Two weeks ago we covered part 2 of the “Beat the Market” series, in that part we built several model portfolios in an attempt to leverage data to generate alpha. Today we are going to take these model portfolios one step further. But before we jump in let’s set the stage with a quick recap.

Here are the results of the 6 model portfolios we designed. The results shown indicate the CAGR of investing in the top 20 stocks selected each year using each model portfolio for the period 2019-March 2024.

If we take a look at the “Alpha to S&P” column we can see that each model portfolio was able to generate a considerable amount of alpha (CAGR) relative to the S&P 500 between 2019 and 2024. This however is not overly promising because by simply investing in the entire investable universe we could have outperformed the S&P 500 by a wide margin. The more important data point is the level of alpha each model portfolio was able to generate on top of the CAGR of the investable universe. While 5 out of the 6 model portfolios were able to generate alpha here, that alpha was not very significant. Don’t get me wrong, 3-4% of additional return per year can turn into significantly more money after just a few years. However, I personally would like to see a larger potential level of outperformance.

What Drives Returns

In order to improve the returns of the model portfolios we have to go back to the drawing board and think about what actually drives stock returns. To do this let’s extrapolate on a quote from the late Charlie Munger.

As Mr. Munger beautifully explains, it is the long-term return on capital of the underlying business that will determine the return we receive from owning that business. We checked this tick mark in the last part of this series, by attempting to build a model that can identify high quality companies that consistently generate healthy returns on capital. The second nugget of wisdom hidden in Charlie’s quote is that if we are able to buy these businesses for a more attractive price we can squeeze out a slightly better than “fine result”. The important part here is “slightly better” because investing in a stock at the right price will only give you a minor initial boost in total return. Beyond this slight squeeze from accurately timing our entry point, the long-term return of our investment will solely rely on the rate at which the underlying business is able to grow. This is what we will focus on in part 3, implementing a valuation metric into the model portfolios to hopefully give us a slightly better long term return.

The Benefit of Valuation

The valuation metric of choice that I decided to test is the Free Cash Flow Yield. The Free Cash Flow Yield measures the amount of cash generated from core operations of a company relative to its valuation. Companies that have higher FCF Yield’s are potentially more attractive investment opportunities relative to their counterparts.

I took the 6 original model portfolios and designed 6 new portfolios all including the FCF Yield.

Model Portfolio #7

This model portfolio looked for stocks that were “better than median” for each of the 5 metrics (ROIC, ROCE, DGR, EPS & Revenue). The stocks were sorted by the number of metrics that exceed the median value of the universe, with the secondary sorting criteria being the ROCE. Each stock was assigned a rank from 1-111. Next I sorted all of the stocks by their FCF Yield and also assigned each stock a rank from 1-111. Then I averaged out both rankings and sorted the list again to find the top 20 stocks with the lowest combined ranking.

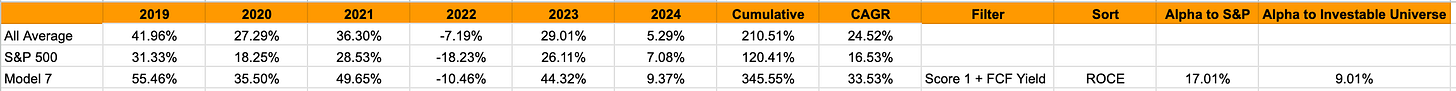

Here is how this model portfolio performed.

The results are promising as this model portfolio delivered 17.01% alpha over the S&P 500 and 9.01% alpha over the investable universe. Quite a significant improvement over the model portfolios that did not include a valuation factor.

It’s worthy to note that this portfolio generated more alpha during years where the market was up but it saw a slightly larger loss in the one down market year.

Model Portfolio #8

This model portfolio looked for stocks that were “better than median” for each of the 5 metrics (ROIC, ROCE, DGR, EPS & Revenue). The stocks were sorted based on whether or not they exceeded the median for at least 4 metrics or whether they didn’t, with the secondary sorting criteria being the ROCE. Each stock was assigned a rank from 1-111. Next I sorted all of the stocks by their FCF Yield and also assigned each stock a rank from 1-111. Then I averaged out both rankings and sorted the list again to find the top 20 stocks with the lowest combined ranking.

Here is how this model portfolio performed.

The results are also promising as this model portfolio delivered 16.93% alpha over the S&P 500 and 8.93% alpha over the investable universe. Although the outcome was strong, it delivered very similar results as model portfolio #7.

Model Portfolio #9

This model portfolio took a new direction, opposed to measuring the stocks relative to the median or a fixed threshold, I decided to directly pit them against the investable universe. Borrowing from a prior strategy I developed, I decided to test how a 5 factor selection process would work with these metrics and this investable universe. Each stock was ranked against the investable universe across each of the 5 metrics. The stocks were then sorted by their combined result, with the secondary sorting criteria being the ROCE, and assigned a rank from 1-111. Next I sorted all of the stocks by their FCF Yield and also assigned each stock a rank from 1-111. Then I averaged out both rankings and sorted the list again to find the top 20 stocks with the lowest combined ranking.

Here is how this model portfolio performed.

The results are also promising as this model portfolio delivered 16.35% alpha over the S&P 500 and 8.36% alpha over the investable universe. But as we can tell we are moving in the wrong direction here, with slightly worse levels of alpha compared to models 7 & 8.

Model Portfolio #10

Given that the ROIC and ROCE are fairly similar measures of return I thought it would be interesting to see the results of model portfolio #9 with only one of these two metrics. I decided to scrap the ROIC and run the same process as was explained for model portfolio #9.

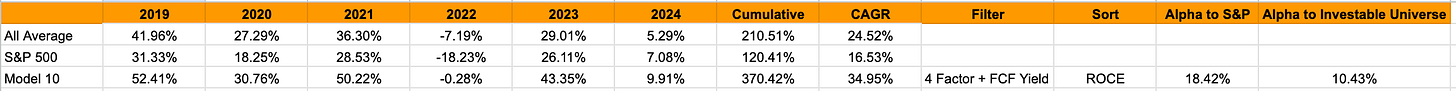

Here is how this model portfolio performed.

This proved to generate the best return and alpha yet. The model portfolio generated 18.42% of alpha over the S&P 500 and 10.43% of alpha over the investable universe.

It’s interesting to note that this model portfolio beat the S&P 500 and the investable universe in every single year in the test period, even 2022. Now, this could be chalked up to the “luck” factor and its certainly not to be assumed that this model would be able to repeat these results in future down market years.

Model Portfolio #11

This model portfolio was a build on Model #7 with the exception of replacing the “better than median” measure with the following fixed threshold.

20% for ROIC and ROCE, 12% for DGR and 7% for EPS and Revenue.

Here is how this model portfolio performed.

While the results are great, they are not better than the prior model portfolios.

Model Portfolio #12

This model portfolio was also a build on Model #7 with the exception of replacing the “better than median” measure with the following fixed threshold.

15% for ROIC and ROCE, 10% for DGR and 7% for EPS and Revenue.

Here is how this model portfolio performed.

The outcome here is slightly lower than model #11, showing that the fixed thresholds yield no additional upside.

What Comes Next?

I think it’s clear that including a valuation metric makes logical sense, the results speak for themselves. Now comes the hard part, which of these new model portfolios will be the one that I will apply going forward. You can let me know which one you like in the comments below, make sure to say why you like it as well.

Model portfolio #10 produced the best CAGR (+34.95%), but Model portfolio #7 wasn’t too far behind (+33.53%). I’m not sure if the better than average return model #10 generated in 2022 is directly related to the strategy or just a coincidence. I’m personally leaning towards adopting Model #7 since it builds on the original application of these 5 metrics opposed to shifting to the Factor strategy. I have some time to decide which model will be chosen and launched on May 1st. In the meantime I may have another part to add to this series that will document how the investable universe will be selected. If you recall I previously stated that a few of the stocks chosen by the initial screening criteria did not appear to be high quality companies upon closer review. Given that I would prefer to automate the full stock selection process, leaving any biased decisions on my end out, it’s only logical that I try to tighten the screening criteria to better weed some of these bad apples out.

I’m pretty excited to get this portfolio launched and to see what it can do. I’d like to invest some actual capital to benefit from this strategy, if it proves to be fruitful. I’ll have to think about repurposing any of my existing brokerage accounts to follow this strategy or opening up a new account. All will be disclosed closer to the end of April and you’ll be able to follow along with this strategy in real-time with weekly or monthly updates.

This series is meant for informational purposes only and should not be taken as financial advice. Please consult a financial advisor or conduct your own due diligence prior to making any investing decisions.

Lookling forward to the 30th and listing of stocks. Your rational and approach is similar to mine. I will also run a portfolio with the 20 issues you come up with but will let the dividends reinvest and we can compare the results at the 1 year time frame.

Always like your YouTube videos and now enjoying these articles. Keep up the good work 👍