3.31% - The Magic Number For Visa

**The newsletter is early this week due to a travel engagement I have**

The Magic Number

What the heck is the magic number? And why is it 3.31% for VISA?

It’s certainly not the current dividend yield this stock pays, that’s a mere 0.75%. The magic number is also a “yield” and arguably it is a more important yield than the dividend yield, it is the Free Cash Flow Yield!

A dividend yield can tell you how much a given stock will pay YOU relative to how much you have to pay to purchase a share of its stock.

A free cash flow yield will tell you how much free cash flow a given company generates relative to how much you have to pay to purchase a share of its stock.

While the dividend yield may be important to YOU because it is directly tied to cash flow ending up in your pocket. The free cash flow yield is arguably more important because it is directly tied to the return on your investment. The value of any investment can be summed up as the present value of all future cash flows from that investment. Hence, you should be interested in the price you are paying for the current free cash flow stream from any given stock.

Let me explain why 3.31% is the magic free cash flow yield for VISA stock right now.

Why 3.31%?

I analyzed VISA’s free cash flow yield between May 2012 and today. This analysis offered some insights into more attractive entry points to initiate a position in VISA’s stock during the past 7 years.

3.31% is currently the trailing 5-year average free cash flow yield for which VISA’s stock has traded, taking into consideration all trading days.

Looking at the 6 year period between 5/19/17 and 5/17/23, the average price only returns from investing in VISA’s stock was 13.19%. This is the average annualized return of buying VISA’s stock on any day during this period of time and holding that position through 5/17/24. Price only means that this does not factor in dividends or reinvestment of dividends.

I purposely excluded the prior 12 months to base my analysis on returns of at least 1 year.

In the chart below you can see VISA’s free cash flow yield (blue line) juxtaposed with its rolling 5-year average free cash flow yield (red line).

As you can tell the 5-year rolling free cash flow yield moved around a little bit during the last 7 years. It started out at 3.61% on May 19, 2017, then it trended down to 3.43% by the end of the year. In 2018 it trended higher, peaking at 3.83% in February of 2019, since then it has progressively trended lower to its current level of 3.31%.

Now, suppose that during the 6 year test window (5/19/17 - 5/17/23) we used the 5-year trailing free cash flow yield as a “buy” indicator for VISA. This would have improved the average price only return from 13.19% to 16.46%, a nearly 25% boost in return.

The inverse of this, buying VISA when it traded below its 5-year trailing free cash flow yield, would have led to an average return of only 10.10%.

Pretty good results right?

On average they are. But looking at the full dataset we can tell that while using the trailing 5-year average free cash flow yield led to improved returns, on average, it wasn’t a perfect system.

In total there were 1508 trading days analyzed. Here are the statistics for when VISA traded above or below its 5-year free cash flow yield.

Above.

717 days

Average Return 16.46%

Worst Return 9.56%

Best Return 32.88%

Below

791 days

Average Return 10.10%

Worst Return 3.97%

Best Return 18.99%

Based on the “best returns” possible we can tell that there were a handful of days where VISA traded below its trailing 5-year average free cash flow yield, yet investing in the stock would have still led to an attractive return.

So, while the trailing 5-year average free cash flow yield isn’t perfect, it is still a very good indicator of when a given stock appears to be “attractively” valued!

It is worthy to note that in addition to generating a better return on average, buying VISA stock while it was trading above its 5-year average free cash flow yield would have also helped us avoid the poorest possible returns.

Today the attractively valued cutoff for VISA is a free cash flow yield of 3.31%!

And VISA’s free cash flow yield as of 5/17/24 was 3.48%, about 5% above its trailing average. Implying that the stock is attractively valued right now.

Visuals

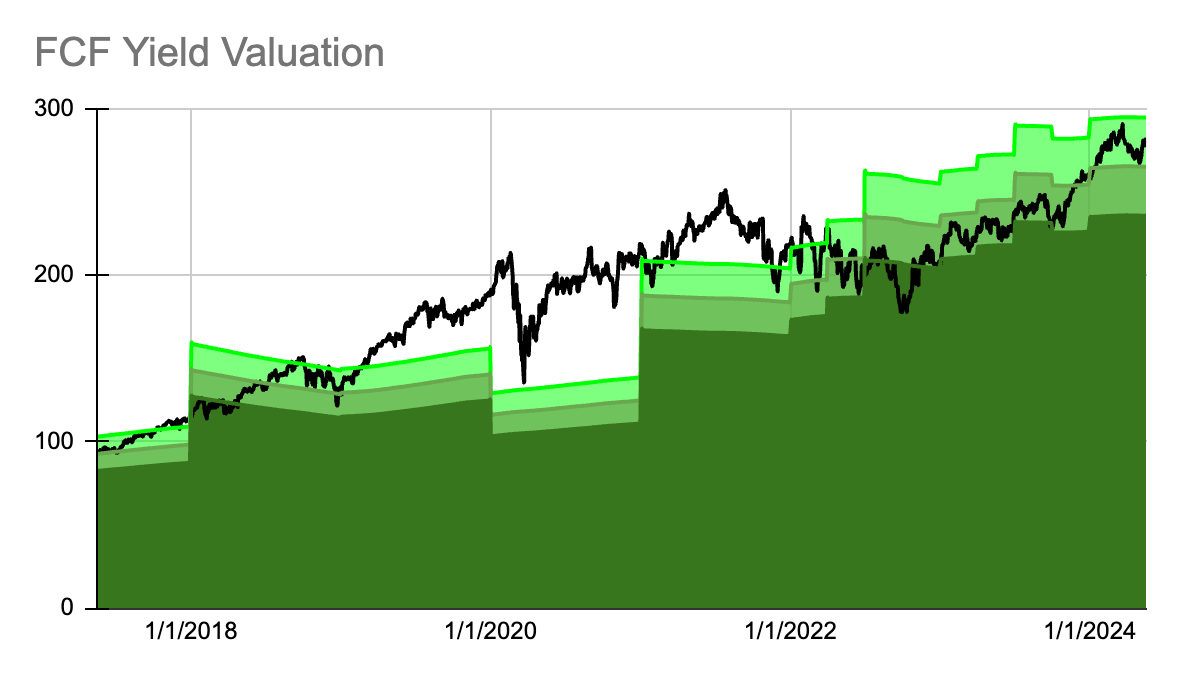

Here’s a visual of the actual stock price for VISA.

The black line shows the actual price of the stock.

The top of the light green shaded area is the “fair value” using the trailing 5-year average free cash flow yield.

The next darker green line is a 10% margin of safety.

The darkest green line is a 20% margin of safety.

The average return of investing in VISA, using the margin of safety thresholds, would have further improved, to about 18.6% at the 10% MoS and about 19.3% at the 20% MoS. However, using the margin of safety thresholds would significantly reduce the number of days where the model suggested the stock was an “attractive buy”.

Percent of days rated “buy”:

Fair Value line: 47.35%

10% MoS: 25.86%

20% MoS: 8.86%

3DGR Portfolio

The portfolio is cruising along in May, it did hit a few bumps already with some stocks performing worse than the broad market. While the portfolio has a positive overall return it is currently trailing the S&P 500 by a decent margin.

Portfolio: +4.03%

S&P 500: +5.59%

We’re only 20 days into this year long journey, so its too early to pass any judgement. Things can still get much worse or much better, patience is the key here.

I’ve already had time to ponder about one element of the model strategy that was deployed. And this is something that I plan on testing further in the near future. While the model portfolio assessed valuation based on the free cash flow yield, and this was used to rank the investable universe, there is room for improvement in this aspect. While free cash flow yields are a useful measure of valuation, they are more impactful when measured relative to each stocks history.

For example in this newsletter I analyzed VISA’s free cash flow yield and we saw that the stock appeared attractive while it’s free cash flow yield was above 3.3 - 3.8% during the last 7 years. However, Home Depot, another of the chosen 20 stocks for the portfolio, appeared attractive while its free cash flow yield was above 4.75 - 5.5% during the same period of time. Comparing these two stocks based purely on their free cash flow yields, Home Depot would almost always look “cheaper” than Visa. Clearly, based on the returns these stocks generated that has not always been the case.

Perhaps measuring valuation using the free cash flow yield relative to each stocks trailing history would be more effective than comparing stocks against each other. More to come on this.