Quality Dividend Stock Snapshots: TSMC, Intuit, Qualcomm, UnitedHealth Group and Pepsico

A quick stock analysis to help you identify potential opportunities to explore further.

Financial Snapshots

Here’s a quick financial snapshot of 5 stocks I recently looked at in my Quality Score tool. I use these snapshots to determine whether a given company looks attractive and warrants a deeper dive. While I don’t always move forward with a deeper review for all the stocks I look at, perhaps some of them may spark interest in your eyes.

You’ll notice that I have added 2 new metrics to my quality analysis; Liquidity and Share Dilution.

Let’s dive into the financial snapshots, if you’d like to see more detail for any of these stocks I have attached PDFs at the bottom that include a historical chart for each financial metric.

1. TSMC TSM 0.00%↑

Positives

Strong Revenue Growth

Superb Free Cash Flow Growth

High and expanding Gross Profit Margin

Healthy and growing Return On Invested Capital

Very high Liquidity

An attractive and low Payout Ratio

Negatives

Mixed track record of Dividend Growth

No Buyback history but also no Share Dilution

Very strong historical Rate of Return

Potentially Undervalued based on Free Cash Flow Model

Potentially High Forward Rate of Return Assumption

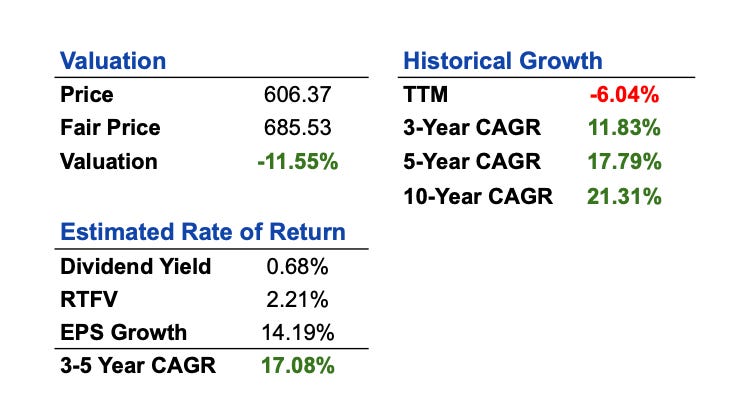

2. Intuit INTU 0.00%↑

Positives

Strong Revenue Growth

Very good Free Cash Flow Growth

Very high but marginally declining Gross Profit Margin

Very attractive pace of Dividend Growth

High Liquidity that has declined during the past decade

An attractive and low Payout Ratio

Negatives

Decent but declining Return On Invested Capital

Marginal Share Dilution

A strong but slowing historical Rate of Return with a poor TTM

Potentially Undervalued based on Free Cash Flow Model

An attractive potential Forward Rate of Return Assumption

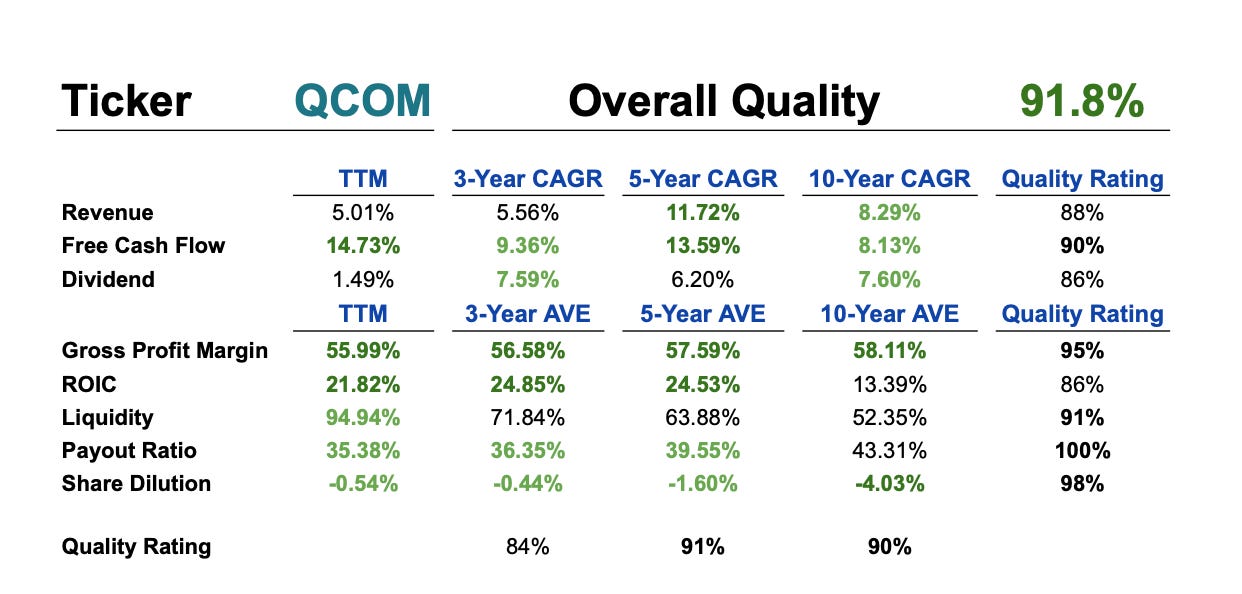

3. Qualcomm QCOM 0.00%↑

Positives

A good track record of Free Cash Flow Growth

A high and steady Gross Profit Margin

A strong and growing Return On Invested Capital

An average pace of Dividend Growth

Strong and improving Liquidity

An attractive and declining Payout Ratio

A nice track record of Share Buybacks

Negatives

Decent but slowing history of Revenue Growth

A good long-term historical Rate of Return with a poor past few years

Potentially Undervalued based on Free Cash Flow Model

An respectable potential Forward Rate of Return Assumption

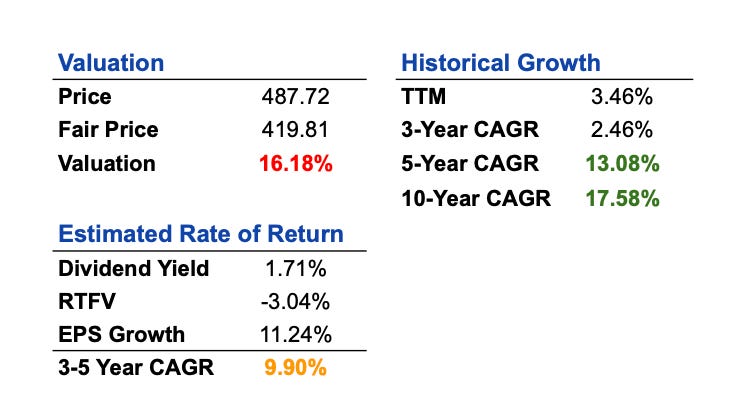

4. UnitedHealth Group UNH 0.00%↑

Positives

A strong track record of Revenue Growth

A decent and steady Gross Profit Margin

An excellent history of Dividend Growth but one that is slowing

A steady history of Liquidity

An attractive and declining Payout Ratio but one that is creeping higher

A nice track record of Share Buybacks

Negatives

A slowing history of Free Cash Flow Growth

A decent but low Return On Invested Capital

A good long-term historical Rate of Return but the stock has underperformed in the past few years

Potentially Overvalued based on Free Cash Flow Model

A just below attractive (10%) Forward Rate of Return Assumption, despite the overvaluation

5. Pepsico PEP 0.00%↑

Positives

A reasonable track record of Revenue Growth that has stagnated recently (see full PDF)

A high and steady Gross Profit Margin

An good track record of Dividend Growth that is holding steady

A steady but somewhat high Payout Ratio

A nice track record of Share Buybacks

Negatives

A rather poor history of Free Cash Flow Growth

A decent but low Return On Invested Capital

A steady but low history of Liquidity

A below average long-term historical Rate of Return

Potentially Undervalued based on Free Cash Flow Model

A just below attractive (10%) Forward Rate of Return Assumption, even with the potential undervaluation

What Do You Want To See

Let me know if there is a stock you are currently considering that you would like to see a financial snapshot for and I may include it in the next edition.

Full Analysis PDFs