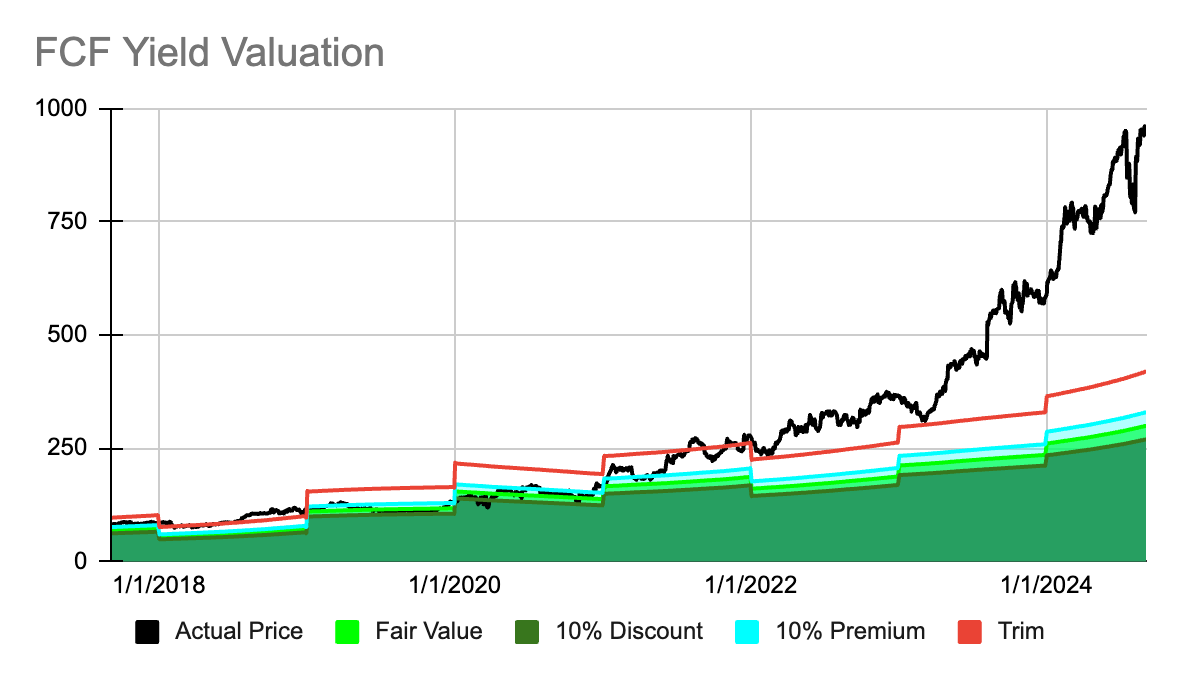

Most humans are visual creatures and as investors we all love to look at charts! If I were to tell you that XYZ company is 10% undervalued you can certainly use that information to influence your decision on whether or not to invest in the stock. But if I were to show you the following chart that also shows XYZ company as being 10% undervalued, you will likely interpret the same information differently.

First off this chart shows you how this particular valuation model has worked out in the past. You can see that it had a few good predictions but it hasn’t worked great all of the time. You can assess that the company’s valuation has finally caught up with its share price that perhaps got ahead of itself in the period shortly following the pandemic. So even though the chart represents the same current data point as me telling you that this stock looks 10% undervalued you can also extrapolate much more information from the chart.

Do you think its easier to base your decision on someone telling you the valuation of a specific stock or showing you a chart like the one above?

I think there’s certainly merit to both methods of delivering this information. There are benefits to valuing businesses with charting data and today I’d like to show you the valuation for 4 different dividend stocks. They will each range from undervalued to grossly overvalued, and I’ll address the benefits and pitfalls of charting valuations as we dive into each of them.

Let’s start with the company that looks to be grossly overvalued, I’ll tell you which company this is after we look at the chart.

First off, we can tell that this valuation method worked much better for this specific company during the time period 2018-2021. Since about mid-2021 the share price of for this company started to diverge from the valuation method. If you purchased shares prior to this inflection point and held this position through today your gains would be exceptional. However, if you following this the recommendation from this valuation model you may have exited this position much too early. Interestingly enough much of the best gains offered by this company came in 2023 and 2024. During this time the company was trading for a price above the “trim” level in the chart which is a 40% premium to fair value.

Here’s the first pitfall of valuation models. While the model may suggest a more opportune time to invest in a given stock it isn’t always reflective of the type of return a stock can have from any given point in time. This is partly why I don’t use a “sell” recommendation in my valuation models. If a given company is of high quality my preferred holding period is forever. I may not add more capital to a stock that is trading for a hefty premium but I also don’t want to find myself in a position where I took my foot off the gas pedal too early. My “trim” rating is merely a suggestion that if I find another opportunity highly favorable I should consider trimming one stock to invest in the other. I rarely act on my “trim” recommendations.

The company charted above is Eli Lilly that has gained traction with their weight loss drug. The reason the share price deviated from the valuation model is because Eli Lilly’s free cash flow isn’t reflecting this optimism just yet. The company is pumping a significant portion of their cash into R&D that is eating away at the free cash flow figures.

Let’s look at the second example.

In this chart we can see a slightly better valuation model. The reason I label this valuation as just slightly better is because for the most part this model suggests this company was overvalued almost all of the time during the last 7 years. Clearly we can see that investing in this company during the past 7 years would have more than quadrupled our original investment. However even the 2020 pandemic low only brought the share price down to the 10% premium level and it wasn’t until late 2022 that the share price appeared to e trading for a bargain valuation.

Investing in this stock every single trading day in this 7 year window of time would have generated a 22.19% CAGR not factoring in the dividend income or compounding effect. If you used the 10% discount line as a trigger to dollar-cost average you would have seen a CAGR of 40.32%, an 81.72% improvement over the full 7 year test window. However, only 0.26% of all the trading days happened to fall at or below the 10% discount line.

Using the fair value line the average CAGR would be 35.16%, a 58.47% improvement over all trading days. But only 4.76% of all tested trading days fell under this line.

Using the 10% premium line the average CAGR would be 32.32%, a 45.64% improvement over all trading days. But even here only 10.45% of all trading days fell under this valuation line.

And using the “trim” line, 40% premium, the average CAGR would be 24.90%, a 12.23% improvement over all trading days. 40.21% of all trading days fell under this valuation line.

The pitfall of this valuation chart is that while it did suggest a handful of more opportune days to invest in this company, and this would have led to a higher CAGR, simply investing in this stock everyday also would have led to a very respectable long term return.

High quality companies often times go on strong momentum runs that can last for a long time. If you wait for a specific valuation to initiate a position you may miss out on generous long-term growth along the way.

The company in this chart is Microsoft.

Let’s move on to the third chart.

This valuation chart is more pleasant to look at. We can see a few good entry points in 2018 and 2019. This is followed by a short rally in the “hold” zone with another good entry point during the 2020 pandemic low. Following the pandemic the price gained momentum and deviated from its normal valuation trend, but in 2022 it came back down to earth. Since mid-2022 it has oscillated nicely around its fair value zone.

While this chart is much easier to trade because it suggests many entry points and period where you should hold off, the long-term CAGR this stock offered wasn’t quite as rewarding as the prior two examples. The average CAGR for all trading days was 14.1% excluding dividends and compounding. Using the valuation zones would have led to the following CAGR’s:

10% discount +26.69% CAGR with 0.66% trading days

Fair Value +21% CAGR with 9.39% trading days

10% premium +18.80% CAGR with 26.46% trading days

40% premium +16.69% CAGR with 64.68% trading days

So even though this valuation model would present us with plenty of days to potentially invest in this stock the returns, albeit very attractive, pale in comparison to investing in Microsoft or Eli Lilly.

Just because one stock looks more attractively valued relative to another does not imply it will go on to generate a better long-term return.

The company in this chart is MSCI.

Let’s take a look at the last chart.

In this chart we can see that this company is currently trading for a deep discount (more than 10%). We can also see a few deep discount entry points historically. However as you can tell from the share price movement during the past 7 years the overall return from this stock has not been overly impressive.

The average CAGR for all trading days is a mere 6.28%. The 17.92% of trading days that were in the deep discount zone (more than 10% discount) would have led to an average CAGR of 12.74%. Investing in MSCI on all trading days would, on average, have led to a better return.

Again, just because a stock looks attractively valued does not mean that it will go on to generate a strong return.

The company in this chart is Zoetis.

Hopefully I haven’t confused you too much by pointing out the pitfalls of strictly following a valuation model. Valuations are meant to assist us with making better, more informed decisions, but they can also lead us to make poor choices. I would personally recommend focusing more on whether a given company is of high quality rather than if its attractively valued. Ideally if you can find a company that fits both these parameters that is the stock you want to invest in. If you can’t, place more emphasis on the business itself rather than its valuation, especially if you intend to hold onto your shares for a very long time. That being said, valuation is still an important factor because when we find ourselves in the next recession, and you can bet that sooner or later we will, the high flying stocks are more likely to take a bigger tumble.

Stocks that deviate from their valuation models are inherently more risky investments. In Eli Lilly’s case the high share price needs to be substantiated by future growth in its financials, otherwise the valuation will correct. Zoetis is a great business, in my opinion, and its future return may very well trump the other 3 stocks presented, simply because it is trading for a very attractive multiple of its free cash flow.

Have a great rest of your Thursday!

Another great article. Thank you!