Dividend Kings: June 2025

17 Appear to be potentially Undervalued with attractive long-term return projections.

Dividend Kings

There are now 55 Dividend Kings, following the recent inclusion of RLI Corporation RLI 0.00%↑. Year-to-date (through June 24th), the group has delivered an average return of +2.01%, trailing the S&P 500’s +3.83% (as tracked by the SPY ETF). However, 23 Dividend Kings are outperforming the broader market so far this year.

Top Performers in 2025 (YTD)

Leading the pack is National Fuel Gas, boasting a remarkable +40.83% gain. In second place, though well behind, is Abbott Laboratories with a +23.30% return. Rounding out the top three is Canadian Utilities, up +18.86%.

June Snapshot: A Challenging Month

So far, June has been a drag on the Dividend Kings, with the group posting a -0.41% loss versus a +3.26% gain for SPY. Still, a few names have bucked the trend with impressive monthly gains:

Nucor Corporation: +17.23%

Archer-Daniels-Midland: +9.65%

Emerson Electric: +9.51%

Looking Ahead: 17 Dividend Kings That May Be Undervalued

Past performance is just one piece of the puzzle. What matters more is what lies ahead. Based on Dividend Yield Theory and forward-looking return estimates, here are 17 Dividend Kings that currently appear undervalued and may offer attractive long-term return potential.

Important Note: The valuations and expected return estimates shared below are based on assumptions and models. They are not investment advice, but rather a data point to support your own research and due diligence.

17. Genuine Parts Company

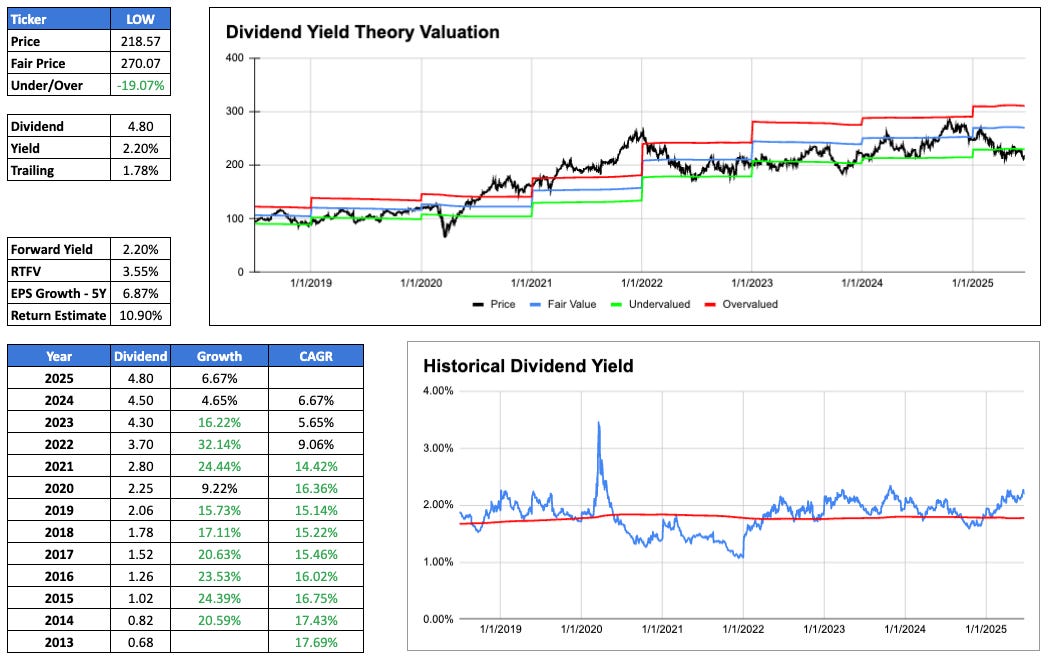

16. Lowes Companies

15. Johnson & Johnson

🔒 Premium Access: Top 14 Dividend King Opportunities

The 14 most compelling Dividend King opportunities—based on valuation, yield, and long-term return potential—are exclusively available to paid subscribers.

As a subscriber, you’ll also gain full access to the Dividend Kings Google spreadsheet, which includes detailed data on all 55 Kings to support your investment research.