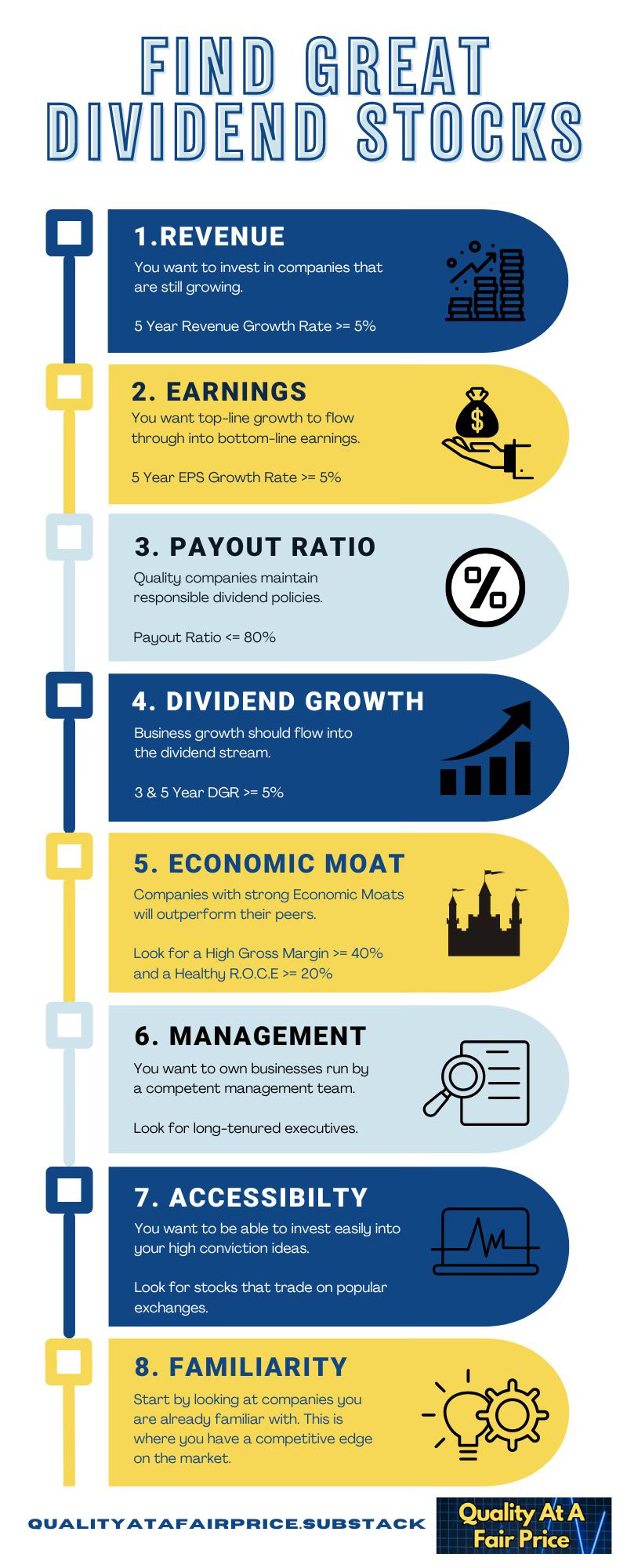

How To Find Great Dividend Stocks

The most time consuming part of investing is searching for your next great investment idea. There are thousands of publicly traded companies, so how do you find the needle in the haystack?

Allow me to share my methodology for identifying exceptional dividend growth stocks. At the center of my investment philosophy is the pursuit of high quality businesses, chosen for further in-depth research. The criteria I scan for is elegantly presented in the image below.

If you’re enjoying this newsletter and you’d love to see more investment ideas like this, subscribe using the button below.

If you have access to a robust stock screener, searching for companies that meet these criteria should be fairly simple. Alternatively, you can screen for the 7 metrics I mentioned in the first 5 steps on Stratoshpere.

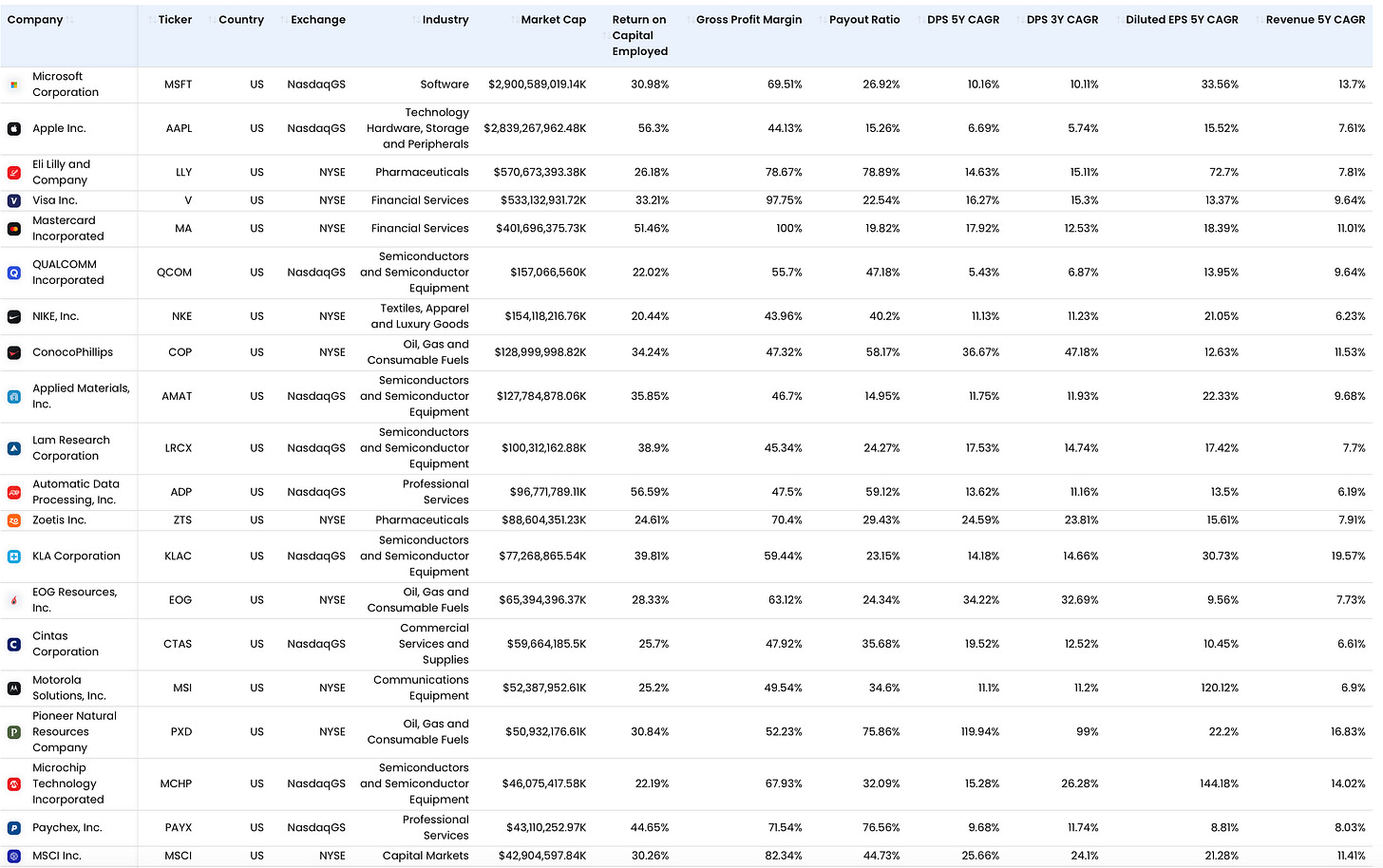

Here are the 48 U.S. companies that meet the criteria as of January 17, 2024.

Step 8 calls for starting your research with companies you are already familiar with. This can be retailers you frequent, service providers you engage with or companies associated with your professional trade or personal hobbies. It will be much easier for you to gauge whether a company has a strong economic moat if you’re already familiar with how the business works and why you use their products or services over those of competitors. Peter Lynch summarized this style of stock research very well in “One Up On Wall Street”, a book I highly recommend you read.

Once you identify companies to research further, research the business itself and not the stock. This is Warren Buffett’s “secret sauce”, he invests in businesses not stocks! Once you do find a business you’d like to own, next you have to figure out how much you’re willing to pay for it.

Coming up with an intrinsic value for a business can be very challenging. There are multiple ways to value a business, but ultimately they are all based on assumptions of future growth. I gravitate towards valuation methods that require the fewest assumptions. Given the challenge of predicting the future, minimizing the need for speculative projections enhances the outcome of the valuation process. Personally, I rely on a Price-to-Earnings Multiple valuation and Dividend Yield Theory. Both are fairly simple to put together and don’t require any assumptions, other than believing in reversion back to the mean. Reversion to the mean assumes that stock prices cycle up and down, but when viewed over an extended timeframe, they oscillate around a common trailing average.

If you read my prior posts you might have noticed the valuation charts I use for the PE multiple valuation and Dividend Yield Theory. If you’d like to use these charts as well you’re in luck. Quality At A Fair Price has a referral program through which you can get a Free copy of my PE valuation tool and my Dividend Yield Theory valuation tool. All you have to do is share this newsletter with your friends, for more details click here.