Recap

Two days ago I launched the first Data Driven Dividend Growth Portfolio. This was the culmination of over a month of work and research that hopefully will bear fruitful results, only time will tell. Today, lets take a closer look under the hood of this portfolio to see exactly what I got myself into for the next 365 days.

Portfolio Statistics

Let me start off by breaking down a few financial metrics for the portfolio.

Number of Stocks: 20

Dividend Yield: 1.97%

Historical ROCE: 31.89%

Current FCF Yield: 5.83%

5 Year Dividend Growth Rate: 16.79%

Payout Ratio: 29.98%

5 Year Revenue Growth Rate: 9.76%

5 Year EPS Growth Rate: 30.38%

Pretty healthy stats if you ask me. I know the dividend yield may not be appealing to some dividend investors, but the primary objective of this portfolio is to deliver a respectable total return.

The portfolio includes some familiar companies but also a few that I have never looked into. This is where a rules based data driven strategy may appear somewhat crazy. I invested a decent amount of capital into companies I have not performed proper due diligence on. This can work out great or it could be a big disaster, only time will tell.

The portfolio has exposure to 8 sectors but is heavier in some more than others.

30% Industrials

20% Consumer Discretionary

15% Financials

10% Technology

10% Consumer Staples

5% Energy

5% Communications

5% Materials

There is however some diversification within the sectors that can be comforting.

Industrials

6 of the chosen 20 companies fall into this sector. We have:

AGCO Corporation that focuses on farm and heavy construction machinery.

Allegion PLC that focuses on security and protection services

W.W. Grainger Inc. that focuses on industrial distribution

Lincoln Electric Holdings, Inc. that focuses on tools and accessories

Mueller Industries, Inc. that focuses on metal fabrication

Paychex Inc. that focuses on staffing and employment services

Consumer Discretionary

4 of the chosen 20 companies fall into this sector. We have:

Home Depot, Inc. that focuses on home improvement retail

Papa John’s International Inc. that is in the restaurant business

TJX Companies, Inc. that focuses on apparel retail

Williams Sonoma, Inc. that focuses on specialty retail

Financials

3 of the chosen 20 companies fall into this sector. We have:

Kinsale Capital Group Inc. that focuses on property and casualty insurance

MSCI Inc. that focuses on financial data and stock exchanges

Visa Inc. that is a payment processor with a focus on credit services

Technology

2 of the chosen 20 companies fall into this sector. We have:

Applied Materials Inc. that focuses on semiconductor equipment and materials

Microchip Technology Inc. that also focuses on semiconductors

Consumer Staples

2 of the chosen 20 companies fall into this sector. We have:

Coca-Cola Consolidated Inc. that focuses on non-alcoholic beverages

Hershey Company that focuses on confectioners

Energy - Communications - Materials

The remaining 3 companies each fall into the following 3 sectors.

EOG Resources that is the Energy stock with a focus on Oil and Gas

NetEase Inc. ADR* that is the Communication stock with a focus on electronic gaming and multimedia

Steel Dynamics Inc. that is the Materials stock with a focus on steel

*ADR stands for American Depository Receipt and its basically a U.S. bank issued certificate representing shares in a foreign company for trade on American stock exchanges. NetEase is a Chinese based company.

The only other foreign investment in this portfolio is Allegion PLC that is domiciled in Ireland.

Seeking Alpha Health Score

I setup a portfolio with these 20 stocks on Seeking Alpha so I can stay up-to-date on any news on these companies. If any of you are also tracking portfolios on this website you may be familiar with their “Portfolio Health” feature. Let me tell you what Seeking Alpha thinks of this portfolio.

The overall health of this portfolio is 3.33 out of 5.00. 1 of the stocks is rated as a strong buy (MLI). 2 stocks are rated as a buy (NTES & LECO). 16 stocks are rated neutral (HD, AMAT, WSM, MCHP, TJX, EOG, PAYX, HSY, GWW, PZZA, STLD, V, AGCO, MSCI, ALLE and KNSL). And the remaining stock (COKE) is not covered.

A health score of 3.33 places this portfolio amongst the top 64% of all portfolios tracked by this service.

The average analyst rating for these 20 stocks is 3.59 out of 5.00. This places the portfolio as a whole in the “buy” zone.

The dividend safety score is a flat 4 out of 5.00. However 3 stocks have a dividend safety score of D that is considered risky (NTES, TJX and PZZA).

As for the strengths and weaknesses, the portfolio has the following ratings:

Valuation D+

Growth C+

Profitability A

Momentum B-

EPS Revisions B-

This would suggest that the portfolio is highly profitable but overvalued currently relative to the market.

I thought it was interesting to see what Seeking Alpha thought of the portfolio but I’m not too concerned with some of the weak points this screening tool pointed out.

The real measure of success will be what type of return this portfolio can deliver relative to the original investable universe and the S&P 500.

Here is the full investable universe that I will track for the next 12 months.

I am also considering updating this universe at the end of each month to see which companies fall off and jump into the universe. And to track how the ranking changes throughout the year.

Actual Portfolio

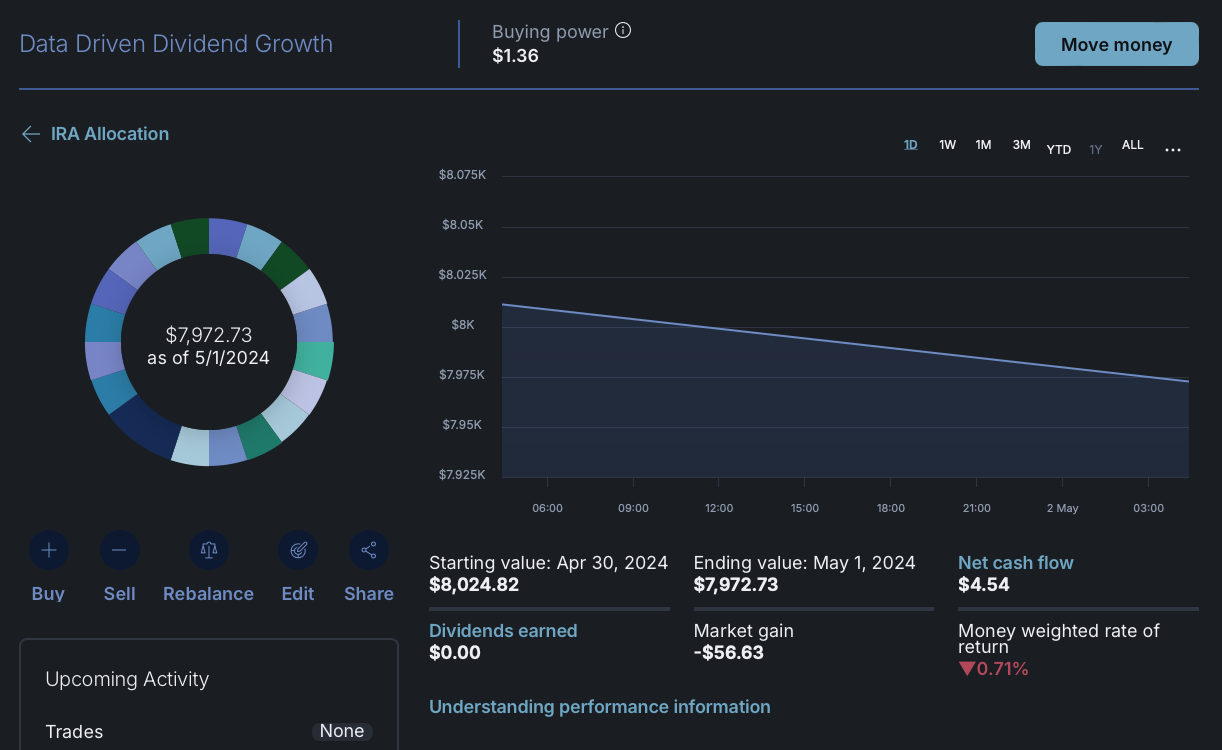

Here are screenshots from the actual portfolio that I will be using to track this strategy. In addition to the actual portfolio I will also track each stock individually and breakdown the results in this newsletter each month.

As you can see the portfolio lost money on its first day, falling by 0.71%.

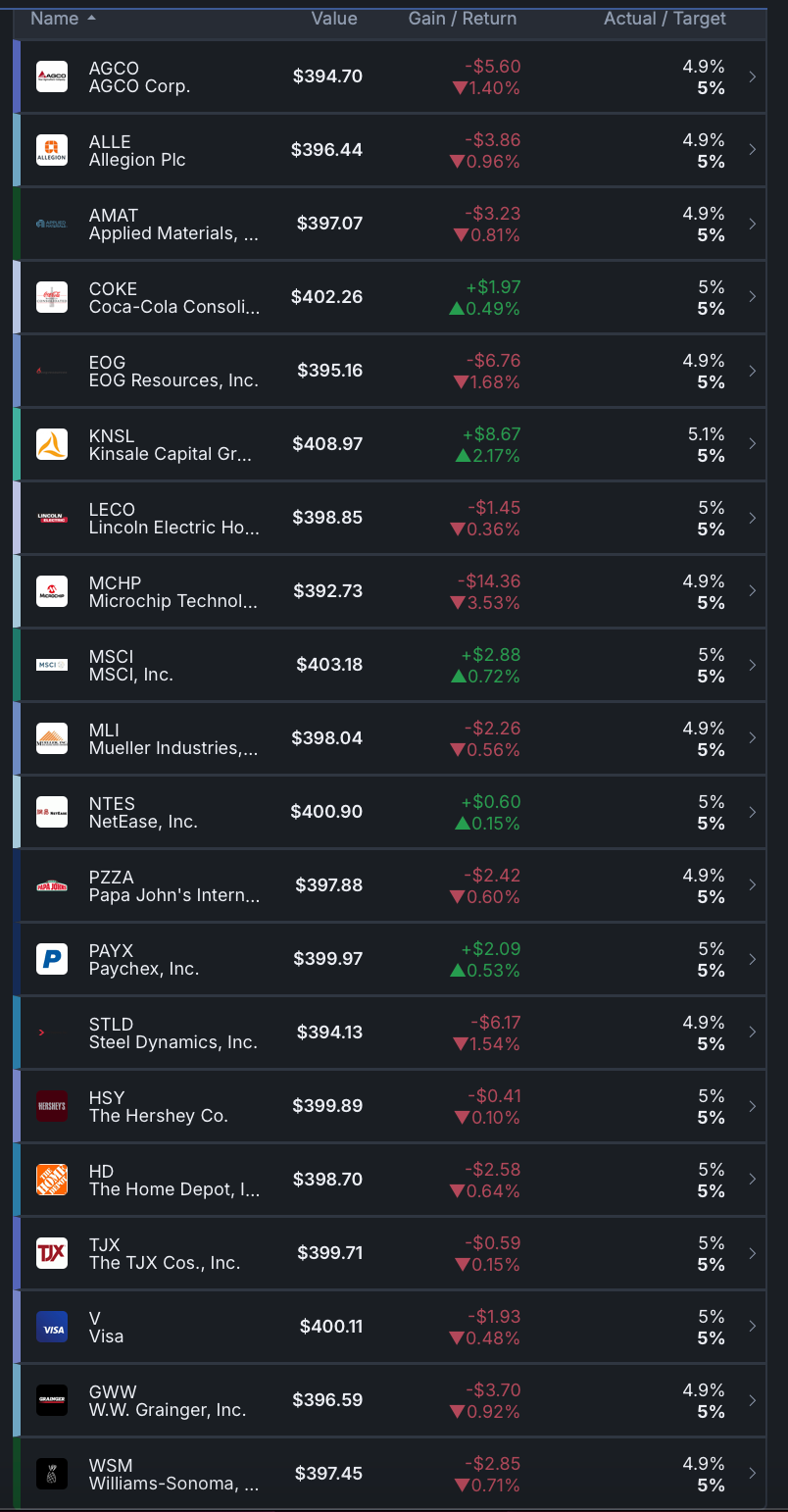

Here are the results for the 20 stocks.

The biggest winner from day 1 was Kinsale Capital Group, and the biggest loser was Microchip Technology.

If you enjoy reading this newsletter the best favor you can do for me is to share it with your friends!

I have copied this pie of investment on trading212 trading platform.

Really like the strategy you have employed.

Hope it works out 🤩

I’m gonna try it out too i like the setup and research you did thanks for the effort