Context is everything! I can make you excited and sad with the same number when presented in a different manner. Here we go.

The 3 DGR Portfolio is up 6.35% in the first 4 months of its existence. Did you know that this pace of growth equates to a 20.29% annual return. At this annual rate of return the value of an original investment doubles every 3.5 years. And it takes $10,000 approximately 25 years to grow into $1 million. Pretty exciting right?

The 3 DGR Portfolio is up 6.35% in the first 4 months of its existence. Meanwhile the SPDR S&P 500 Trust ETF (SPY) is up 12.66% during the same period of time. This means that the 3 DGR portfolio, between May and August, is performing nearly half as well as the broad U.S. Equity market. Pretty sad right?

The same piece of information can impact our feelings in a different way, based on how it is presented. Context is everything!

I could have written this update entirely in one direction with the intention of inciting a specific feeling in you, the reader, but my intention is not to get you excited nor sad, my objective is to relay information in an unbiased manner.

The truth is that the 3 DGR portfolio is not performing bad in the context of the return it has achieved thus far, but it is also performing rather poorly relative to the performance of the broad U.S. equity market.

Clearly being invested in the S&P 500 during the past 4 months would have led to a superior return, relative to the 3 DGR portfolio. However, that’s already in the past and cannot be changed. 4 months ago we made our bed and now we have to sleep in it, so to say. I’m more interested in what lies ahead of us than behind us, however the future is measured with uncertainty. There are no guarantees that the next 4 months won’t play out exactly how the past 4 materialized. I still believe this is merit to this strategy. I know that it will have periods of failure but data suggests that it will have extraordinary periods too. I’ve committed to seeing this strategy through, for better or worse, and therefore I am holding strong and long.

If I haven’t lost you yet with that glowing intro, let’s talk about what happened with this portfolio in August and the start of September.

August 2024 Update

Although August was a shaky month, the S&P 500 (SPY) finished the month with a gain of 2.34%, a 4th consecutive positive monthly return for the index. Meanwhile the 3 DGR portfolio posted a loss of 0.05%.

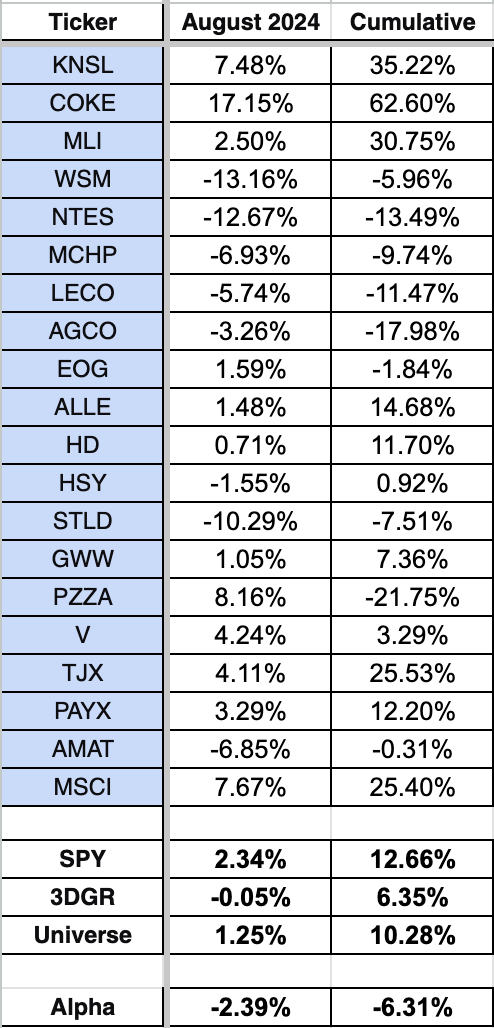

Even though the overall monthly return was poor, not every one of the 20 holdings had a poor month. COKE posted a very nice gain of 17.15%, bringing its cumulative gain since May to 62.6%. It is by far the best holding in this portfolio. We also saw very good gains from PZZA, MSCI and KNSL with gains of 8.16%, 7.67% and 7.48%, respectively. PZZA has been the worst loser in this portfolio and despite the turnaround in August, since May the position is down 21.75%.

12 out of the 20 holdings finished August in the green. Despite a larger number of holdings seeing positive returns, it was the 8 losers that dragged the portfolio into negative overall territory.

The worst performers were: WSM down 13.16%, NTES down 12.67% and STLD down 10.29%.

Here are all of the individual returns from August.

September thus far is not off to a great start. Through Monday September 9th SPY is down 3.06% and the 3 DGR portfolio is right in line with the index. This volatility in the market is not an easy thing to stomach but given that we have a long-term mindset it does not phase us too much.

Actual Portfolio

My actual portfolio dedicated to tracking this strategy faired a little better last month +0.29%. The returns I summarized above assume an equal weight for each of the 20 holdings. My actual portfolio is not rebalanced and therefore will see its return deviate from the indexed return.

On a cumulative basis the portfolio is up 6.5% between May and August, slightly ahead of the 3 DGR indexed return, but trailing SPY by 6.23%.

The portfolio brought in $9.91 in dividend income. This was 29.2% higher relative the May (quarterly corresponding month), however not all dividends from May were captured due to the timing of funding this portfolio.

As of September 9th the largest position in the portfolio is COKE with a 7.85% allocation (5% was the equal weight start for each holding). The smallest position is AGCO with a 3.87% allocation.

The projected annual dividend income today stands at $139.37 which is up from $132.20 at inception. That equates to a 5.42% increase. Please keep in mind that this is just an estimate and the true rate of dividend growth will be computed from the trailing dividend data once enough history is collected.

That’s it for today, I hope you have a wonderful rest of your Thursday and a great weekend!