3 DGR Portfolio - Finishes It's First Quarter On A Bright Note!

After a terrible start in May and a just as upsetting finish in June the 3 DGR portfolio catches a lifeline in July. The stock market is frustratingly difficult to predict and July turned out to be one of those months. With the snap of a finger following the July CPI report the market flipped. A rapid rotation out of the beloved technology and AI stocks saw many other sectors of the market be dusted off and showing signs of life.

The 3 DGR portfolio has exposure to the technology sector that was affected by this rotation, but the portfolio also has some diversification and several stocks were glowing green last month.

So let’s go over what happened last month and what may still lie ahead.

3 DGR Portfolio July Performance

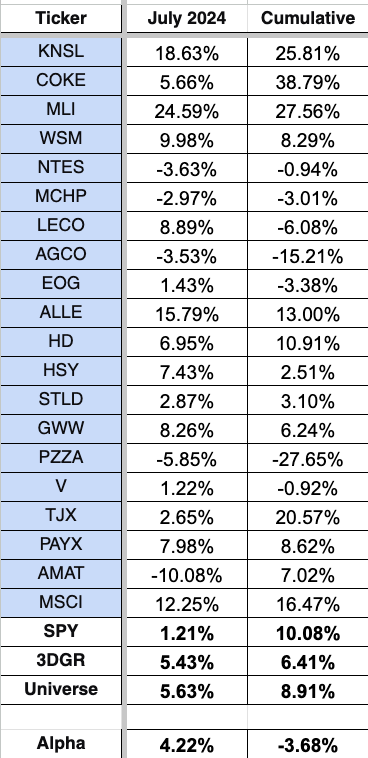

The portfolio posted its best month thus far, gaining 5.43% in July, outperforming SPY by 4.22%, and erasing a big chunk of the losses from the prior two months. 15 out of the 20 stocks included in the portfolio had better returns than SPY last month.

Following the month of June the 3 DGR portfolio had a cumulative return of 0.93% while SPY was up 8.77% (-7.84% of alpha). Inclusive of July the 3 DGR’s cumulative return moved up to 6.41% and is now only 3.68% behind SPY. So, while July was certainly a welcome sight the 3 DGR portfolio still has a ways to go to bridge the gap.

After the first fiscal quarter 7 out of the 20 stocks in this portfolio have double digit gains. But we also have 2 stocks sitting on double digit losses.

I anticipate that volatility in the stock market will persist in the near future and we will continue to see a wide deviation between the returns individual stocks deliver. Whether this plays out to our advantage is the big question mark…

August is seeing a lot of red thus far and SPY is down about 5% in the span of a few days. The 3 DGR portfolio has not performed much better but has not fallen as much as the broad index.

Actual Portfolio

My actual portfolio tracking this strategy posted a return of 5.38% in July, beating the S&P 500 by 4.16%. The cumulative return for the portfolio stands at 6.19% and is 3.87% worse than the S&P 500.

In the dividend department the portfolio generated $7.03 in income during July which sees it finish its first fiscal quarter with $39.82 in dividend income.

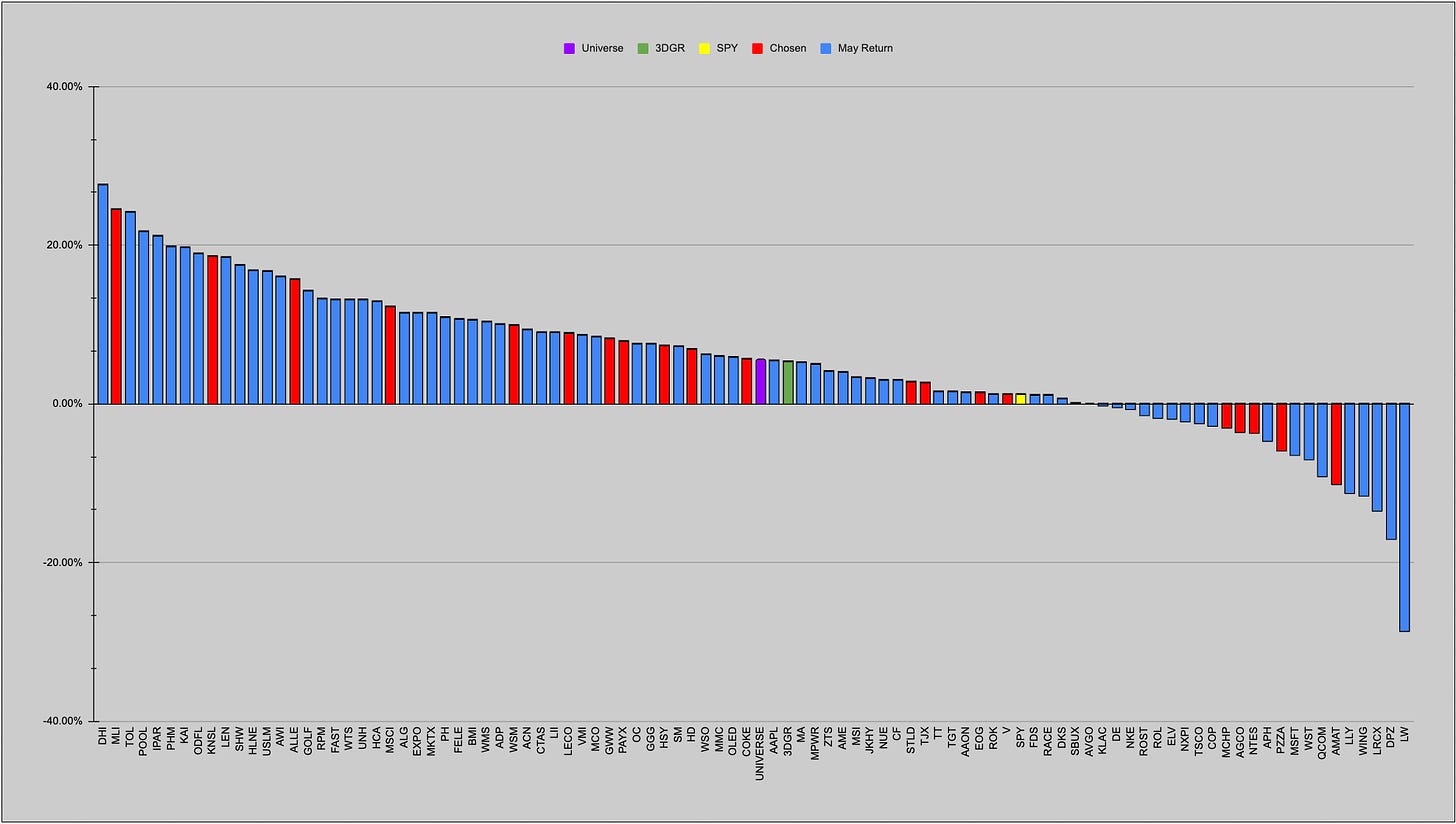

Investable Universe

If you recall the original investable universe from which I made the 20 selections to build the 3 DGR portfolio consisted of 93 unique stocks.

Collectively these 93 stocks are performing better than the 3 DGR portfolio following July, however they too, on average, trail SPY.

Here is how the 20 stocks within our portfolio rank within the investable universe as of 8/5/24 midday.

#1 COKE +46.66%

#4 KNSL +23.51%

#10 MLI +17.62%

#13 TJX +15.89%

#19 MSCI +12.96%

#35 PAYX +6.00%

#37 HD +5.77%

#38 ALLE +5.64%

#42 GWW +3.22%

#48 HSY +2.03%

#64 V -4.05%

#65 WSM -4.64%

#66 STLD -5.23%

#66 NTES -5.34%

#68 EOG -6.27%

#73 AMAT -7.33%

#81 LECO -12.64%

#89 MCHP -18.43%

#90 AGCO -20.49%

#92 PZZA -30.88%

It’s wild to see that the gap between the best and the worst stock is 77.54% over the span of just 1 quarter.

Despite the volatility and fear in the market there are still catalysts for stocks to continue delivering positive returns in upcoming year. The Fed will start cutting rates in the near future and earnings are on average stronger than expected. While we may continue to see investors shuffle their positions around and plenty of big up and down days I don’t believe a major market crash is imminent. I may be wrong and I certainly won’t be betting one way or another.

My approach to investing is simple, I don’t react to market news and I don’t sell along with the bears. Instead I wait patiently on the sidelines and analyze my decisions with a long-term outlook.

I hope you have a great rest of your Thursday!