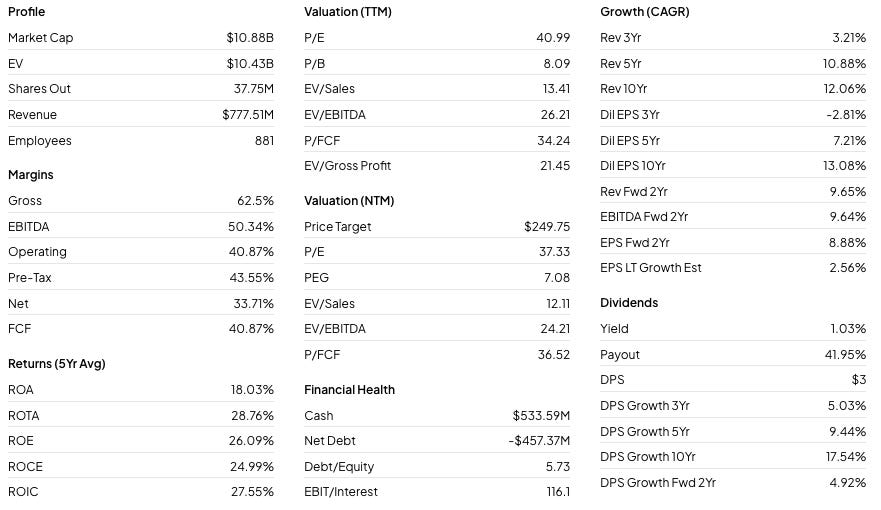

Here is a quick look at some of their financial metrics:

Is MKTX a winner?

One of the best ways to determine if you are looking at a high quality company is to review their long-term history. Since inception in late 2004, MKTX has returned more than 1,500% or a little more than 15% annually.

Over the past decade this stock has definitely seen its ups and downs. The chart begins in late 2014 where the stock was trading in the $60-$65 range and by the end of 2015 had surpassed $100/share. Through 2016 and by the end of 2017 the stock doubled to about $200 a share. 2019 is where the stock really took off and by September of 2019 had risen to more than $400. The stock reached a peak in late 2020 at nearly $580 a share. However, in the 2nd half of 2021 and during most of 2022 the stock saw some steep declines and ended 2022 near $275 a share. In early 2023 the stock briefly shot up about 35% to $380 but quickly came back down by mid year. During the 3rd quarter of this year the stock has climbed nearly 50% from $200 to nearly $300. MKTX has channeled quite a bit over the past decade but ultimately returned more than 350% equating to a CAGR of 16.44%

Dividend Data

Since we are looking for a quality Dividend stock it only makes sense that we consider the company’s dividend history.

MKTX has grown its dividend at a relatively steady pace, although the increases have slowed over the past couple years. The company’s 3-year dividend growth rate sits at just 4.45%, while its 5-year growth rate is a more respectable 8.5%, and its 10-year just above 17%.

The payout ratio is quite low but is on an upward trend. In 2014 the payout ratio was about 30% and now sits about 33% higher at just over 40%. There is still plenty of room for the dividend to grow, but ideally investors will see the dividend increases in the 8-10% range or higher moving forward instead of low to mid-single digit increases.

Quality Metrics

In my opinion the three most important financial metrics that all high quality companies should have in common is a rising revenue stream, a consistent gross profit margin and a healthy return on invested capital.

Let’s review the chart below for MKTX.

Revenue per share has grown at a healthy clip including a better than average increase in 2020. It has flattened out over the past half decade but it still on an upward trend.

The gross profit margin has not changed a whole lot since 2014. It has fluctuated only minimally from 64% at the beginning of the chart to a high of 72.3% in 2020. In the most recent fiscal year this metric has trickled back to a still very healthy 64%.

The return on invested capital was very robust pre-pandemic, near or above 50% almost every year. Unfortunately, since the pandemic this metric has been cut by more than half, to 20%. This is still a very good ROIC but hopefully the company can return to pre-pandemic levels in the near future.

Valuation

The last consideration is whether MKTX is trading for an attractive price today. As the custom FCF valuation tool below suggests the stock is trading for a slight discount to fair value. We can see during the pandemic the valuation was all over the place. In late 2019 the stock was overvalued, but less than a year later, thanks to a healthy increase in the company’s FCF/share, the stock was trading for a heavy discount for a short time. By 2021 the stock was again overvalued due to a drop in the FCF/share. Lastly, since the beginning of 2022 through current, the stock has been trading below fair value for the majority of the time, only recently has the stock price climbed putting it closer to fair value.

MKTX currently has a long-term expected rate of return of just 4.36%, this ROR is made up of 3 components:

1.01% dividend yield

0.79% return to fair value (hence the current slight undervaluation)

2.56% expected earnings growth rate

MarketAxess has had a nice run since inception, giving investors who could stomach the price movement, market beating returns. MKTX doesn’t offer a lot in the way of yield and unfortunately the dividend growth has slowed recently. The financial metrics are still quite healthy, especially the gross profit margin, and hopefully the ROIC can return to pre-pandemic levels. As previously mentioned, the expected rate of return is 4.36%, which leaves a lot to be desired and investors may want to consider other stocks that have more potential future earnings growth.

If you found this post insightful and would like to receive more Dividend Stock reviews directly to your inbox, subscribe below!